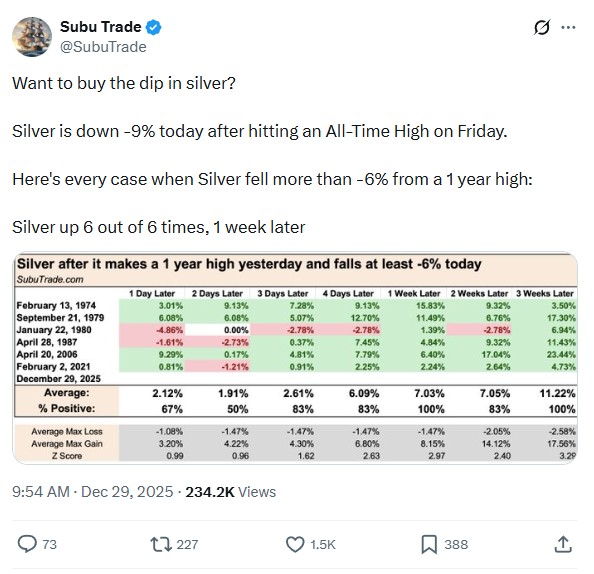

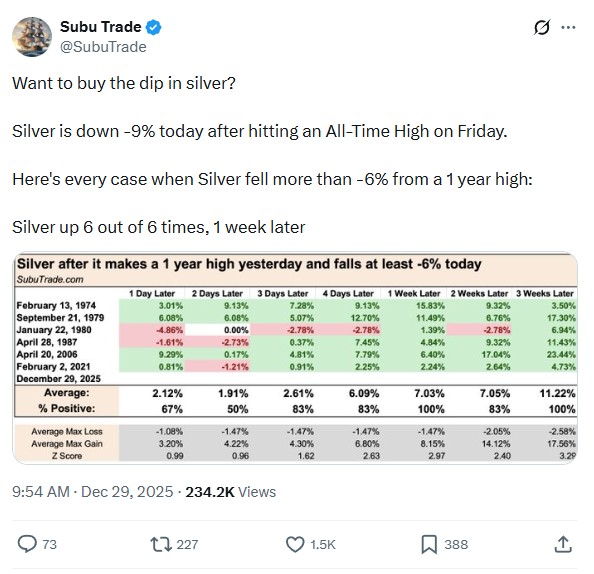

I’m of the opinion that we were down about 9 or 10%

https://x.com/SubuTrade/status/2005683855530037284

I’m of the opinion that we were down about 9 or 10%

https://x.com/SubuTrade/status/2005683855530037284

Otavio (Tavi) Costa

@TaviCosta

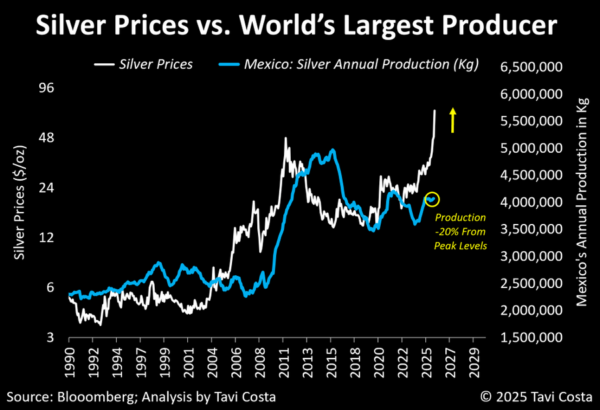

A lot has been said about silver over the past 24 hours and I want to offer a longer-term perspective on a theme I’ve followed closely for years.

1) Bubbles in monetary metals don’t form with tight supply and rising structural demand while the global fiat system is in crisis.

2) Silver rarely moves in straight lines. Volatility is part of the process and should be embraced, not feared.

3) The low-price metal environment of the past decade is unlikely to return. The inflation genie is out of the bottle, and central banks lack the ability to put it back in.

4) Despite trading near prior nominal highs, silver remains materially undervalued in a world of fiscal dominance and a structurally weaker dollar.

Let the dust settle and the hype fade.

In commodity bull markets, leadership rotates.

This game is far from over, in my view.

Yet I’m not seeing any silver shares up more than 3%.

At some point these silver shares are going to explode aren’t they? They have to.

Gold loses $200, bounces back $56. It will take gold a week or two to get that $200 back.

Check that, we’re getting the standard Crimex 9 am paper dump.

Forgive my impatience, I guess we are lucky to be bouncing back at all this am.

about the coke. ChatGTPT just denied it outright and said, this is conspiracy stuff.

Grok goes much deeper and explores many avenues chat dismisses.

South Asia Index

@SouthAsiaIndex

·

9h

Saudi Arabia has just bombed a UAE weapons shipment in the port city of Mukalla in the South Yemen.

Saudi Arabia also publicly announced that this weapons shipment originated from UAE and was meant to fuel to the conflict in Yemen.

The shipment was meant for Southern Transitional Council which is trying to create a new state in Southern Yemen namely “South Arabia”. It also claims some territories of Saudi Arabia.

Saudi strike signals rapidly increasing tensions between the Kingdom & UAE who are now indulged in a proxy war in the region.

I totally agree with your idea of the Chinese trying to “weaponize” Silver.

I’ve always felt that this is ultimately a financial war as well. And it wouldn’t surprise me if this Asian guy posting all of this information is some sort of AI entity, to use as another weapon against the West in this war.

Happy New Year to all!!

so whoever sold 10,000 lots of silver in 15 mins……is staying close to their nearest dunny.

2 hrs ago. Check the comments. People selling gold for silver. I wonder though who buys gold? The Central banks.

The silver contagion is growing. Kevin OLeary, Ron Paul, many other familiar names all coming out on silver. I’m worried if it grows too big will government go after stackers for silver. . We are a small group maybe too small to worry about if not holding in big numbers but if everyone starts buying. will it be worth it for them to restrict or confiscate. Sure it’s likely going up but so are the others. It just happens to be a big target of manipulation and the day of reconning has come.

Another thought is it China weaponizing it to bring down the western economy knowing supply’s are low they made lower shutting down exports and now encouraging everyone to buy it.

Still using the carrot on a stick and FOMO on silver but other metals and rare earths are also important. Is it a distraction,,? Trying to figure out motive

He mentions Australia in this one Someone said the perth mint was closed a few days ago..Was that on Christmas lol

Up $5.77. Must suck when the paper shorting kryptonite doesn’t work anymore

Where Did All That 1934 Silver Go? A Timeline of Uses and Disposals. The acquired silver wasn’t just hoarded; it served monetary, industrial, and strategic purposes. Over the decades, it was gradually depleted through coinage, wartime lending, industrial releases, and sales. By the early 2000s, U.S. government silver stockpiles were essentially gone. Here’s the breakdown:

quora.com +8

1930s–1940s (Initial Uses): Much was minted into silver dollars or used to back silver certificates (paper currency redeemable in silver, helping expand the money supply). Some supported wartime efforts; e.g., during WWII, ~300 million ounces were lent to the Manhattan Project for electrical conductors in uranium enrichment (later returned). Additional silver was lent to allies under Lend-Lease (e.g., to the UK). The Act was repealed in 1946, but stockpiling continued for strategic reasons under the Strategic and Critical Materials Stockpile Act.

reuters.com +4

1950s (Peak and Industrial Drawdowns): Treasury holdings peaked at 3.9 billion ounces (1959). Rising industrial demand (photography, electronics) led to releases; e.g., silver was sold or allocated to defense needs.

1960s (Depletion Begins): Silver prices surged due to global shortages, prompting the 1965 Coinage Act, which eliminated silver from dimes/quarters and reduced it in half-dollars (saving ~1 billion ounces over time by switching to clad coins). In 1968, 165 million ounces were transferred from the Treasury to the new Defense National Stockpile for strategic materials (stored at West Point and San Francisco Mints).

usmint.gov +4

1970s–1980s (Sales and Auctions): In 1970, 25.5 million ounces were removed from the strategic stockpile (for industrial sales), leaving 139.5 million. By 1979, silver was deemed non-essential for defense. The General Services Administration (GSA) auctioned Treasury bullion in phases (e.g., 105 million ounces authorized for disposal by 1983, leaving ~34 million). Much went to industry or investors, e.g., sales to cover coin production or stabilize markets amid the 1980 Hunt Brothers price spike.

quora.com +3

1990s–2000s (Final Depletion): The strategic stockpile declined steadily (e.g., to ~49 million at West Point by the late 1990s). By 2002, it was fully depleted, with remnants sold to the U.S. Mint for American Silver Eagle coins. Today, the U.S. government holds virtually no silver reserves—any remaining is negligible and for minting commemoratives.

about a $6 gap from the LBMA fix.

It is interesting that the physical price followed the paper price down, although the gap has closed to $5 now.

I checked the $ 34 billion Fed borrowing …not true and not true that anyone is in trouble…..according to Grok.

The Fed has to report borrowing on a daily basis, so not easy to hide , if it can……Who ever is behind the AG guy can check this as easily as anyone …..why bother to lie.

Besides that back to the content..all the info is not accurate. For instance is Gold a better conductor than silver? The mysterious bank? Russia is taking resources from Europe as retaliation of them stealing theirs. Truth is they have only threatened to at this point. Prices on China aren’t accurate.

I saw a other one with the same words of A,G. But who was a elder white man that sounded a lot like a economic YouTuber Professor Wolff but AI.

That leaning towards fear porn type or propaganda. Who ever it is wants followers piling into silver and suggesting selling gold. They are bringing attention to silver and don’t trust the times he asked to say where the watchers are from. I don’t think the attention to stackers it’s bringing would be welcome attention from governments.

FEAR OF MISSING OUT PORN.

That said, one thing he said is close to the truth but I won’t mention it until after the clock strikes 12 am on Dec 31.

Once you see it you can’t un-see it! He has lost all credibility IMO and I bet lost many more of his followers and subscribers by making that video.

This happens quite often but the mouth makes the proper movement for the words we are hearing, it’s just that the sound and picture are not exactly coordinated. At least that is what I think since it is a common occurrence in videos for the sync to get off. Thanks Again. SNG

Listen to it, why don’t you? His companion made his living out of reading people’s faces. The facial movements, the eyes are the easiest to check upon, are on continuous repeat. And they are dead – as you’d expect from a CGI. Which would make him a bloody good poker player.

The Ninja whinger, on the other hand, his eyes are full of anger, and fear. His emotions are too easy to read. The CGI is cleaning up at the table. “Know when to walk away, ‘n know when to run”.

AG didn’t math the voice. I didn’t mentioned it but it didn’t match. I saw a comment on the video on it. It didn’t match. He was talking when the voice paused. I also have some experience on that and sign language for the deaf and hard of hearing although forgot a lot by now and would have to revert to finger spelling, spelling in sign language. While signing you would accentuate the words my saying them even silently to lip reading with it.

Here’s on about the reason for the crash by AG. If you miss the pauses take notice on lip reading words starting with letters like B or P where you would put your lips together. Not that I want to help improve a deception. There’s also another group that is advanced and that is sight impaired or blind passt or present who can recognize voices to people.

And why does it matter anyway? Surely the content is the thing; the only reason AI became an issue is the content hating ninja!

I beg to differ. I am hearing impaired from years of running all kinds of industrial machinery and equipment so I do a combination of lip reading and listening/hearing, and I find his lip sync to be perfect on the several videos I have watched….Not that I believe he is not AI created. Maybe if anyone has one he has done where they believe the lip sync is off, please post the video. Thanks from SNG!

🙂 🙂

Hopefully we can hold on through tomorrow.

And bring a lot of wigs and costumes.

I remember the silver bars about 10 yrs ago but not the gold bars bring given away. If I saw that I might have tried to get their GPS location.

The AI guy that is. Not the Economic Ninja whinger.

Loved your quip about why are we never approached by people offering the choice between a chocolate bar or a silver bar! Ten years ago they were using one ounce gold coins. Something must’ve altered the risk profile.