That’s highly unusual.

I can’t imagine what France will look like in 20 years

Visegrád 24

@visegrad24

BREAKING:

The Law Commission of the French Parliament has adopted a bill that will grant the right to vote and stand for election in municipal elections to non-EU foreign nationals residing in France

The French Parliament will now vote on it on Feb. 12th

aurum

Tks ….see my addition regarding the wave sizes….that the C waves are so small could be super bullish….and as we have such good Fib fits, I think the count is good….we now wait to see.

That the wave particularly in AG is so large in price, might mean it is all of the correction.

Cheers

Maddog 8:54

The down can be counted as you have shown (although a 5 wave count down is also possible), regardless though it is likely imo that it is just the 3 or 5 wave A. If so, the B wave should using the rule of thumb retrace half of the A wave and then again using the rule of thumb the C down should equal the length of the A. I know you are aware of this but I post it for an IMO for the others.

aurum

Lets see what we have in terms of Fibonacci numbers in a poss A-B-C retracement in Au and Ag

A dn = 50.25 Dollars…B up = 19.8 or 38 % of A, perfect Fib No

C = 28.18 or 0.56 of A, and 1.42 times B, again a near perfect Fib

A = 1196.35 $ B + 689.55 or o.57 of A not far from O.62 Fib

C = 436.66 or 0.62 of B perfect Fib and 0.36 of A….v near 0.38

plus each wave so far has been 3 days an exact Fib No……

Was this all of a Larger A wave down and we now rally in a larger B …twds recent Hi’s or was it all of the correction time will tell, but the perfect Fib No’s say and entire dn wave has been completed…..and in 3 waves…which confirms a corrective wave only …..again O/n action suggests we are done down for either a while or longer….

If this scenario plays out the fact that the C waves are both smaller than the A waves, especially so in Au…..is a v bullish sign …in Golds case super bullish.

More Somali culture on display

Ilhan Omar’s Winery Exposed As Fake Shell For Alleged Money Laundering

https://www.zerohedge.com/political/ilhan-omars-winery-exposed-fake-shell-alleged-money-laundering

SLV broke the 50 dma yesterday

Would really like to see it bounce back above today, but it’s another buck and a heavy lift.

Not that charts have been uber reliable as of late.

Gold is a stud though, it doesn’t want to break the 20 day.

We seem to have the dollar at our backs for the first time this week.

Didn’t realize how badly they wrecked silver after the SM close last night

The ridiculous Shanghai (I’m calling it that now) put their heads together and gave us a pm fix last night of $82.42 after an overly generous (to the shorts) am fix of $76.83. It’s become clear that there’s very little difference between exchanges as they both answer to big money interests and will direct prices in favor of said interests. Markets aren’t markets they are directed money flow agents of the decision makers, who are the tools of the powers and principalities who run the actual world.

So, after pondering all that, I decided to take a look at the pre-market shares to see what the powers were going to give back after yesterday’s drubbing, (since they’ve been so generous with the metals thus far) and it appears they’re offering the usual 10 cents on the dollar.

That is, if we survive the jobs report.

Are demos smarter than a 5th grader?

Average Somalian has a IQ of 68

Shirley found them in California too

Somali daycare

Sng Epstein files

Mexican model traumatized screaming in a hotel about how they were eating humans.. babies. Then disappeared.

To Americanos

Trump announced his discount drug site

Trumprx.gov This will start competition.

Find the world’s lowest prices on prescription drugs

TRUMP RX DOT GOV

Ferrett

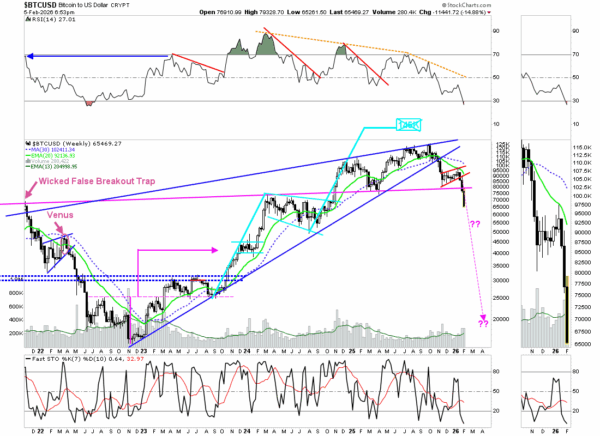

I don’t know why Bitcoin is selling off but I wonder if as least some of it was sold to purchase tangibles like PMs especially if their realizing the shortages and still outside the banking system if you hold it. Maybe even some of the stocks too. Not saying the only reason. Just like when Bitcoin got going and the PMs kept down some of the PM money moved to Bitcoin or the Bitcoin miner stocks.

Analysts ramp up gold forecasts as global uncertainties mount

Part:

Gold’s rally took it to all-time highs just shy of $5,600 on January 29 before prices plunged to $4,403 an ounce on Monday, with the meltdown and profit-taking sparked by U.S. President Donald Trump’s nomination of Kevin Warsh to be the next Federal Reserve chair.

Analysts believe the factors driving gold – including geopolitical risks, robust central bank buying, concerns about Fed independence, rising U.S. debt, trade uncertainty, and de-dollarisation – will continue to support the safe-haven asset in 2026.

“Gold’s thematic drivers remain positive and we believe investors’ rationale for gold (and precious) allocations will not have changed,” analysts at Deutsche Bank said.

Analysts expect central banks to keep adding to their gold reserves as they diversify and reduce reliance on the U.S. dollar, although jewellery demand is likely to contract further in key Asian regions due to high prices.

Analysts ramp up gold forecasts as global uncertainties mount

If you “invest” in Strategy after watching Saylor’s performance in this video

Michael Saylor Freaking Out As Stock Price Collapses

byu/CryptoEmpathy7 inButtcoin

then I think you’re nuts. He demonstrates an alarming lack of basic financial knowledge. Apart from the fact that it’s a bitcoin ETF.

Think or Swim thinks the BTC low was $60,005

It was $127K in Oct.

Re The Naked Shorts

What about the naked longs? I suspect a lot of them are momentum traders noticed the uptrend, and climbed into our sand box going long on contracts, ETFs etc. Naturally they came in late and high, and after prices start dropping, they cash out or sell the paper.

It could be Contracts, SLV or GLD etc etc. They have nothing real to sell, so they are naked longs, driving prices too high and then driving them too low. We’ve already seen crazy highs and crazy lows, but the primary trend is up.

I think they created those things as decoys to take investor’s attention away from precious metals, holding the prices net down for decades, but its not working so good anymore because of the obvious new highs anyway.

certainly heading to your target.

Just bounced off $64.

Bitcoin was over $125,000 on 6th October last year. Four months later and it has kissed $60,000.

Sorry no selling of bullion

Just my PM stocks. It’s too complicated to sell fiz in the US right now. I don’t want to lose my fiz position. Mailing is not safe any longer imho and local dealers are scalping people pretty deep. But if it crashes this is an amazing time to buy You don’t even have to pick the bottom, just stack. I do think we are going much higher, but something has to give in the short term, it seems. I also think dealers are going underground. As the price rises, it becomes more dangerous. Theft, robbery. Crazy volatility for dealers is bad, and I do believe the prediction that a large portion of dealers are not going to make it.

eeos, yes, it is scary.

Nearly as scary as Mrs F when it shoots up so suddenly to AUD7,942 when the “sell, sell” is mixed with “it’s going to $8,000”. And then it crashes to AUD6,371 (when, of course, the $8,000 prediction is sidelined). So I point out that if we had sold 10 oz at the peak, and paid the capital gains tax, and bought back at the low we would end up with 9.97 oz. Without taking into account the sell commission of 10% (at the time) and buy at 2.4%. Or the impossibility of actually selling at the peak even if we’d recognised it (we would have had to be sitting on the bullion dealer’s counter for that milli-second) or buying at the low (which was the middle of the night).

So we’ll sit it out. Best of luck to all.