Alex Valdor @ 12:05

Yes reality is coming very soon now.

Look at Ford.

Ford Shares Slide After Net Income Plunge, Suspended Guidance | ZeroHedge

In the ‘old days’ – if Ford had put out a report like that – not just Ford – but the entire market would be crashing.

Now, Trump puts out one distraction – Bessent puts out another – and presto chango – stocks have a big comeback which of course is a ‘good reason’ to minimize PMs. (all thanks to computers/AI/algos – our friends? – not – they are our enemies)

But these characters always think they can outsmart the market(s).

The Blackrock boys (et al) thought they were so smart using passive investing into index funds to rig the markets – but now they face a disorderly unwind.

And it will happen no matter how much they fight it – it’s coming.

The only thing they will be able to do in order to preserve their grip on the people will be a major print, hyperinflation (in order to inflate away the debt), and a new currency regime (hopefiully with programable currency to keep the plebs in line).

You must hope they don’t get that as their true natures would be revealed.

We need to fight this … our very survival depends on it.

So don’t be stupid and lazy like far too many.

Get out there and support local heroes – that are attempting to organize your political economy – that is based in your best interests – not those of the rich and powerful in DC who don’t give a flying F about you.

Sound Money Defense League – Bringing gold and silver back as America’s Constitutional money

God’s Speed all

Thanks Buygold

Just put HL on my “watch list”

Captain Hook , I believe you are soon to be vindicated

I recently placed an order with a nationally known chain of low cost imported goods, associated with the name Walton , the family which accumulated enormous wealth after Henry K. and Zbignew B. scuttled US manufacturing jobs by making political deals in a large Asian country . ( Apologies for not naming names , but there is a reason ).

Overnight I received two emails from that corporation. One stating that my address could not be located ( it was not a problem in the past with that company ) and a second , saying my payment was being refunded … they were cancelling the order , because of the ‘address issue’).

The email when I placed the order indicated a delivery date of May 22 . That told me it was arriving from an International source – you can guess from which nation as well as I can .

I predict that there will be many empty shelves at the local stores of that and other chain stores very soon , with significant impact on the corporate share prices . We are already seeing volatility in stock market indices .

It will be blamed on Trump , and there will be economic pain , but building product in America once again will be worth it . It will take years !

A friend in Colombia owns a small metal manufacturing firm , and came to America to buy a used numerically controlled turret stamping/punching machine complete with dozens of interchangable dies . He paid pennies on the dollar for that huge machine. A very wise investment at this time will be the purchase of functional , usable heavy manufacturing equipment for use in rebuilding American infrastructure .

ferrett @ 23:56

“joined at the hip with China”

Hadn’t thought of that before. You guys export a lot to China. They are partly the reason you are so prosperous. JMO I don’t think this tariff war will persist. It’s in no one’s interest. Then again when you get humans involved …

Scanning the options market (cause R640 no longer appears to be with us)

Took a look at Hecla. Pretty good open interest for the June 20th $4, $5 and $6 calls. It appears there are some folks that are betting on a recovery in that stock.

Not recommending, just observing. 🙂

Some of these shares aren’t quite decoupling

The silver shares I watch just keep drifting lower, NEM is pinned down.

Maybe they’ll come back toward the end of the day like yesterday, but they just can’t seem to catch/hold a bid.

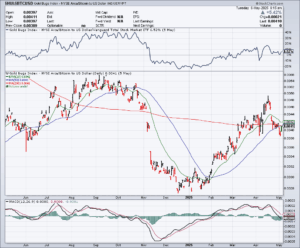

HUI/BTC Ratio defines timing …

… of recent bounce in the PM sector …

From the bottom in December, the HUI/BTC Ratio traced out a four month – five wave affair … and so far, has put in a two-week correction … matching the weakness in the PM sector up until this week.

If history is a good guide, technically the PM sector still needs to consolidate for approximately another month or so … potentially matching the presence of a head and shoulders pattern in the trade.

Anything can happen … however odds are odds.

Be careful folks

Tapping on $3400

Beautiful.

Correction.

PMI’s and ISM’s were out yesterday. International trade balances today were larger than expected. Hard to understand unless these countries frontloaded deliveries before the tariffs.

SLAM Discovers Mineralized Quartz Veins

https://ceo.ca/@accesswire/slam-discovers-mineralized-quartz-veins

INITIAL DRILL RESULTS AND EXPLORATION UPDATE AT MACHUCA PROJECT, ANTIOQUIA, COLOMBIA

https://ceo.ca/@newswire/initial-drill-results-and-exploration-update-at-machuca

Silver Storm Announces Acquisition of Till Capital

https://ceo.ca/@businesswire/silver-storm-announces-acquisition-of-till-capital

Maritime Provides Update on the Hammerdown Gold Project

https://ceo.ca/@newsfile/maritime-provides-update-on-the-hammerdown-gold-project

Santacruz Silver Announces Second Payment to Glencore of US$7.5 Million Under Acceleration Plan

https://ceo.ca/@newswire/santacruz-silver-announces-second-payment-to-glencore

Inventus Announces Early Warrant Exercise by McEwen Mining and Begins Grade Control Drilling at Pardo

https://ceo.ca/@GlobeNewswire/inventus-announces-early-warrant-exercise-by-mcewen

Abcourt Closes $4.6 M Non-Brokered Private Placement

https://ceo.ca/@GlobeNewswire/abcourt-closes-46-m-non-brokered-private-placement

Skeena Releases 2024 Sustainability Report Entitled “Rebuilding Together”

https://ceo.ca/@accesswire/skeena-releases-2024-sustainability-report-entitled

Harvest Gold and Vior Add 25 New Claims to its Mosseau Gold Project in the Urban Barry Belt in Quebec

https://ceo.ca/@thenewswire/harvest-gold-and-vior-add-25-new-claims-to-its-mosseau

Probe Awards EIS Contract; Advances Permitting for Novador Project

https://ceo.ca/@GlobeNewswire/probe-awards-eis-contract-advances-permitting-for

Riverside Resources and Questcorp Mining Execute Definitive Option Agreement for La Union Project, Sonora, Mexico

https://ceo.ca/@newsfile/riverside-resources-and-questcorp-mining-execute-definitive

AuMEGA Metals Identifies Major Structure at Bunker Hill from RC Drilling

https://ceo.ca/@newsfile/aumega-metals-identifies-major-structure-at-bunker

Questcorp Signs Option Agreement to Acquire 100% Interest in La Union Project, Sonora, Mexico and Completes Technical Report for La Union Project

https://ceo.ca/@newsfile/questcorp-signs-option-agreement-to-acquire-100-interest

Centerra Gold Reports First Quarter 2025 Results; Approved up to $75 Million to Repurchase Shares in 2025; Announces Updated Mineral Resource at Kemess and Advancing Studies on the Project

https://ceo.ca/@GlobeNewswire/centerra-gold-reports-first-quarter-2025-resultsapproved

Centerra Gold Announces Updated Mineral Resources at Kemess; Advancing Studies on the Project

https://ceo.ca/@GlobeNewswire/centerra-gold-announces-updated-mineral-resources-at

Golden Cariboo Resources Announces Two Parallel Private Placements

https://ceo.ca/@thenewswire/golden-cariboo-resources-announces-two-parallel-private

AngloGold Ashanti and Gold Fields Agree to Pause Proposed Ghana JV Discussions

https://ceo.ca/@businesswire/anglogold-ashanti-and-gold-fields-agree-to-pause-proposed

SILVER ONE ANNOUNCES IN-GROUND MINERAL RESOURCE ESTIMATE PREPARED IN ACCORDANCE WITH NI 43-101 ON ITS CANDELARIA PROJECT, NEVADA

https://ceo.ca/@newswire/silver-one-announces-in-ground-mineral-resource-estimate

Discovery Files Final Base Shelf Prospectus

https://ceo.ca/@GlobeNewswire/discovery-files-final-base-shelf-prospectus

IMPACT Silver Announces Full Year 2024 Results With Record Revenue and a Return to Net Profit in Q4

https://ceo.ca/@newsfile/impact-silver-announces-full-year-2024-results-with

Aura Declares Dividend of US$0.40 per share and US$0.1333 per BDR based on Q1 2025 Results, resulting in a Dividend Yield of 11%¹ in the LTM

https://ceo.ca/@GlobeNewswire/aura-declares-dividend-of-us040-per-share-and-us01333

Aura Announces Q1 2025 Financial and Operational Results

https://ceo.ca/@GlobeNewswire/aura-announces-q1-2025-financial-and-operational-results

Aura Announces Confidential Submission Of Draft Registration Statement For Proposed U.S. Public Offering

https://ceo.ca/@GlobeNewswire/aura-announces-confidential-submission-of-draft-registration

McFarlane Lake Announces Listing on the Canadian Securities Exchange (CSE) Effective Thursday, May 8, 2025

https://ceo.ca/@accesswire/mcfarlane-lake-announces-listing-on-the-canadian-securities

First Nordic Provides Corporate Update

https://ceo.ca/@newswire/first-nordic-provides-corporate-update

Sixty North Gold Announces Drill Intersection of Massive Sulphides Returns Anomalous Gold Values

https://ceo.ca/@newsfile/sixty-north-gold-announces-drill-intersection-of-massive

Aurania Closes Private Placement with Total Gross Proceeds Of C$1.72M

https://ceo.ca/@newsfile/aurania-closes-private-placement-with-total-gross-proceeds

Kinross announces ownership of shares of Eminent Gold Corp.

https://ceo.ca/@GlobeNewswire/kinross-announces-ownership-of-shares-of-eminent-gold

Apogee Minerals Announces Acquisition of the May Lake Project Located in Saskatchewan, Canada

https://ceo.ca/@GlobeNewswire/apogee-minerals-announces-acquisition-of-the-may-lake

Sanatana Enters into a Definitive Agreement to Acquire 5,900 Hectare Gold Strike Two Project Establishing Foothold in the Rogue Plutonic Complex Region in Yukon, Canada

https://ceo.ca/@newsfile/sanatana-enters-into-a-definitive-agreement-to-acquire

MKANGO RELEASES YEAR END 2024 FINANCIAL STATEMENTS

https://ceo.ca/content/sedar/MKA-2025-05-05-news-release-english-3a1b.pdf

Romios Gold Resources Inc. Announces Termination of Letter of Intent With Star Gold Resources Corp.

https://ceo.ca/@newsfile/romios-gold-resources-inc-announces-termination-of

Stellar AfricaGold Updates on Tichka Est Gold Project, Morocco and Zuenoula Gold Project, Cote D’ivoire

https://ceo.ca/@thenewswire/stellar-africagold-updates-on-tichka-est-gold-project

High Grade Gold Anomaly Extended at John Bull in Preparation for Drilling

https://ceo.ca/@GlobeNewswire/high-grade-gold-anomaly-extended-at-john-bull-in-preparation

Star Gold Corp. Refocuses Strategy on Longstreet Project

https://ceo.ca/@accesswire/star-gold-corp-refocuses-strategy-on-longstreet-project

Latin Metals Announces Private Placement for Gross Proceeds up to $1.0 Million

https://ceo.ca/@GlobeNewswire/latin-metals-announces-private-placement-for-gross-fbd7c

Dolly Varden Silver Announces Agreement to Quadruple Tenure Area in the Golden Triangle by Acquiring Hecla Mining Company’s Adjacent Kinskuch Property

https://ceo.ca/@newsfile/dolly-varden-silver-announces-agreement-to-quadruple

Greenridge Exploration Announces 2025 Exploration Plans for the Blackbird Project in Northern Saskatchewan

https://ceo.ca/@GlobeNewswire/greenridge-exploration-announces-2025-exploration-plans

Fuerte Metals Intercepts 10.3 g/t AuEq over 2.4 m, 7.0 g/t AuEq over 1.4 m, 5.6 g/t AuEq over 3.6 m and 0.7 g/t AuEq over 95 m at Its Cristina Project, Chihuahua, Mexico

https://ceo.ca/@newsfile/fuerte-metals-intercepts-103-gt-aueq-over-24-m

StrikePoint Drills Broad Zones of Near Surface Oxide Gold at the Hercules Gold Project, Nevada

https://ceo.ca/@newsfile/strikepoint-drills-broad-zones-of-near-surface-oxide

Update on Expanded Small Mine Application and Badogo Permit Transfer

https://ceo.ca/@newsfile/update-on-expanded-small-mine-application-and-badogo

Eminent Closes Private Placement Including $3 Million Strategic Investment by Kinross Gold Corp.

https://ceo.ca/@newsfile/eminent-closes-private-placement-including-3-million

GALIANO GOLD ANNOUNCES DISCOVERY OF NEW HIGH-GRADE ZONE AT ABORE WITH INTERCEPT OF 50m @ 3.2 g/t Au & RESULTS OF INFILL DRILLING PROGRAM

https://ceo.ca/@newswire/galiano-gold-announces-discovery-of-new-high-grade

Morning Maddog

Yes, and that puts us around what a 90 gsr or so. The SLV chart looks decent to me, assuming we continue up today. Strong day today followed by a Fed pause tomorrow might look good assuming we don’t give it all back tomorrow. First things first, we gotta take care of today and overcome the Crimex selling well no doubt face at different times today.

I’m surprised by the strength in the metals with the SM weak and the dollar near flat.

It seems we’re trying to decouple albeit slowly

Shares firm, Yesterday they sold them at the open. Today?

Thanks goldie, he only worked three months on an exchange program.

Now he’s travelling around the States, then he’s off to Peru and Mexico and returning to Oz in time for our ski season – living his best life. Then down to earth again. I doubt he bothered with health insurance ……. ah, youth.

But he has a few ounces of precious!

Morning Buygold

Re Silver Yr wish is the charts command…take out 33.5/33.75 and yr next target is 39.50….as Inverted H7S will trigger on daily Chart

Darn

The overnights are back in play and the oddest thing, silver leading tonight up near 2% and above $33. Gold no slouch up another $40

By pointing out the lopsided gold/silver ratio, one can only hope Goldman stirred some interest in silver. Even a move back to 90-1 with gold cruising higher would help.

Oil back up over 2% tonight but still sporting a $58 handle. Finally seeing some gas prices ease here a little, down to $2.85 from $3.10, but should be more coming.

Dollar down a little, rates up a couple bips. Bitcoin and SM down a smidge.

Fed meeting looms tomorrow. Hopefully we can get our licks in today with a solid rally. Hard to believe gold is already only $20 from $3400.

PMI and ISM services today. Meh.

Ferrett

If you’d talking about Bezo he probably has gold but it’s a wcs thing and doesn’t make money or passive income. Do you know how many companies Amazon bought! A heck of a lot. At the rate he was going he could of probably owned many of the company’s that sold in Amazon if it was worth his while. I’m sure he has some concerns about the tarriffs selling us cheap stuff from China. Meanwhile Canada is working on rare earths. Not just the rare earths but the production of them along with energy companies that process uranium and working with the US and Australia too.

The last thing we all need is dysfunctional and over populated countries spilling over on the rest of us that made the conscious effort not to do that and then they let them in to do just that. They just want serfs not family central they are trying to break up and independent free thinking people. If the people don’t do something if not too late they’re kids and grandkids will have no one to blame but their parents and grandparents.

I hope your son is getting health insurance at a reasonable price as it not free here and after the Obama care scam prices tripled or more for insurance. They’re effectively making slaves out of people because soon as they get their checks they have to give it to all the companies getting rich off them. They can’t even invest. Hopefully he will get the experience and references to move on to a better paying job but check the math, the job out as some are headaches not worth it.

goldie, I wonder why Wazza didn’t park it in gold?

Wasn’t his Dad a gold bug way back? Maybe his investing style still needs to mature a bit … 🙂

ipso, difficult to work out the differences between countries. Exchange rates are a factor, this year my son was working for his company in Dallas for three months on an exchange, but paid in AUD still. The company paid for his accomodation and a car, but he reckons he just broke even. Property, we took over a million migrants in the last couple of years. Nobody voted for it, nobody really knew. Most would have to have been fairly wealthy to get in, but that just puts property under huge pressure, adding 4% to the population with no plans for more houses. Prices have doubled in five years, helped by very low rates and covid stimulus, and yes, it’s very difficult for young’uns now. Food prices are still ridiculous. Hopefully the tariffs will push more home grown beef into our market – not that you don’t need it with your herd at a 70 year low!

But we ain’t seen nuthin’ yet. Our prosperity is joined at the hip with China’s, and with that economy in collapse when it filters (cascades?) through to us then we will see real problems, property prices collapsing and mortgages under water. Then goldie’s banks will be reaping their rewards. Like Solomon said, even the evildoers prosper, and this is a puzzle.

Barrick changing name US symbol to B

Because it also mining copper with gold at the for front.

ferrett @ 17:06

I feel sorry for the coming generations. The country is so much in debt, and the people too so that the future is going to be much less prosperous than now. We’re already sliding that way. Even though the top earning people are doing well the poor class is growing. I don’t know how it is in Australia but here in the US I have never seen this huge homeless problem before. More and more people can’t afford to put a roof over their heads. I know that there are various causes of this but one of the biggest is just that housing is so expensive … with different reasons for that as well.

Ferrett

Right and the banks don’t pay savers any real interest in money they put in their banks they then make money on by lending out to others then have the audacity to charge some a service fee or ask you why you want you money. If they want interest they would be better off buying shares of the bank or credit card companies or other investments other than keeping it there.

BTW besides Warren Buffett who went to cash by billions Jeff Bezos is planning on selling billions worth of his Amazon stock by the end of May 2026. I wonder where he’s going to park it.

ipso 15:37, true, but they are willing slaves.

They love it! They love being slaves to the credit card and car loan bankers. They want to pay heaps of interest for stuff they want, but don’t need. It’s all voluntary.

Back in the sixties HP (hire purchase) finance in the UK was known as “the never-never”, as in, never, never use it, because you become a debt slave. Even though it required a third down to buy restricted items: only things like furniture were allowed. Then came the credit cards – again, initially with restrictions, supermarkets couldn’t offer payment by them. But now, well, you know what it’s like now. Holidays, gifts (why are you paying interest at 25%+ to give someone something you can’t afford?) hell, even illegal stuff like drugs and sex are payable on cards, and legal evils, like smokes, gambling and donations to political parties.

Debt is inflationary – it’s just money printing. There is no such thing as good debt, that’s just a phrase used by the marketers to suck people in. Abolish debt.

Ipso

You summed that up. They are greed motivated predators who need consumers making them rich, not investors or savers to exist. Something schools should teach children.

Buygold @ 15:31

Looks like a good place for the shares to turn higher! They wouldn’t disappoint me … right? ![]()