…How the Kremlin said that Berlin could become a target if the Taurus missiles are used against Russia. Suddenly Germany gets cold feet about supplying the missiles.

And Russia holds all the Hazelnuts.

…How the Kremlin said that Berlin could become a target if the Taurus missiles are used against Russia. Suddenly Germany gets cold feet about supplying the missiles.

And Russia holds all the Hazelnuts.

They can get your financial info.

And thanks to our sponsors for another stunning auction today, the usually insignificant 7’s this time, pushing the 10 below 4.5% again. Much appreciated. Scott.

I see oil made a nice reversal and ended up down solidly. Bitcoin down some too.

10 yr. all the way back to 4.42% as everyone breathes a sigh of relief, but the dollar down with it goes against what we’ve been seeing.

Like that we’re back above the $33’s. One more day left, this week has gone fast. Then we start the first leg up to $4K by the end of summer. 🙂

maddog – saw your charts on AG. That’s a slippery bugger. Head fake city, loves to break above the moving averages and then dump right back. Literally what it did all of February and now again in April-May. I think if it can be picked off around $6 or a little lower tomorrow, it could make a little money, but that’s one stock that always needs to be traded, never held, and definitely never chased.

It looks like a bunch of cardboard boxes assembled by a couple of kindy kids.

Germany to deny Ukraine’s request for Taurus missiles – Bild

Germany will not supply Ukraine with Taurus long-range cruise missiles, Bild reported on Wednesday, citing sources. Officials in Berlin have for months been reluctant to greenlight the shipment over concerns that it could lead to a major escalation.

https://www.rt.com/news/618269-germany-ukraine-taurus-missiles/

For myself, I listen to what I call my HIGHER POWER who tells me what is right and what is wrong. IMO we all have this guidance. Everything we do is a choice, and every decision we make comes from our free will. What is important is not the choice we make, but knowing the choice we make is what we BELIEVE to be the RIGHT choice. It’s when we INTENTIONALLY make the wrong choice(s) that we begin to get off our intended path, and making an intentional wrong choice makes it even easier to make the next intentional wrong choice, and the next…until we are completely off our intended path.

Nobody can say it is someone else’s fault for the way they currently are. We all made those choices ourselves. The key to getting back on the right path is to start making the choices you KNOW or BELIEVE are the right ones, and never intentionally make a wrong one. That is how my life has become Silver and Gold. SNG!

OTOH, we haven’t been hit the last couple of days when we probably should have.

They don’t want us getting too happy at the end of the month. Hopefully we start June with a bang.

Whats happening to China is exactly what happened to the USA after 1970. China is a very well off country now, thanks to the good guys of the USA, but the good guys always finish last. Until now.

China can well afford to take time off for a few decades like we did, and figure out new wealth and tax absorbing jobs, in other words, cannibalize themselves like the USA did.

China should be thanking the USA and other dumb countries that gave them all those wealth creating tax paying jobs and shut the hell up.

|

The PE ratio of the S&P 500 is now around 23.7, down from a P/E of around 28 just a few weeks ago, which is the highest (most expensive) in at least 150 years of this chart (via worldperatio.com). To buy at these levels is to assume that earnings will soar to reduce that ratio. Is that realistic in the current environment? Anyone who thought the markets were very overvalued at the top in mid-February would probably say they are overvalued again now as stock valuations recently returned to those highs. Those highs will be exceeded on a further rally, which makes the market very vulnerable to a sharp decline sometime over the next 3 months. And one big factor for that decline will be China… CHINA’S IMPACT: China, the former “locomotive” of the world economies, is now in a depression with an estimated 46.5% unemployment in the prime age group. China is facing a banking crisis, Perhaps thousands of banks will fail or be “rescued” by government. It has happened before. Failed banks are dumped into a pot called “bad bank,” and investors are “persuaded” to put some money into this “bad bank.” Now the government of China decided not to publish any important economic statistics. They were always untrustworthy, but they don’t want to even reveal that the economy is not growing, much less that it is in a DEPRESSION (we did a deep dive on China’s Depression in our May 12, 2025 Wellington Letter Special Bulletin). WSJ reports that whereas, “not long ago, anyone could comb through a wide range of official data from China… then it started to disappear.“ One article we saw said that, “even the US Bureau of Labor Statistics is a rank amateur compared to Beijing’s National Bureau of Statistics,” It is very important to realize that China’s problems were not due to the tariffs imposed this year. The source of the huge problem was the COLLAPSE of their Real Estate market and the biggest developers in China, with tens of millions of people losing their life savings and jeopardizing the banking system. Stock market investors here in the U.S. must think about this to curb their enthusiasm about the recent stock market rally. What happens in 90 days? Lower tariffs are very likely. But low enough to stop the China Depression, which had nothing to do with tariffs? We doubt that. The big unknown is whether Trump’s polices, as great as they are, can protect the US and EU economies from the historic events inside of China. However, money managers are talking as if this all doesn’t matter. No, they believe “earnings can soar even if 1.5 billion people in China have no food and no money.” China is a big factor in the sales and earnings of many US stocks. If China is in such a dire economic sate, that will surely have a big impact on US firms. Remember what we have said many times over the past few months: China is in a DEPRESSION, not just a recession. An article at ZeroHedge said: CONTINUED…READ THE ZERO HEDGE ARTICLE HERE!Feel free to share with friends and colleagues! |

I’ve known for decades, that most jobs don’t produce anything of value, they just absorb wealth and taxes from the economy, or other people. So the above main difference is, that all our production jobs, that produce things we need, that create wealth and actually pay taxes, were given away to other countries. Global socialism, of which too from the USA for global greater good.

So we all imported, and or put foreigners to work instead of Americans until they sucked us dry. And thank God a Trump came along to try to take back what they took away.

When we were producing everything here there was a shortage of labor, people made more money than ever, US businesses with no foreign competition made big profits, and we all paid adequate taxes to cover all the gov’t expenses up until 1970.

I remember the under 25 year olds were the biggest new car buyers with at most, three year loans.

By they way, after 1970 our idiot representatives’ created the EPA to create MORE new wealth absorbing tax absorbing jobs to make up for the losing of production jobs. Not one US president after JFK did anything to stop it, they were all a bunch of boobs, or puppets or idiots, even during Ron Reagan, ’81 to ’89, who everybody loved, the jobs leaving picked up enormous speed.

During Reagon, they gave tax write offs for big machinery purchases, from 10 years to 5

years, but what did all the factories do that I was associated with? They all bought brand new Japanese and Korean machinery. I warned them back then, and now they are all gone, out of business.

Senators Bash Nvidia’s Plans for Facility in China

The Terminator movies have come to life.

These guys are nuts.

Please somebody with the resources do something.

Or it’s end of times as per The Book of Revelation.

Let’s all hope the Antichrist does not unleash AI on us.

I think I need a nap and its only morning coffee time.

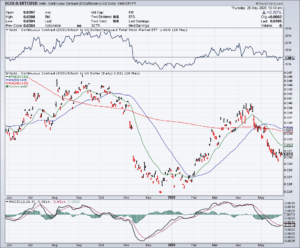

… is set to break higher again …

Five waves up off a November low … then a three-wave correction … and now a resumption of the trend.

So expect a reversal in bitcon and new highs in gold in the weeks ahead.

Watch the MACD for a cross in coming days.

Cheers all

Mrs. Rabbit Hole

@mrsrabbithole

·

10h

“Rules and regulations will accumulate until everything is illegal. That’s why it’s essential we have a conscious effort to reduce laws and regulations or no one will be allowed to do anything.”

— Elon Musk

US Tightens Screws: Jet Engine Parts, Semiconductor Tech Exports To China Halted Amid Supply Chain War

by Tyler Durden

Thursday, May 29, 2025 – 04:20 AM

The Trump administration has intensified the U.S.-China trade war by suspending exports of critical American technologies to China, including jet engine parts, semiconductor design software, specialized chemicals, and industrial machinery. The move follows Beijing’s recent decision to restrict shipments of rare earth minerals to U.S. firms. In a further escalation, Washington also announced plans to begin revoking visas for Chinese students in sensitive research fields.

Were the usual suspects aware the ruling would be what it was and therefore could be made very MAGA negative….and now they are smashing the mkts to make it look a disaster ???????

Amazing to see……..I know it’s been discussed here, but there has to be something explosive tied to the price of silver that exposes a world of pain for the scum…..FWIW

… when you see Trump so worried about its future prospects … he actually becomes a pumper …

Trump & Bitcoin A Disaster In The Making | Armstrong Economics

Look out below at some point if history is a good guide.

Not a good sign for the broads in the second half either.

Mornin all

on its way down, which is surprising because rates have come back in and are now down a bip.

GDP beat a little -.02% vs. .02% estimates – still recessionary now for the second straight quarter.

Personal Consumption Expenditures were the surprise, 1.2% vs. 1.8% estimates, I think that might indicate inflation slowing.

Weekly jobs missed as well 240K vs. 230K estimates. More recession indications although a lot of those are probably wasteful government jobs.

The Fed has zero excuses not to start cutting and cutting hard, despite their hatred for Trump

They’re after silver as usual, defending $33.50. It’s like pulling teeth. Just when you think you have a chance – bam, they get ya.

Usual selling at the open. We should do better in an hour or so.

At the same time, gold fought through $3300.

PM shares firmer.

We’ll see if they play games when the GDP numbers come out in a few minutes. Dollar is giving up the goose.