Are the Saudi.’s seeing something ? Central banks looking for a hedge from the dinero..dollar. Hedge for future need to print? De dollarization??? ?? Just in case hedge???? Are we supposed to be surprised?.

Deer 79

Try shutting it down reboot. Only answer you’ll get from a fellow computer challenged.

Ipso

No such luck. Don’t want to bother anyone when pertinent posts should be discussed here.

MAG shares

More active here today than yesterday, so I’ll bump my post from yesterday at 12:34. Any reason to do anything with MAG shares prior to deadline if you have them and simply want them to convert to PAAS shares, rather than take the cash offer from PAAS?

The information is available on MAG’s website magsilver.com under the News header for anyone interested.

Bought some RMRDF this morning as a speculative play

Not looking great technically, somewhat overbought, but I like the story …

Maddog @ 7:22 Re: Saudi’s buying silver

That’s great news! Silver shorts must be having some sleepless nights! 🙂

deer79

Have you tried closing the page and then opening it again? It may revert to your original settings.

D’oh!

Wall Street Mav

@WallStreetMav

The federal government now owes more than the entire net worth of the American people.

Either we pass a balanced budget amendment or we go full Japan — or Argentina. In which case you’ll need that gold.

I apologize

My ignorance with technology made me skew my screen set up (when I last posted), so all I can now see is the postings only in the left side of the page. Anyone know how to get it back to a full page?

Maddog

I hope the commentator (of the video you posted) is correct about the possibilities that he mentions….

I also think that we can’t forget (which has been mentioned here several times), that the scum are going to use their machines and algorithms, to suppress the prices of Gold & Silver as much as possible. Particularly Silver, because it is such a key and vital component for the build out of weapons, chips, and other strategic items for our National defense. And I’m sure that the Saudis are well aware that a lot of those weapons come to their country in arms agreements with the US.

Nice gain in silver on Friday …

… with only a 1600 contract increase in open interest … suggestive the bankers are not stepping in front of the rally.

Metals Daily Exchange Volume & Open Interest – CME Group

This week could still see some giveback however depending on broad liquidity conditions.

That said, the Fibonacci signature on the Gold / Silver Ratio is suggestive silver could move to $50 rapidly under the right conditions.

What’s more, the head and shoulders pattern in the trade measures to 66, a 20 point move from here, which could propel silver well above $50 even if gold remains rangebound.

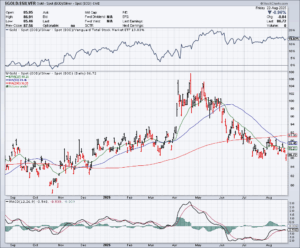

Matched with breakouts in several silver stock indexes this past week, one can lean on the bullish side until the Gold / Silver Ratio is vexing the 70’s if the bankers continue to allow silver to run.

Mornin all

End of the month week

We’ve stumbled at the end of the month in 3 of the last 4 months. The chart of the HUI looks like it may be set to do the same this week with the RSI at 68 and its 50 pts. above its’ 50 dma. Doesn’t mean it has to but seems likely. We are still in the pm market.

So, we start with the dollar up a bit, rates up 1 bip, SM a little lower, oil a little higher, and Bitcoin taking it on the chin for $2K after a huge day on Friday. Crypto has not been strong for the last couple of weeks.

Our pm’s are a little lower, nothing scary. PM shares are on either side of flat.

No eco data worth noting really. Just a plain vanilla day where we hope they don’t pull the usual low volume bleed.

Amals

Sorry I shouldn’t have been so presumptive. You guys all seem to be married. The single guys would be presumed to be out having fun instead on the weekend. Just kidding with you.

goldie @ 6:49

Good advice, I’m sure, but I’m single, so doesn’t apply. I think it’s a shame we have to be so vigilant, but I agree it’s important in this day and age.

Why I Started Trusting Rabby Wallet (and How I Use It Without Losing Sleep)

Whoa!

I stumbled onto Rabby while chasing down a weird approval that kept draining small amounts. My first thought was: another wallet? Seriously. But something felt off about the UX on the alternatives, and Rabby hooked me quickly. The experience nudged me toward rethinking how I secure browser-based keys.

Okay, so check this out—

Rabby is a browser extension built with DeFi safety in mind, not just convenience. It looks familiar if you’ve used other EVM wallets, though actually the team layered in a few defensive tools that are easy to miss. One of those is transaction simulation, which previews what a dApp will attempt before you sign. That preview has saved me from somethin’ dumb more than once.

Hmm…

On one hand the extension model is risky. On the other hand, a well-built extension like Rabby reduces many attack surfaces by design. Initially I thought browser wallets were basically the same, but then I realized subtle UX choices (like approval scoping and clear nonce warnings) really change outcomes. I’ll be honest: the details matter way more than marketing blurbs. My instinct said to test everything slowly.

Seriously?

Yes, really—there’s a difference between a wallet that looks pretty and one that prevents accidental approvals. Rabby surfaces token approvals, lets you set limits, and displays contract calls in a human-readable way. Those readouts aren’t perfect, but they’re better than blindly accepting long hex blobs. I’m biased, but that clarity is a major comfort when I’m swapping obscure tokens.

Whoa!

Here’s a practical tip I learned the hard way: create separate accounts for casual DeFi plays and long-term holdings. Keep one account with small balances for experimental interactions, and another cold or hardware-backed account for value storage. Rabby supports multiple accounts and integrates with hardware wallets, so it fits that workflow well. I couldn’t tell you how many times that split saved my bacon. Also—yes—use a dedicated browser profile for all dApp work.

Hmm…

I ran a mini audit on my own approvals last month. Rabby made it easy to revoke allowances in bulk, which I did very very quickly. The feeling of removing persistent approvals is oddly satisfying. It reduces the blast radius if a dApp later turns shady. That simple act is one of the clearest security wins for everyday users.

Whoa!

Download discipline matters. Do not grab extensions from random links in Discord. Instead, use verified sources and check the extension publisher carefully. If you want to get Rabby, you can find a trusted download link here. Double-check the store listing, read recent reviews, and verify the extension ID if you know how—small steps, big impact.

How I Approach DeFi Security with Rabby

Whoa!

Start small and be repetitive about safety checks. Look at every permission request like it’s potentially malicious. Actually, wait—let me rephrase that: treat every permission as something you’ll regret granting if you aren’t sure. Rabby gives contextual hints, but your brain still needs to do the final vetting. I make it a habit to pause for 10 seconds before I approve anything, and usually I catch the sketchy bits.

Hmm…

Use hardware wallets for real value. Use software accounts for experiments. That separation is simple but powerful. Rabby works smoothly with hardware devices, so there’s no friction switching between play and vault accounts. If you care about peace of mind, this is non-negotiable.

Whoa!

Revoke approvals periodically. Check token allowances. Use the built-in approval manager or a reputable revoke tool. I check mine monthly, and that cadence catches a lot of lingering permissions that most people forget. Don’t be surprised if you see approvals you never consciously made—dapps sometimes add permissive allowances under the hood.

Seriously?

Phishing lives in subtle places. It’s not always “click this shady link” anymore. Some sites will mimic legitimate UIs and ask for “confirm” on transactions that are actually approvals to drain funds. Rabby’s transaction previews help, but they aren’t foolproof. Combine them with on-chain explorers and a little skepticism and you’ll be okay. I’m not 100% certain this will stop every attack, but it reduces risk a lot.

Whoa!

Consider using separate browsers or containerized environments for high-risk interactions. It’s annoying, sure, but using a browser profile dedicated to wallet work isolates cookies, extensions, and potential injectors. On one occasion, an errant extension on my main browser injected UI elements and almost tricked me into signing. I caught it because the wallet page looked wrong—trust your gut.

Hmm…

Backups are basic but they fail when people rush. Seed phrases belong offline, and you should have redundancy. If you keep a spreadsheet or notes, stop. Seriously. Create an air-gapped backup, and test the restore process somewhere safe. I’ve recovered test accounts from paper backups and also lost access because I was lazy—learn from that, not me.

Security FAQ

Is Rabby Wallet safe to use for DeFi transactions?

Whoa! Nothing is 100% safe, though Rabby adds multiple defensive features that reduce common risks. Use it with hardware wallets for high-value holdings, audit approvals, and keep browser hygiene. Combine Rabby’s tools with sound habits and you raise the bar significantly.

How should I download Rabby Wallet?

Seriously—use official channels and verify the publisher. You can access a trusted download link here for convenience, but always cross-check the extension listing and recent community feedback. (Yes, I said it twice because it matters.)

ipso facto @ 10:35

I think they left one more ‘H’ out of his name!

MAG shareholders

I just noticed the deadline for action regarding merger offer with PAAS is upon us. If I read everything correctly, one has to do nothing if one holds MAG and wants to participate in the merger and end up with PAAS shares; that one only has to act if one wants to opt out and receive cash for MAG shares. Do I have that right? Is there any downside to doing nothing and just letting it happen?

Pass the popcorn

Gold Ventures 🟡

@TheLastDegree

🚨🚨🚨 the major Silver miners breaking out of a 14 year base this week. time to pile into the Silver smallcaps, as a mania is about to unfold.

Dave Hunter there’s going to be a meltdown far worse than a recession, financial crisis and global bank failures

We’re currently in a melt up gold to 4K. Final leg of a bull market. 2026 meltdown 80 percent bust only seen in WW11 financial crisis then QE 20 trillion. Will take gold silver down temporarily then gold 20k silver 500. They all have their numbers that’s Dave’s hyperinflation the cause coincidentally lining up with Armstrong war panic then his suggestion to have victory gardens. The market leaders will change from tech to commodities he sees oil going 500.

We had a power out probably.high temps but they want Calif all electric.

Comedy relief

Life is precious. Like father like son. Father is going to realize how quick a child can learn by just watching him, including guns but this one is tires. I saw a tire out there and tools making it easy for son to imitate his dad. Hilarious, the mom could hardly contain herself while videoing him.

Amals

I’m not familiar with that Golden Trumpet story. I’ll have to look it up .Being in a disaster is a milder form but still a form and even the best plans will have surprises. When things go away from norm people change, panic, go crazy, get drunk, preach the end of the world while others will wander around and steel the minute you walk away from what ever you have left them the out right psychos and criminals are out there if they had the opportunity. If you have a wife get her a couple of hand guns. One being if you can a small belly gun or semi. They have bras now with velcro that can hold a small gun they can quickly.pull out in a second for close contact defence. Also strapped to her ankle. Have her practice with it and to not pointing at her but then release the safety if any and only then put her finger on the trigger to fire would take a quarter of second Men want bigger guns but they are heavy and awkward for woman to carry around and might not fit their hands right at a time seconds count. The second gun a more powerful longer distance one but still one they can handle and pull the trigger easily.. Tell her to go nowhere without one not even in the house especially if she’s alone. That includes the shower which would be a bad place to be without her robe hanging.obet the shower with a gun in the pocket or a table in reach concealed. She can carry a waist pack with Velcro not zippers no time and can get stuck to hold it too. A purse can get taken from her by surprise. Now they have her keys to her car and house, her ID and address and her gun. Not a good idea, even a cross body strap with purse in front of her can be taken before she could get to her gun before then. . Best for as many people as possible stay together if it all goes bad and not get picked off one by one. Other wise low key yes but your wife should also be armed and know how to use it.