I’m starting to nibble on a few shares here…

The run on physical gold accelerates

Oct 17, 2025 11:00 AM

Yesterday (Oct 16) 3,878 new contracts (12 tonne) were written on the October contract. Since the October contract is in the delivery period this activity is for physical metal to be delivered by the end of the month. That one day buy is just 19 shy of the single day record which was set earlier this year during the Feb 2025 contract. See the plot below to put things in context.

A glimmer of hope in the UK …

… to thwart the commies and their efforts to imprison their subjects …

CBDC’s are bullocks.

Chuckle

Buygold

Yeah they need more fiat to buy more phyzz they owe for delivery they didn’t have and maybe buy some for themselves while their at it.

I might be crazy

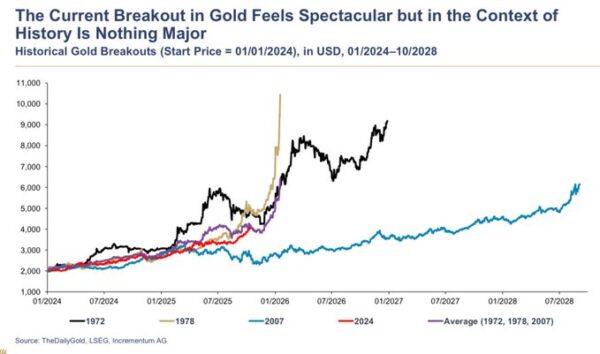

but a violent selloff like this is exactly what we needed. The more violent, the sooner we rebound. I’m thinking this is just the first of a few more to come. I know in the 70’s and 1980, the swings were monstrous on their way to $800. Heck, they saw $200 swings. This is really nothing, unless it goes on for a while, but I’m not sure it will. When we start having $500 swings, we’ll know we are getting close to the end.

I might add, if you look at the chart of GLD, there has been a down move like this every 4-7 days all the way up since this really got going in September. The SLV and HUI are somewhat similar.

Every time since then this has been bought and moved much higher

It’s a given that I’m not at all right in the head, but just my two cents. 🙂

Bears are going ape…having real fun…..

up the stairs down the elevator….

Maddog @ 9:32

“Fly on the wall” That would be a real reality sandwich! How does the world really work?

Maddog

“$300” All I can say to that is Righto! 🙂

Ipsofacto

Re Orban, Trump and Putin

That is a big coup for Orban and a large kick in the balls for the Globalists…..I would love to be a fly on the wall when the three of them get together …….some serious truths will be told.

ipsofacto

I read yesterday that the 2011 $ 50 hi in Silver was a third of what the 80’s equivalent inflation adjusted….so with more inflation around since ….today would need $ 300 …..

Buygold

Sellers are not getting the scum to really pile on……hence

Fingers crossed! A glimmer

Orbán Viktor

@PM_ViktorOrban

·

17h

I just got off the phone with President @realDonaldTrump. Preparations for the USA-Russia peace summit are underway.

Hungary is the island of PEACE!

All over the map

Sellers don’t seem too sure about what to do.

Maddog

Yes I looked it up lol That’s what I was talking about though because there the ones that use cat.converters that use platinum or so I thought. I was surprised to read that they were using Palladium and switched to platinum as a cheaper option. I think I need to go back to sleep before the sun comes up here. 5:32 here.

Buygold

You might be right there. I remember back then. I knew it wasn’t gonna go past 50 so went to a dealer and traded some if my silver eagles and ore 65s get this, just to many to hide and traded it for gold. There were a lot of people coming in to buy it. Even the dealer thought it was the place to be. It was good for me at the time though. This time it is different and people can think unusual but the times are unusual and catalyst are a bit different.

goldielocks

ICE engines are Internal Combustion Engines, the standard petrol or diesel ones…the ones everyone want s !!!

That kitco info…must have killed them to write….$ 32500 for Gold…..I knew someone who used to talk to Jim Sinclair all the time…he was some character.

Goldie

I’m sure there were a lot of people that bought at 2011 prices that couldn’t wait to dump their silver.

They are getting serious about the selling now. Wonder if Crimex will pile on or take the opportunity to cover?

Moving fast. As I typed gold jumped back up $15, back over $4300. Silver still weak with plat and pall.

This is BS!

Bondi DOJ Backs Warrantless Invasion Of Gun Owners’ Homes

Tyler Durden’s Photo

by Tyler Durden

Thursday, Oct 16, 2025 – 07:35 PM

By Aidan Johnston, Director of Federal Affairs for Gun Owners of America,

The Department of Justice under Attorney General Pam Bondi is advancing an argument that threatens to hollow out the Fourth Amendment’s core protection: that Americans may be secure in their homes against warrantless searches.

The lawsuit is Case v. Montana. After a difficult breakup, William Trevor Case was at home alone when police arrived for a so-called “welfare check.” They spent nearly an hour outside his house. Officers walked around the property, shined flashlights through windows, and even discussed calling his relatives or reaching him directly. They never did. Instead, they retrieved rifles and a ballistic shield, broke down his door without a warrant, and shot him.

https://www.zerohedge.com/political/bondi-doj-backs-warrantless-invasion-gun-owners-homes

Buygold

The irony is I don’t even need to be up watching. I just woke up and didn’t go back to sleep. This would definitely be a time again for a closer watch if carrying shares while not getting too spooked. People have already bailed even way before gold hit 4000 and silver 50 and lost significant gains while they watched it keep going higher. I can’t blame them after decades of past events but didn’t have to go all out till a direction is confirmed or a support is breached to the downside although in this sector it tends to move fast so less you can set stops that’s sleepless nights and occupied time during trading hours.

Makes me smile

John Bolton Indicted On 18 Counts Over Mishandling Classified Documents

https://www.zerohedge.com/political/john-bolton-indicted-over-mishandling-classified-documents

Goldie – makes sense

Your targets at least for gold and silver.

The SM futures have coming roaring back since my last post. I didn’t expect to see this when I got up again.

Dow poised to open slightly positive. QQQ only down 1/2% now. Bonds are now selling off a bit and rates up a couple bips to 3.99%

PM’s sliding some, but the real action takes place in an hour when the Crimex opens. PM shares still weak.

Doesn’t look like a SM wipeout anymore. PM sector is overdue for a rest.

A homage to Jim Sinclair

A fair Sinclair Ratio brings gold to 30,000 gold.

The great repricing: market models point to $30,000 gold amid silver supply shock | Kitco News

If you scroll down on this you’ll see Texas is already ahead of the digital replacement with their own gold backed dollars.