Who hates Elon?

I like Elon. You been hitting the white powder again?

Treefrog

Got a call from a friend yesterday checking on me and how my moving is going along. She brought up gold and silver. She was always against it because her husband dominated the finance as she is American now but Japanese born. She said the first time that she wished she bought it when it was cheaper but her husband said no it’s a bad investment. He’s retired Fed worker. They are not poor, well off not really rich other than in having what they need and no debt.

She said one of her friends on the coast in another state has been buying gold bars since the 70s and said she’s a millionaire now. She asked if that’s true how big are those bars. She knows nothing about buying it and that isn’t unusual. I told her there’s different sizes of bars but if she’s been buying since the 70s she might just be a millionaire. I told her silver eagle going up too. That silver I gave her for retirement yrs back is worth more and the birth of her grandson she got a couple of Koalas for him and parents. . I told her back then if something happened it will get you groceries.

I’m hearing this more than once from different people now. Including my son who has some but wished he had more, makes good money but his wife likes to spend but learning. The never buyers are now regretting not buying it. My friend said her husband kept saying it was a bad investment again questioning his decision. I told her maybe he was probably thinking stocks because they’re volatile but not the physical and why. It’s still not to late. If there is a market crash at some later point and temporary decline I’ll tell her she’ll get one last chance in both phyz and stocks as the market moves more into PMs vs equities as things are now anyways. A lot of people are talking about it now so time to be quiet around the public.

au/ag ratio

49.49 …the beat goes on.

important announcement

If you’re selling back to your dealer, be very careful because the bad guys are inside the priority registered mail USPS, even though this division is separate, the employees are all bonded and insured it’s becoming shadier by the day. Be careful what to insure it for, if you need to go out and replace it, the spread is fat right now. Also, last Friday was the last day a Silver Eagle mint box could be shipped back to a dealer. Mint boxes became insurable this morning with the Silver price action. Same with $1,000 junk bags. They were easy to order and now problematic to get back with the maximum $50K shipping insurance at USPS.I didn’t think this problem would come so soon.

Chips on the brain..

Nobody hates him personally anyways except maybe libs. He’s just starting, techs still in its infancy in a big leap forward at that, learning as he goes along , everything will get better and better over time. Just hope it doesn’t take too many jobs with it..

Might sound ridiculous

But after hearing about someone who walked into a room where a MRI machine was being used carrying a portable oxygen tank it was pulled out of her arms flying across the room into the machine where unfortunately a child was in perhaps the magnets could be used for better reasons.

Magnets

I wonder if they can use them for rescue? When they can’t rescue someone because they get to them they can drop a magnetic vest and fly them out lol

Overton

I wonder if they can make some kinda electronic magnet they can deploy to capture all that metal from.thevnickel and cobalt that’s going to fly around in a battery fire after they redirect traffic and air planes. Although I don’t know why they haven’t thought of that to put on ships if they can make it go in one direction to keep enemy aircraft and now drones away in one big sweep.

If you hate batteries

please short Telsa, so I can have some of the PM money. I have lots of friends with the Tesla battery pack, be for real. Haha. Scared of fire? The power wall is outdoor rated too. My house is double wythe brick from 1943, I care not about fires. If it burns my roof off, I’m adding a pop top to my house!

This is a bizarre letter, Supposedly that Trump wrote to the Norwegian prime minister

Sprinter Press

@SprinterPress

·

4h

American journalist Nick Shifrin published a letter from US President Donald Trump to Norwegian Prime Minister Jonas Gahr Støre, linking the Nobel Prize and Greenland:

“Dear Jonas: Given that your country decided not to award me the Nobel Peace Prize for preventing more than 8 wars, I no longer feel obligated to think solely about peace, although it will always prevail, and now I can think about what is good and right for the United States of America. Denmark cannot protect this land from Russia or China, and why do they even have a ‘right of ownership’? There are no written documents, there’s just the fact that a ship landed there hundreds of years ago, but ships have also landed there for us. I’ve done more for NATO than anyone else since its founding, and now NATO should do something for the United States. The world will not be safe if we don’t have full and total control over Greenland.”

Thank you! President DJT

Ferrett

This AI is kinda funny. I don’t think it’s self aware.

I asked it who programed it.

After it added this summary to the conversation with someone.

Goldielocks asked the AI to reveal who programmed it, and XXX wondered if it would answer.

okay I covered space in there too

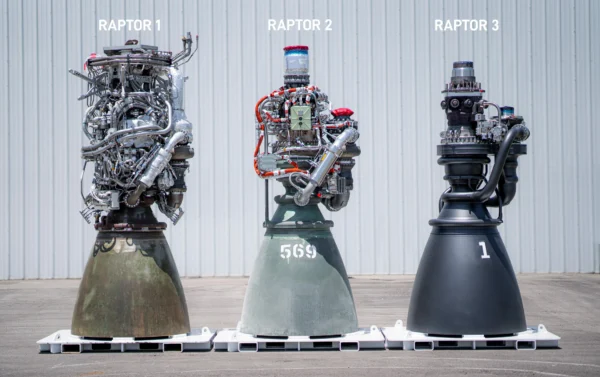

Starship is going to kick ass! The Falcon 9 just did it’s 600TH landing. Show me another company. Listen Elon’s new rocket engine, the Raptor 3 is so sophisticated that one of the most powerful rocket executives in the world didn’t even think the Raptor 3 was even real.

That Jackass CEO cowboy over at some retarded rocket company ULA, while everyone lapped up his shit. He can sit over there at Blue Origin with the rest of those bozos. Wait until the starship makes its 600th landing, it’s already in the works. We will no longer recognize anything. When Space X IPO comes, eeos is unloading some PM stocks and buying the greatest trade in history that’s coming. We haven’t even seen the Raptor 4 rocket engine yet. Bruno went on to X after Elon posted the Raptor 3 and he said anyone can show pictures of an uncompleted engine. But Elon was ready for him and he trolled his azz on Twitter, and posted the Raptor 3 firing at the Mcgregor testing center and Bruno went silent.

Power plants

It’s not working

Excessive wind and solar killing birds and whales put where and not sufficient and windmills that can’t deteriorate maybe we can send in space?!!!

They need to stop politicizing power and work together. They need a power system that charges the batteries at the same time from the power source , a perpetual self sufficient system without alternatives and keep those for smaller projects in off grid areas.

I’ve already discussed power plants

Don’t be silly we’re not building more power plants, it’s a stupid idea. Why would we build power plants that don’t run at 100 percent output? There is no reason to ever build another power plant in the United States of America (for a VERY long time), I already explained that all of this power output just needs to go into battery banks and we have a grid that charges battery packs at the peak of the duck curve (where power production can even be near free at times from excessive wind and solar inputs) and re-energizes the grid at mid and high tier power rates when consumption is greatest and rates are highest. This is a very simple engineering fix, And just like gold and silver people make money in arbitrage this is easy; buy low, sell high- come on.

Guess who won? It’s Elon, the guy you guys all hate, and guess what company? This technology’s buried in Tesla the car company that’s no longer a car company, but an AI, robotics, and energy management company. He fooled you. That’s why I’m banking.

To take it a step further and make the grid even more resilient, now instead of all of this power being concentrated in one giant battery bank, instead we’ll have battery packs on every single house and building in the United States and the grid will be decentralized and much more stable, and it will also be impossible to attack the United States power output at that moment. And all of these battery packs make changes in thousandths of seconds and work in unison as one giant power plant. Forked all the bad guys in energy production at once.

Well, I’m not buying a battery pack then, they’ll be too expensive. It will be in your car instead. Cars are going electric, that’s why silver is FLYING.

Well eeos, the sun only shines when it’s not cloudy and the window is only 8 hours long. You forgot about the Starship! The largest rocket in history. Solar is 24/7/365 in space. It’s going to be beamed via microwave is my prediction. Okay beaming power to earth is theory only. Okay, guess what, he’s sending AI compute to space then!

PRICE IS THE ONLY OUTLET

Why 15 Years of No Supply Bump Meets President Trump’s Power Plant Emergency Just Guaranteed a Decade of Higher Mineral Prices!

It was not a subtle hint or a vague policy paper. It was a public declaration of emergency, a brute-force solution to a crisis that has been building in plain sight for years.

The announcement from the Trump Administration’s National Energy Dominance Council was the sounding of an alarm and the unveiling of the response in a single, stunning move: a call for emergency auctions to build over $15 billion of new, reliable baseload power plants across the American Mid-Atlantic.

This moment is the 21st-century equivalent of the industrial mobilizations of the past; a peacetime echo of the arsenal of democracy, a domestic version of the Marshall Plan, but for our own crumbling infrastructure. It is the point of no return.

This is the moment the United States government officially acknowledged that the nation’s power grid is on the brink of failure, wholly unprepared for the tsunami of demand from the artificial intelligence arms race and the wholesale electrification of the economy.

For years, the narrative has been one of managed decline, of “energy subtraction,” as the administration itself called it, with reliable power plants being prematurely shut down in favor of intermittent, renewable sources that have proven incapable of shouldering the load.

Now, in a stunning reversal born of necessity, the directive is to build. And to build fast. This proclamation is far more than an energy policy; it is another in the long list of definitive catalysts that ignites a historic, multi-decade super-cycle in critical minerals.

The emergency buildout of power plants is not just another layer of demand; it is a massive, non-negotiable demand accelerant being stacked directly on top of an already unprecedented demand profile from A.I. data centers, military modernization, and a creaking, 70-year-old power grid that must be rebuilt from the ground up.

This is the government admitting that the transition to a new energy and technology paradigm cannot happen without a foundation of raw physical materials, a foundation that we have neglected for decades.

- You need to understand this bombshell announcement and its profound implications for the types of critical minerals investments we all make.

- You need to understand how this government-mandated construction boom is pouring gasoline on an already raging critical minerals supply fire, creating a perfect storm in the resource sector.

- You need to understand how the dots connect between the urgent need for power, the 15-year supply drought in the mining industry, and the escalating geopolitical cold war with China over the physical inputs that make modern life possible.

- You need to understand that the conclusion is inescapable: we are entering a new paradigm, one where the structural deficits in copper, silver, nickel, uranium, and dozens of other materials are so severe that dramatically higher prices are no longer a possibility, but a mathematical certainty.

- And you need to understand that the most powerful government on the planet, the government of the United States of America, has just taken a megaphone and announced to the world that the resource crisis is here, and they will print and spend whatever it takes to solve it. The super-cycle is no longer a theory; it is now official state policy.

The reality is that price is the only outlet. 15+ years of no supply bump meeting President Trump’s power plant emergency, layered on top of an already historically absurd demand stack, guarantees a decade plus of higher critical mineral prices!

Let’s Dig Into The Following:

- First, we need to deconstruct the emergency power proclamation catalyst. To grasp the magnitude of this, we must understand the desperation behind it. The announcement was not a proactive measure, but a reactive, emergency response to a grid that is actively failing. The administration’s statement laid the blame squarely on the “forceful closures of coal and natural gas plants without reliable replacements,” which left the country in an “energy emergency.” Why the government has effectively underwritten a massive, multi-billion-dollar construction boom, that is a non-negotiable infrastructure project deemed essential for national and economic security!

- Then there is the unprecedented demand stack and the pouring of gasoline on a raging critical minerals supply fire. This new, government-mandated demand for minerals is not happening in a vacuum. It is being stacked on top of a series of simultaneous, historically large demand drivers that were already straining the global supply chain to its breaking point. Why this current situation is unique; it is a multi-front war for physical resources, and the power plant buildout is the equivalent of opening a massive new front!

- The 15+ year CAPEX winter has led to a great supply deficit and the bill is now coming due. A rip higher in demand is only half of the equation. The truly explosive nature of this super-cycle becomes clear when you examine the supply side. Why the reality is that the global mining industry is completely and structurally unprepared for the demand shock that is now arriving!

- Then there is the geopolitical pressure cooker and new cold war for resources. This collision of unprecedented demand and anemic supply is transforming the market for critical minerals from a purely economic issue into one of urgent national security. That is clear for anyone paying attention. The logical chain is simple and unbreakable: 1- Without critical minerals, you cannot build new power plants. 2- Without new power plants, you cannot power the data centers needed for A.I. supremacy. 3- Without A.I. supremacy, you lose the new cold war with China. And that is not an option. Why securing a reliable, independent supply of critical minerals is no longer a “nice to have”; it is a fundamental requirement for survival as a world power!

- Then there is the human factor and a lost generation of miners. A whole generation of skilled geologists, engineers, and mine operators retired or left the industry for more stable careers in tech or finance during the 15+ year winter in critical minerals. Universities that once had robust mining engineering programs saw enrollment plummet, with some programs shutting down entirely. This creates another critical bottleneck. Even if a company discovers a world-class deposit and secures a permit, who will design the mine? Who will build it? Who will operate it? The brain drain is real. Why this is another reason the supply deficit will persist for longer and be more severe than the market currently understands!

- And that brings us to the crux of it all and that is that the only outlet is price. We are entering a new paradigm, one defined by structural deficits and state-sponsored, non-negotiable demand. In this world, new all-time highs in mineral prices are not a signal of a market top; they are merely the beginning of a much larger re-pricing event. They are the market’s first, tentative attempts to grapple with the sheer scale of the deficit that is coming. Why the price signals will have to become so loud, so painful, and so extreme that they force a decade’s worth of investment into a compressed timeframe!

|

|

||||||

|

Aussie guy explains hate speech.

Satire lol

PM fix $103.26

We’re sitting on a $10 gap between China phyzz and American paper. Even with the tax, I don’t think that can be maintained,

I would think the gap needs to shrink, but what do I know?

ferret – interesting about the JGB’s, I noticed our 10 yr. is up again too – 4.22%

Something wicked this way comes…. 🙂

Japanese rates take off across the board.

Currency steady, so carry trade intact so far. But then, with rates in the US climbing, no incentive to unwind anyway.

Pm dealer reacts to US Mint repricing.

People interviewed coming into buy.