Mark

@Mark_IKN

·

9h

Newmont $NEM beat guidance, stayed pat on its dividend, shares dropped.

Barrick $B missed guidance, juiced its dividend, shares rocketed.

Maybe, just maybe, there’s a lesson for the Newmont tightwads here.

Mark

@Mark_IKN

·

9h

Newmont $NEM beat guidance, stayed pat on its dividend, shares dropped.

Barrick $B missed guidance, juiced its dividend, shares rocketed.

Maybe, just maybe, there’s a lesson for the Newmont tightwads here.

He was a lot better then the opposition who would of made thing much worse. Like Trump there was too much uniparty and corruption around him. He had to settle for let them eat cake deep state Bush who could run business as usual behind the scenes and we seen where that went.

No argument here.

Many Republicans I have met/known over the years idolize Reagan. I no idea why.

The National Debt also approximately tripled during his presidency to nearly $3 Trillion

You forgot Reagan was a puppet. Re your “Reagan facilitated the production of Gold Eagles.”

No it was Ron Paul.

The American Gold Eagle coin program was created by an act of Congress — the Gold Bullion Coin Act of 1985 — which was introduced by Representative Ron Paul of Texas.

The coins were first issued by the U.S. Mint in 1986 under this law.

So, in short:

➡️ Creator/Sponsor: Rep. Ron Paul (R-TX)

➡️ Authorized by: Gold Bullion Coin Act of 1985

➡️ First issued: 1986

I’d say it is ultra cheap.

The alligator climbing the fence was hilarious, and rare.

So in the poll, four (three passes and two neutrals).

Common over the counter pills along with some prescription that can cause brain damage and dementia Read the comments, a lot of testimonials. Common as Benadryl …

There’s amazing creatures and survivors. If you like being in the water could be a problem though. Here we have much water through many rivers, lakes and the ocean. The waters cold because we have mountains too that keep away tornados and brings skiing and kids sleighing here though which also keeps down things like brain eating amoeba especially although pool water less treated well on warm days or some lakes could be at risk and flesh eating bacteria your more at risk there particular after hurricanes. So water proof any scratches or healing wounds, before hand.

Alligator in Florida

https://www.facebook.com/reel/1617195272585785/?mibextid=rS40aB7S9Ucbxw6v

My Grandmother knew Reagan too since the acting days I think she said in Chicago. I meantioned to her the young wanted to vote for him because he wanted to legalize pot which I.believd it should too even though I didn’t smoke it I thought arresting people over it was ridiculous. She told me he smokes pot too. It’s not too much a hidden thing now but I don’t think he was much worried about it since he even had it placed on the table after dinners.

I looked up Reagan and the great SS heist. See what it said. It left out obummer who also borrowed. They all used up all the decades if reserves it needs now that never got paid back. Not to mention demos giving it including disability to new illegals. Ordered them to make up things to put them in SS disability after giving them a SS number.perbwhiztld blower shocked and disgusted by it.

I can believe Reagan was pretty much a puppet.

As they all were, excluding JFK, except Trump, as you noted.

illuminatibot

@iluminatibot

·

Nov 8

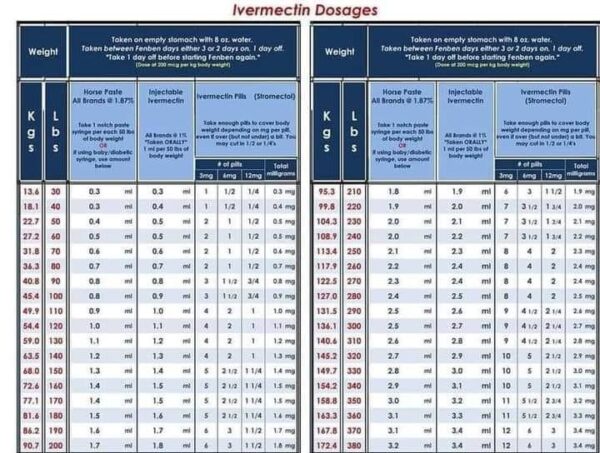

IVERMECTIN DOSAGES & RECIPE. 🪱

Paste, Liquid, Capsules

IVERMECTIN kills parasites. Parasites cause cancer.

IVERMECTIN & CANCER

TUMOUR GROWTH – Ivermectin suppresses tumour growth and metastasis through degradation of PAK1 in oesophageal squamous cell carcinoma

– PubMed

https://pubmed.ncbi.nlm.nih.gov/32237037/

RENAL CANCER – Antibiotic ivermectin preferentially targets renal cancer through inducing mitochondrial dysfunction and oxidative damage – PubMed

https://pubmed.ncbi.nlm.nih.gov/28847725/

I pretty much agree re Reagan ’81 to ’89 the jobs FLEW away. But I suspect it was his vice president Bush and his crew that was responsible. Because when Reagan was campaigning, and looking good, he was approached and told they would finance his campaign if he took Bush as a running mate.

So Bush had 8 years running the ship, then he won after Reagan and got four more years 12 total. After that, TPTB (Fed Res?) wanted to switch over to democrats, no sense giving Bush another 4 years or 16 years total.

So, they abruptly raised the rates and caused the “Bush Recession” so he lost, and right after that they abruptly lowered the rates. Generally the past presidents were best at doing the talking and getting the votes. The bribed “crew” was leading. Not with Trump though. He’s leading the “crew”.

I have never understood the fascination with Reagan.

He greatly encouraged and paid manufacturers to move our production overseas during the 80s. He oversaw the gutting of Made in America, and was a traitor in my opinion.

The one good thing that I know he did is facilitate the production of Gold Eagles. See the post below.

The legal ability for U.S. citizens to own gold was established when President Gerald Ford signed a law in 1974, which became effective on December 31, 1974. This act ended a four-decade ban on private gold ownership that had been put in place by President Franklin D. Roosevelt.

The Gold Bullion Coin Act of 1985

The origins of the Gold Bullion Coin Act are both political and economic. In part, the Act was a response to the rising popularity of foreign national coins, like the South African Gold Krugerrand and the Canadian Gold Maple Leaf.

In 1984, “more than $600 million worth of Krugerrands were marketed in the United States,” however, sales plummeted in mid- to late 1985 as a reaction to “growing racial strife in South Africa and a mounting worldwide protest against apartheid,” reported the Los Angeles Times in October 1985. Per the L.A. Times, South Africa derived half of its foreign exchange earnings from Krugerrand sales, and the U.S. was its biggest market.

Perceiving the Krugerrand as a symbol of apartheid, President Reagan banned imports of the coin effective October 11, 1985, “formally denying South Africa its most lucrative market for gold coins” and punishing the “white-run Pretoria government for its racial policies.”

While the Canadian Gold Maple Leaf Coin stood to fill the supply gap created by the Krugerrand ban, the U.S. wanted to join the national gold coin business, too, which is where the Gold Bullion Coin Act of 1985 enters into the picture.

The details of the Gold Bullion Coin Act

During the 1980s, the state of the world economy and political scene made for favorable demand for gold bullion coins. Relations between the U.S. and Russia were rough, American unemployment was on the rise, and Social Security was on the rocks—to name a few factors.

In 1984, reports Coin World, “the Krugerrand still held about two-thirds of the gold bullion coin market worldwide. By early 1986, that distinction belonged to the Maple Leaf.”

The Gold Bullion Coin Act, however, paved the way for the U.S. to compete with the likes of the Canadian Maple Leaf. It required that the U.S. Mint start producing a family of 22-karat gold bullion coins in one-half, one-quarter, and one-tenth denominations and it defined everything from the coins’ diameters to their design.

In short, the Gold Bullion Coin Act of 1985:

Directed the Secretary of the Treasury to mint and issue gold coins in $50, $25, $10, and $5 denominations

Mandated that the specified gold coins be issued in quantities sufficient to meet public demand

Required the gold for such coins to be mined from natural deposits in the U.S. or in a U.S territory, within one year after the month in which the ore was mined

Prohibited the Secretary from paying more than the average world price for gold

Allowed gold to be used from U.S. reserves in the absence of available supplies of such mined gold at the average world price

Required any profit from the sale of such coins to be deposited in the Treasury and applied towards reducing the national debt

This legislation offered support to American miners, eventually led to the establishment of the American Eagle Gold Bullion Program, and in 1986 the production of one of the world’s most popular gold bullion coins: the Gold American Eagle.

Source:

https://www.usmoneyreserve.com/news/coins/gold-bullion-act-1985/

Vote! Vote!

Thanks for your vote.

Since my rebate is unlikely, and I didn’t qualify my offer, do you like Taco Bell? Lol

Re your “What a f*cking country we’ve become,”

The decline started after Silver coins stopped being produced in 1965, then the gold backing was removed from the US Dollar in 1971. After 1971 the idiots created the EPA for wealth absorbing jobs versus wealth producing jobs.

After 1981 the off shoring picked up speed. Then back around 1989 they moved the factories from Japan etc all to China.

Also the decline started after 1969 when the Americans gleefully started buying imported cars, then in 1984 no more American TV sets. No more American tools machinery or even our clothing. The leaders gave away our factory.

Global Markets Investor

@GlobalMktObserv

·

Nov 9

🚨Almost NEVER in the history of the US economy has consumer sentiment been SO DEPRESSED:

US consumer sentiment fell to 50.3 points in October, the 2nd-lowest EVER.

There’s joy in Mudville! 🙂