This brings us to one of the “other factors” that we described in the opening paragraph of today’s article. As we’ve already described, there are tens of bearish factors currently in place, but there’s one thing that has bullish implications and that appears to be quite efficient.

What is it?

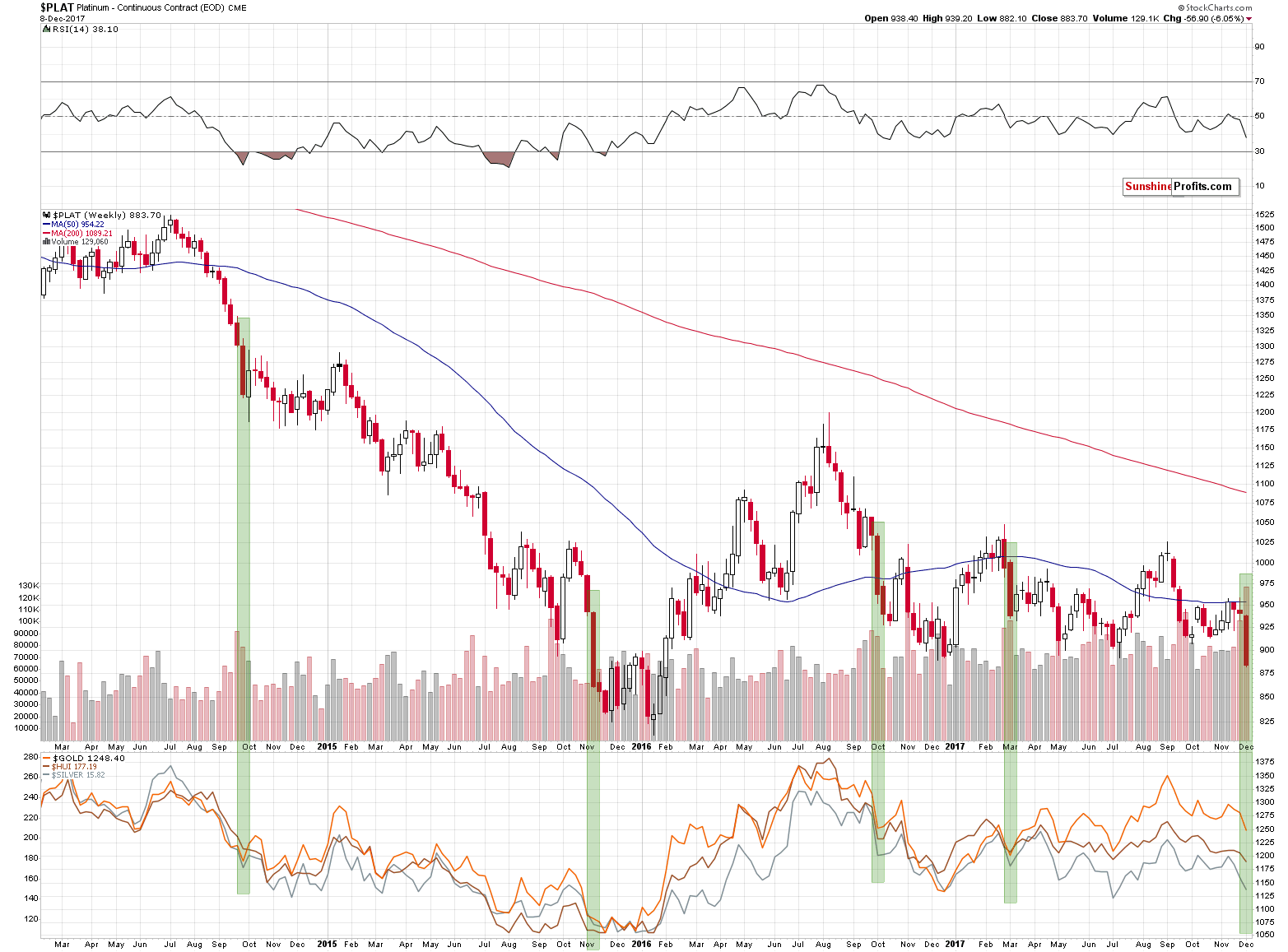

Platinum’s huge weekly decline.

As odd as it may sound, whenever platinum declined in a very profound way (about 5% in a week), it meant that either a corrective upswing was about to start in the following week (2014, 2016) or that a decline had just ended (2015, March 2017). We’ve seen this phenomenon 4 times in the recent years and in each case, it had bullish implications. 4 out of 4, meaning 100% efficiency is not something that should be ignored.

Does it mean that the precious metals sector will soar immediately? No. The above chart is based on weekly candlesticks in the case of platinum and weekly closing prices in the case of gold, silver and the HUI Index that are visible in the lower part of the above chart. Consequently, whatever implications the above chart has, they are in terms of the next week’s closing prices. So, gold, silver and mining stock are likely to end the next week higher, but not necessarily rally in its first part.

We previously mentioned that the Fed interest rate decision day could mark a turning point or we could see the interim bottom very close to it. The above chart supports this outlook and it suggests that we should be prepared to either exit the short positions or to switch to long ones. We are considering both options and which decision we take will depend on the confirmations that we get in the meantime.

Summing up, there multiple signals that point to lower precious metals prices in the coming weeks, but there are also signs that point to higher prices in the short term. The scenario that seems to fit most signals is the one in which the precious metals market forms a temporary (!) bottom sometime this week, rallies for a bit and then starts another major slide. There are many factors that come into play at this time and we’ll keep monitoring them.

We hope you enjoyed today’s analysis, even though it might appear controversial. If you’d like to receive follow-ups, we invite you to subscribe to our Gold & Silver Trading Alerts.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager