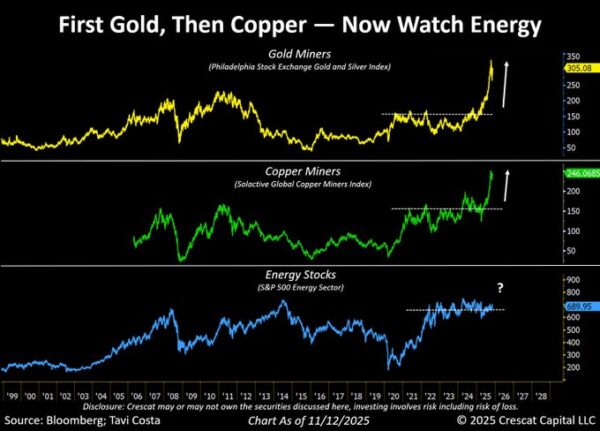

Tavi likes energy stocks here too. Maybe a place for diversification?

Otavio (Tavi) Costa

@TaviCosta

·

Dec 7

Energy stocks keep inching higher, quietly building the pressure for what I think could become a sharp, decisive breakout.

You can’t perfectly time these inflection points, but the macro pieces are falling into place:

▪️Positioning remains deeply bearish.

▪️U.S. oil and gas rigs are contracting meaningfully.

▪️Oil is trading near one of the cheapest levels in history relative to the money supply.

▪️Energy’s weight in the S&P 500 is hovering near record lows.

It reminds me of when people said I was crazy for buying mining stocks, insisting metals would never move.

While my conviction in miners hasn’t changed one bit, I also see energy equities as one of the most fundamentally attractive corners of the market right now.

Otavio Costa

Otavio (Tavi) Costa

@TaviCosta

·

15h

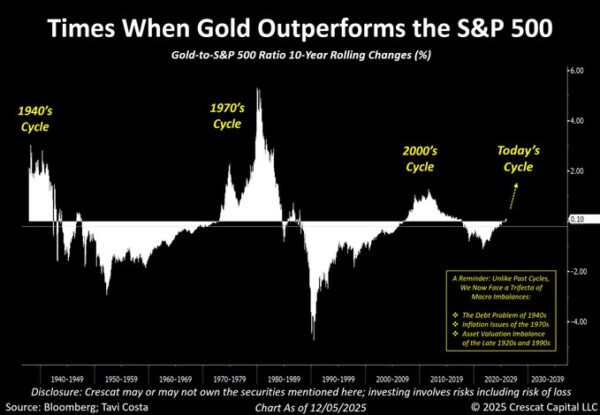

Some argue that gold’s recent outperformance relative to the S&P 500 was a temporary anomaly.

I disagree.

This dynamic follows very long-term cycles, and I believe we’re likely only in the early stages of this one.

A key reminder:

Unlike past cycles, however, we now face a trifecta of macro imbalances:

▪️The Debt Problem of the 1940s

▪️Inflation Issues of the 1970s

▪️Asset Valuation Imbalance of the Late 1920s and 1990s

ferrett @ 5:32

That’s an incredible tragedy. It’s time for the US to pack up and leave the place entirely. No more troops in Europe, no intelligence sharing, no starlink, no nothing for the war.

Ferrett 5:32

I saw that and no surprise. He’s like in checkmate but won’t concede and hope removing him is enough to stop the neocons in Europe even if they did after ruining their economies and country.

Unfortunately Goldie,

this will only end with the removal of the comedian. Or nuclear war.

Ferrett

Well there’s something we can agree on. Putin is the only wise adult in the group who’s looking at the welfare of millions of people not like the shady neocons looking at the millions dollars they can purloin from the millions along with their lives.

Ever since he cancelled elections.

https://www.reuters.com/world/europe/putin-says-legitimacy-ukraines-zelenskiy-is-over-2024-05-24/

Basically saying Z has no authority to sign a peace treaty – which means, if he did, it would be invalid. Yes, Putin definitely wants to stop the war but as he has said all along it must be a lasting peace, which needs a treaty with strong foundations. A dodgy agreement is a recipe for lasting war.

ferrett @ 18:54

I haven’t heard that Putin said that? I think he’d like to stop the war.

ipso 17:25, I think that’s why Putin won’t accept him as a signatory.

He doesn’t have legitimacy now, and if he did that it would leave it wide open for the neocons to insist the peace arrangements are null and void.

So now we have resistance

Until Powell decides to either hand out candy canes or charcoal. That’s how it will be seen anyways.

Big Ruling

Senator Eric Schmitt

@SenEricSchmitt

·

Sep 8

Big win today for the Trump Admin. as the Supreme Court leaves in place the firing of former FTC Comm’r Slaughter.

While only a preliminary ruling, SCOTUS showed its hand.

ferrett @ 16:48 re: Zelensky

If he signs the deal it might be harder to remove him. If he was smart he’d sign the deal and head for Switzerland with all his ill gotten gains. He might just disappear! I’m sure he doesn’t sleep too good at night without chemical help.

What a wonder if there was an actual fair election there!

Cheers

deer79

Yes I have a bunch of Dolly Varden as well. DVS ended down around 6% today and CTGO a fraction of that. So the knee jerk reaction at least for DVS was pretty negative. In the long run this may be a good move for both companies. DVS has some great exploration-development properties and CTGO has cash and an income. So in the future this cash can be used to develop the DVS properties without having to sell more shares or make deals with the bankster devils. I’m sure there’s a lot I don’t know or isn’t known but longer term I’d guess it’s a good thing. Just my own likely clueless opinion.

I never heard of CTGO before today.

Cheers

deer, 13:10, carry trade.

Yes, it is a huge carry trade. Can it unwind as a trickle, or will it turn into a cascade? Watch the Yen as well as the yield, is my thought.

Here in Oz there have been many adverts for, and thus much discussion on, buying dilapidated Japanese properties, renovating them and then renting them out. The firms advertising this idea also offer all the services; permits, loan applications, legal fees, help in selecting contractors, materials etc. etc. and of course the properties are very cheap. Well, of course they are. There’s nobody to live in them, that’s why they are dilapidated to start with. Everyone is dying. Dead people don’t rent.

However with the price of a renovated 4 bed house in Tokyo a quarter that of Sydney, or outside at say Nagano for a sixth the cost, it just seems too good to miss! But if the country banks are in trouble with their loan portfolios, offloading obsolete properties, the renovation of which will also stimulate the local economy, to gullible gaijin is a great idea.

ipso 08:09 the race is on.

Can the neocons substitute him before his regime falls and a Trump appointee is installed? Europe is working hard on that, we may be sure.

Ipso

I own a few shares of Dolly Varden, and will be interested to see how this “merger of equals” all pans out.

What stands out for me is that DVS is merging with a company ( Contango) that has $100 million + of cash in the bank, only $40 million of debt, and is in the process of Gold exploration, and rare earth elements.

Contango also owns a 30% interest in a JV which leases almost 700,000 acres of land in Alaska for exploration. The remaining 70% is owned by a subsidiary of KGC……..

Merger of “equals”

Contango ORE and Dolly Varden Silver Announce Merger to Create a New North American High-Grade, Mid-Tier Silver & Gold Producer and Developer

https://ceo.ca/@newsfile/contango-ore-and-dolly-varden-silver-announce-merger

Food for thought….

The next two weeks could prove to be very interesting…..

August 2024. A single BOJ rate hike triggered a 12.4% single-day crash in the Nikkei. The VIX spiked above 60 – levels only seen during 2008 and COVID. The yen carry trade had accumulated somewhere between $250 billion and $500 billion in positions. When the BOJ hiked and the yen strengthened, the unwind was violent. Swift. Global.

That was with rates at 0.25%.

Now rates are heading to 0.75%. Yields are at 17-year highs. Regional banks are drowning in unrealized losses. And much of that carry trade remains unwound.

12/9-10 The Fed meets. 12/18-19 the BOJ meets.

Japanese regional banks need to sell bonds that they can’t afford to hold. The carry trade sits there, largely still unwound.

Hmmmmmmm….

7.6 Magnitude Earthquake 50 miles off cost of Japan…Tsunami warnings issued!

https://www.mirror.co.uk/news/world-news/japan-earthquake-live-tsunami-warning-36369609

Earthquakes that register 2.5 or greater are recorded/reported daily. They normally average about 35 earthquakes over 24 hours. Yesterday they got up to 155 earthquakes due to continuous shaking at Yakutat Alaska….and I see it is also continuing there today. FWIW but something to watch besides PM’s. SNG

Elon will not comply

Elon Musk

@elonmusk

The European Commission offered 𝕏 an illegal secret deal: if we quietly censored speech without telling anyone, they would not fine us.

The other platforms accepted that deal.

𝕏 did not.