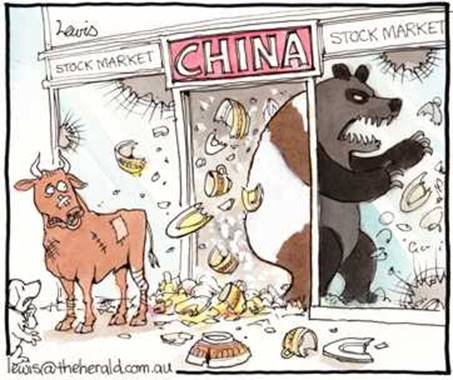

HONG KONG (MarketWatch) — Despite China’s troubled stock markets finding a floor last week, do not expect any quick return to normality.

The dramatic stock rout and subsequent heavy-handed interference by authorities will not be easily forgotten. It has not just rattled investor confidence, but also damaged the political credibility of President Xi Jinping.

For China’s legions of retail investors, the heavy losses have been compounded by wholesale stock suspensions — with half of Shenzhen and Shanghai stocks still not trading. This is a likely to fuel anxiety so long as investors are trapped in stock positions with no liquidity.

It is also likely to lead to a sea change in investor mood from only weeks earlier, when some were even selling the roof over their head to buy equities. There may be a nasty surprise when the first post-suspension bid prices come in.

Albert Edwards at Société Générale highlights the experience in 2008, when Pakistan suspended trading on the Karachi Stock Exchange to try to “put a floor” under stocks after a share-price slump. This episode left authorities’ reputation in tatters, and when the market reopened, it quickly lost another 52%.

For foreign investors, many of the bizarre interventions by Beijing last week will have raised a number of other, more fundamental questions about the competence of China’s leadership and the true state of the economy.

One area of renewed uncertainty is the ongoing policy commitment to allowing market forces to play a larger role in the economy, a part of Beijing’s larger reform program. The reintroduction of a ban on initial public offerings and spate of stock suspensions set a worrying precedent and will refocus attention on political risk.

This, in turn, will place a cloud of doubt over plans for liberalizing interest rates, the capital account and the domestic bond market. Foreign investors are likely to think twice as they face the risk that the government may simply suspend reforms if prices start going against them. These recent actions suggest the voices of conservatives opposed to market reforms are in the ascendancy.

Perhaps the more worrying take-away is that Beijing’s panicky policy actions may reveal that the economy is in worse shape than is being let on.

The scale and intensity of intervention have drawn parallels with the way governments around the world clamored to shore up the financial system and key companies in the aftermath of the Lehman Brothers collapse and ensuing financial crisis. The big difference then, however, was such moves were meant to protect against systematic risk in the financial system.

The reason the banks are so important — and face greater regulation than do most sectors — is because no other industry has the potential to “blow up” the whole economy. Hence, authorities are justified to stand behind these “too big to fail” institutions.

But intervening to support stock prices is not the same as intervening to make sure individuals do not lose their bank deposits.

This behavior will reinforce suspicions that China’s actual economic situation is worse than reported, given that the government sees potential for systematic risk through contagion from the stock rout.

One factor that may drive such contagion is the large role that margin financing has played in the recent stock-market rally. Most attention has focused on the exposure of individuals, which may not be large enough to create systematic problems.

But there has also been speculation that corporations have become involved in margin trading by using their own stock to obtain bank loans. This would put them in a highly vulnerable situation, as the companies too could face margin calls from banks. It might also explain why so many companies have asked for their stocks to be suspended, as some might face the possibility of banks liquidating their shares.

The other way the equity rally impinges on wider systemic health comes from the way the market has been used in some cases as part of bigger plans to recapitalize debt-laden companies and banks. If we do have an extended bear market, expect the window for new listings to close.

While China is not unique in having a stock-market downturn along with high levels of public and private debt across the economy, the reaction of the authorities suggests they either see a serious risk of contagion or have just lost control.

The difficulty for investors going forward will be anticipating Beijing’s next move. Until there is policy clarity and a fully tradable market, anxiety will linger. Already reports have emerged that wealthy Chinese investors are again targeting property markets in the West to seek safe havens away from the domestic stock market.

If more investors worry about money becoming trapped in China, this could easily lead to further hot-money outflows. In that case, we could quickly see stress in Chinese shares spreading to currency markets, with a risk of yuan USDCNY, -0.0177% depreciation.

Shutterstock/Filipe Frazao

Shutterstock/Filipe Frazao