Its not just what he does tell you which is pretty much predictable at this point, nothing to see here everything fine, but what they don’t tell you people better be looking for and have their own plan on what they’re next moves will be.

Buygold

Things are changing a bit where what Power says may not hold much weight especially knowing his bias and how they have made the mistake of driving housing prices through the roof keeping interest rates too low too long even buying mortgage backed securities up to first raise and tightening in 22 one more time, the wasteful cost of their new Fed resort that what ever they have in mind doesn’t benefit the economy but the CE0s of bankers and stock boards not for balance but for unfair profit and outright theft to the economy.

Ipso

A good move taking profits off the table while those who are buying the ETFs and funds are told to buy them instead of gold right now maybe so they can sell left in the dark.

Buygold

Totally agree. Powell is trying to save face with his anti Trump constituents. With approximately $1 trillion of debt needing to be rolled over in the near future, the knee jerk reaction by the algos is insane!

JMHO

Whatever Powell said

He’s bluffing. The dollar is screaming higher and despite the scum’s best efforts we are fighting them off.

goldielocks @ 13:02

I’m sure it’s a good move. Who would know better than the insiders!

Will be interesting

To see how the pm’s react to the Fed. Maybe more importantly is what Powell says, if they are ending QT, if he sees inflation moderating. In other words-dovish. It would be a change for him.

Ipso

I got this in a email today from a reliable source.

Palantir’s Alex Karp has lined up nearly $2 billion in stock sales. Nvidia’s Jensen Huang has already sold around $40 million of his own shares, and plans to liquidate another $800 million.

Wow! Overvalued much …

NVDA’s market cap now equals 16% of the US GDP

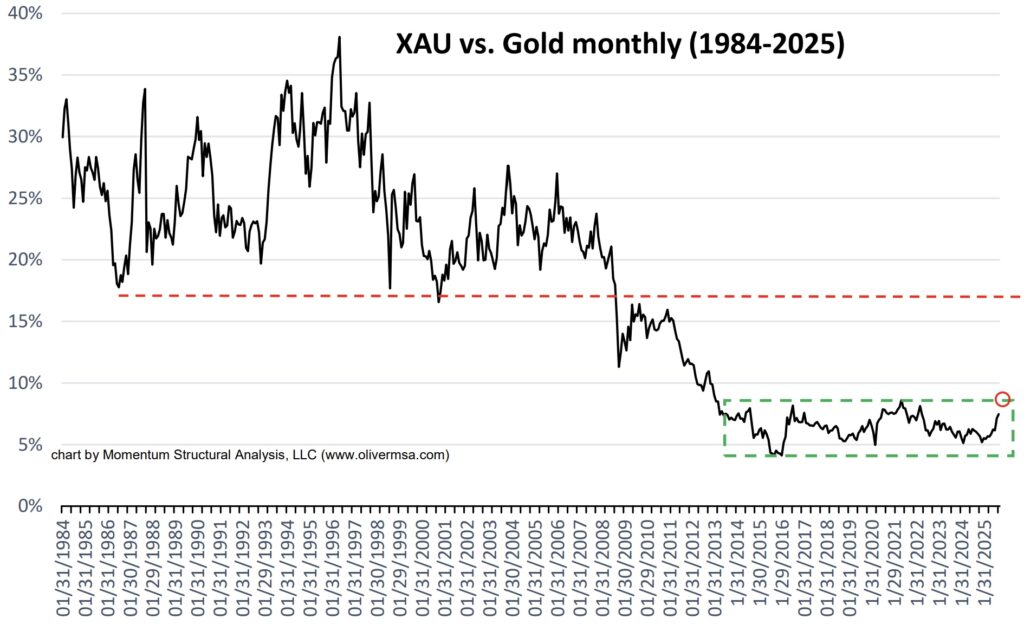

XAU/Gold

Communication from Eric King to Mark Lundeen:

Mark, King World News has been featuring the attached image over and over again of the XAU vs Gold. Because when you look at the XAU chart, it appears that gold stocks have had some type of incredible run, which is patently false when measured vs Gold (see attached chart). Yes, they have risen, in some cases quite dramatically, but vs Gold, the entire complex remains at the most historically undervalued level or range ever seen in history.

Buygold

Are we bottoming?

Yes I know that’s an unfair question! 🙂

Are we going into a recession?

The Kobeissi Letter

@KobeissiLetter

Recent Layoff Announcements:

1. UPS: 48,000 employees

2. Amazon: Up to 30,000 employees

3. Intel: 24,000 employees

4. Nestle: 16,000 employees

5. Accenture: 11,000 employees

6. Ford: 11,000 employees

7. Novo Nordisk: 9,000 employees

8. Microsoft: 7,000 employees

9. PwC: 5,600 employees

10. Salesforce: 4,000 employees

11. Paramount: 2,000 employees

12. Target: 1,800 employees

13. Kroger: 1,000 employees

14. Applied Materials: 1,444 employees

15. Meta: 600 employees

The labor market is clearly weakening.

Traitor

Senate Judiciary Launches Probe Into Gates Foundation’s Alleged Funding Of Chinese Military Fronts

Deer79

I think you’re right. There’s nothing really working against pm’s right now other than the paper players.

The timing for them was good before a Fed meeting, and the fact that we were so overbought. They temporarily brought in enough physical silver at the LBMA to pull it off I guess, but demand should still be strong, and if you wanted silver at $54, you’d surely want it at $48.

I wonder if there is any available silver in India yet. Doesn’t seem like supply problems get solved overnight like that.

.25 basis point cut?

If the Fed cuts 25 basis points ( and leans slightly dovish), it will give us a good tailwind.

Exactly why the correction was so quick and violent; the scum knew what was going to happen this week, and wanted the metals to be climbing out of a hole instead of launching higher from the $4200/4300 range.

Punching back

Despite the dollar and rates being a little higher. Was just about that time I guess.

Shares look strong premarket.

Everything could change after the Fed speaks this afternoon.

May the bounce back be every bit as violent as the selloff!! 🙂

Ipso 13:29

You know they’re up to no good and rotten to the core.

This makes it to easy for him with no qualified citizen running. Qualified would no longer waist their time on this leftist group is the problem. They’re going to have to crash and burn no matter who wins, just a matter of how bad.

Things are not good.

- High interest rates: Following numerous rate hikes by the Federal Reserve in 2022 and 2023, businesses are finding that higher borrowing costs are straining their finances.

- Inflation: Persistent inflation continues to put pressure on corporate bottom lines.

- Tariff uncertainty: Recent tariffs have created an unstable operating environment, especially for companies in the consumer discretionary and industrial sectors.

- Increased competition and debt: Retailers, in particular, have faced stiff competition and have been forced to grapple with rising debt.

- 23andMe: The genetics testing company filed for bankruptcy in March 2025.

- Del Monte Foods: The canned food giant filed for Chapter 11 bankruptcy in July, citing issues with excess inventory and rising interest costs.

- Forever 21: The retailer filed for Chapter 11 for the second time in March 2025, with plans to close all its U.S. stores.

- Claire’s: The accessories retailer filed for its second bankruptcy in seven years, citing increased competition and tariff pressures.

- Year-to-date high: As of July 2025, the 446 large-company bankruptcy filings represent the highest total for the first seven months of the year since 2010.

- Surpassing recent years: The 2025 year-to-date total has already exceeded the full-year bankruptcy totals for 2021 and 2022.

- Across various sectors: While concentrated in the industrial and consumer discretionary sectors, the bankruptcies span many parts of the economy, including healthcare

Lurker 8:31

First thing that comes to mind is check with Edgar or sec filings. If the average citizen is piling in to to index funds but the companies they track are selling are the company insiders selling their shares into the buying? Who’s selling and why. Would you put it past them to be sneaky?

This is not even funny.

If anyone needs to be isolated in Europe and UK it’s the invaders. Not worth talking to just get them out. They’re sending their worst.

They just up and said it in this protest. They really believe they are being invited there by the traitors under direction of the Islamic UN??? to turn the UK and EU into a Islamic state.

Why are you flying the English flag in England says the migrant. It’s no longer your country you know, About a minute.

Amals Ferrett

Watching the weather right now. Tornado warnings going on in the south.

The mark of the beast going on in AI.

It’s already starting and ding bats are writing these programs. Have you ever tried to pay a bill with their talking AIs? They just make things more complicated and cost more time. It was fine the way it was before and they want to record everyone’s voice. What happens if something happens to their voice and hard to talk on top of it. No other option.

I heard from someone today they went to a restaurant and were served by a robot. The only way you can stop that is to not go there and let them know that’s the reason.

I heard a lot of these businesses in the stock market have been doing a lot of buy backs. That businesses are NOT doing as well as the media is making them out.

Yes I’m familiar with him and know he’s one of the good guys I just never went to his sight before. From what your saying he’s not saying anything I don’t already know. I fear for the future of the young. They need to start climbing the ladders. Learn as much as they can, in anything they can and learn to put on different hats they may need to survive and that no job is beneath them if need be temporarily just in case. Get as high as they can but not so fast their blind, it’s easier to go down than up, stay in groups or teams if needed, a flood is coming, it’s already here.

Goldie, you were almost right.

They’re inflatables. Highlighting the epidemic, the desperation, of loneliness, really. Kunstler is a good writer, as amals says.

Society changes. Eventually the norms change, and people accept isolation as normal. Everyone is isolated, they say, so it’s ok if I am too. Most people just want to be normal. Or at least to appear normal. That doesn’t make it natural, though. We are naturally a social being, we cannot survive without cooperating with others. Accepting your isolation as normal is ensuring your doom.