I agree 100%. Plus western bankers and or the Federal Reserve have been losing control. Long lived the king of holding metals down.

Yeah maddog

It’s a real pisser what the scum is doing with the silver shares in particular with the metal up 8%. These things should be flying, up 10-15%. First Majestic is sitting on 753K ounces and they’re struggling to stay up 1%.

I kind of think gold should be doing better as well, although I know the ratios are getting squared up. Still, I’d think there would be some folks contemplating a run at the paper gold market after what’s happened with silver.

$78 Silver

Mr. Copper – The only thing Chat GPT said there that mattered is “in short, because Shanghai trades in real metal, not in paper contracts.”

Besides hoarding silver and freezing exports, this is why I don’t think it’s China that is panicking. I think it’s possible that they could even be encouraging higher prices to break the west’s paper pricing mechanism.”

$100 silver

Back in the early 2000s many of us thought silver would hit $100 long before 2026. As it should have.

Sadly, many are no longer with us.

That day no longer seems far off. And $200 and more no longer seems like crazy talk.

We also wondered if it may be part of and a catalyst for world changing events.

Well, it seems we are finally on the verge of something big, compadres. Hopefully it will be positive.

God bless us all

I asked ChatGPT Why is the silver price so much higher in shanghai

Silver often trades noticeably higher in Shanghai (the Shanghai Gold Exchange / SGE) than in London or New York for a mix of structural, regulatory, and supply-demand reasons, not because the metal itself is different.

Here are the main drivers, from most important to least:

1. China tightly controls silver imports

China does not allow free import/export of silver.

-

Only licensed banks and firms can import silver

-

Import quotas and approvals can be slow or limited

-

When domestic demand rises, foreign silver can’t flow in quickly to arbitrage the price

This breaks the usual “buy low here, sell high there” mechanism that keeps global prices aligned.

2. Strong domestic demand

China is one of the largest silver consumers in the world, driven by:

-

Solar panel manufacturing

-

Electronics and semiconductors

-

Industrial alloys and chemicals

-

Jewelry and investment demand

When Chinese industry ramps up (especially solar), local demand spikes fast, pushing prices up inside China.

3. SGE prices are physical, not paper-based

Shanghai prices mostly reflect physical silver delivery, while:

-

COMEX (US) and LBMA (London) are dominated by paper contracts and derivatives

Paper markets can suppress prices during periods of heavy short selling, while physical markets respond more directly to real shortages.

Result:

👉 Physical premiums appear in Shanghai first

4. VAT and transaction costs

Silver traded in China usually includes:

-

Value-added tax (VAT) (often ~13%)

-

Local logistics and financing costs

These alone can add a noticeable premium versus Western spot prices.

5. Currency effects (RMB vs USD)

Shanghai silver is priced in RMB, not dollars.

-

RMB depreciation or capital controls can make metals more attractive

-

Precious metals are a popular hedge inside China when confidence in financial assets weakens

6. Limited arbitrage

Even when Shanghai prices are much higher:

-

Exporting silver out of China is restricted

-

Importing large amounts quickly is difficult

So the premium can persist for months, instead of disappearing in days like it would between London and New York.

What the Shanghai premium usually signals

Historically, a large Shanghai silver premium suggests:

-

Tight physical supply

-

Rising industrial demand

-

Stress or distortion in global silver markets

It does not automatically mean global prices will jump—but it often precedes periods of volatility.

In short

Silver is more expensive in Shanghai because:

China has high physical demand, strict import controls, and a market focused on real metal—not paper contracts.

If you want, I can also explain:

-

How big the Shanghai premium is “normally”

-

Whether it’s a bullish signal for global silver

-

How arbitrage sometimes happens anyway

-

The difference between gold vs silver premiums in China

Crazy

Buygold that’s a good point on SLV as well as GLD according to Andy who mentioned not safe near the end of that video with who they store it with, where are they going to buy it? Like that one IA ASIAN guy who talks like a white guy voice actor said the ones who work for these managed finds they’re gonna come back from the holidays and gonna have to buy silver or get fired. Things w myill be crazy next few months and it seems the general population hasn’t woke up yet either.

I think I will start wearing band-aids over my couple 18k rings I don’t want to take off and lose when out and about pretty soon.

Zero Hedge

Running a subscriber article that says China is panicking over high pm and copper prices in the thinly traded holidays.

Are they sure it’s China that’s panicking? Seems to me they’d just halt the Shanghai market if they were worried.

I actually expect a trading halt on the Crimex if this continues Monday.

Wow $77.20

Is this a dream?

Wait until the shares wake up.

An 8+% Silver day is

AMAZING! Up $5.80 today

Sounds lucky

Silver up 7%, over $77

darn shares can’t catch a bid……algo’s have a lid on them

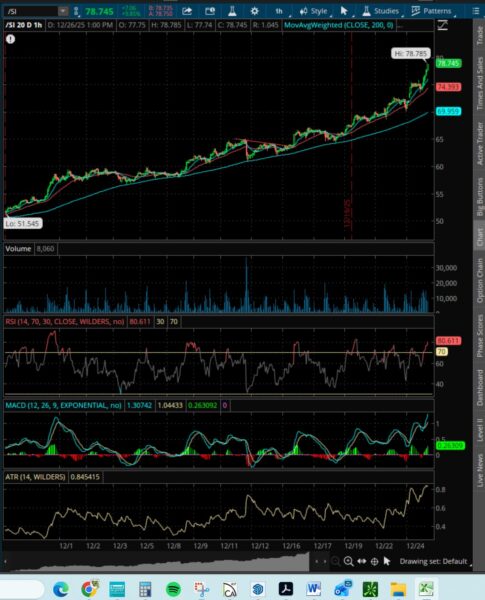

here is the daily

That sounds secure … D’oh!

Trust Wallet has been hacked: users report that crypto is disappearing from their wallets and being sent to unknown addresses.

All victims have one thing in common — before the theft, they installed the Trust Wallet browser extension.

Right now, it’s the main suspected source of the breach.

SLV

Just took a look at SLV and the volume is already heavy approaching 69 million shares. I’d think that’s unprecedented for a holiday week.

The thing is, where are they going to get the metal for all the new owners?

This can’t just be retail people and I’d think funds or hedge funds would be keen to what’s happening in the physical market. Why on earth would they touch that?

Let’s not forget to give Silver respect

Up 7% and $5 in one trading day. Yea! Eagle Eye used to get excited for a few pennies a day

Geesh – I thought we were having a good day

Palladium up 11% almost $200 and Platinum up over $200?

Gold is a slacker, it hasn’t had a single day up $200.

$76 silver, at least the shares started to inch up a little.

Ipso

If they knew about it yeah along with the Covid gang and why don’t they raid their bio labs torturing monkeys and other animals to make sicknesses to give to humans after they can make a drug to treat it to sell to the public.

My brother soee says all the other precious metals are 4 handle and Silver’s is 2 handle

It’s time to change that. On another front, it’s important to also watch MSTR, the stock that is capable of bankrupting Bitcoin hitting new lows! You can buy puts and short Bitcoin with this tool. This is a smoking gun guys!

Wow!!

I think that’s the biggest bullish candle I’ve even seen. First three white soilders then a bullish spinning top then the biggest bullish candle I’ve ever seen in silver. Crazy

Ipso more than maddening ,Trump needs a tracking system right to the ones who caused this to happen. They were and are actively robbing years off the SS system people spent years paying into and giving it to these foreign losers looking for a free lunch. If they’re in the system they need to lose their pensions and pay it to SS. One whistle blower came forwards a while back but was ignored.

goldielocks

“maddening” That’s a good word for all these scams and frauds!

Ipso

I had to edit that whole post..

Ipso

We have been the target of rip offs for decades by other countries. But the few years that traitor Biden was put in office invited a mass rip off as well as a drain on the dollar and dollar reserve in more says they Russia.

I ran into this guy who helps with SS SSI disability etc so watched him a couple of times. Talking about another major rip off of our SS and disability including for veterans by illegals that Biden or his handlers let in illegally gave them SS cards and signed them up for disability that also have a bunch of kids that get money too. He mentioned the Somalis has a whole rip off system going..Major fraud and many went back home after getting it and live off it there. Trump is now tracking them down but there must be mass arrest of those helping them get on it. The tracking could now thanks to these parasite losers affect their AMERICAN privacy too.

It starts slow then gets quite maddening. https://www.youtube.com/live/ceswDGTs4lo?si=aL8TGtsEizfWOOla

This has to be one of the best buying ops

I’ve ever seen for the mining shares. The fact that algorithms are able to keep them down on a light volume day is stunning. They will explode higher in January when folks get back to work. We’re going to see some doubles inside of a month or two.

It won’t matter what the SM is doing if the metals stay strong either.

Silver blows right through $75. Boom.