New regs on gold and silver reporting are changing this month. They’re expanding their who owns it data base.

Used to be 10k nope now 3K

Few things changed stackers should know.

New regs on gold and silver reporting are changing this month. They’re expanding their who owns it data base.

Used to be 10k nope now 3K

Few things changed stackers should know.

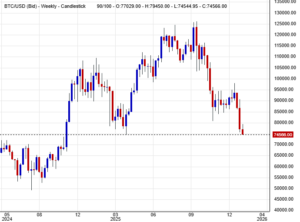

Looks like we witnessed a stick save in bitcon today … that could buy them a few months and a move up to 95 … maybe longer and higher … as we have five-waves complete on the weekly.

So PMs should enjoy one more rally too … we should know by week’s end if we get a V – bottom.

This next leg should be compressed in time … so it too could be complete as early as March (end?) … but it could go longer if the money printers attempt staying ahead of the curve longer … perhaps into late spring / early summer.

Michael Oliver says silver could be $300 to $500 by then.

All just guessing at this point of course … but the bitcon stick save today was very telling in terms of their intent to keep the wheels greased.

Yippi yi yo ki yay

Billy’s court date.

I’m not sure what you’re referring to?

Did not expect the shares to finish well, thought we’d see the same old drift lower to end the day. 20 minutes left to finish strong.

I wonder if Hillary with that smile has some planned deal.

Carnage in software markets, and in private credit AI related markets. So the legacy and the disruptor are both facing headwinds.

Israel confirms that all Hamas’ casualty figures in Gaza are correct.

Epstein files finally giving us what we wanted – heads on plates. Goodbye Mandelson, you traitor. Hello Clintons.

Governments continue to spend, spend, spend like a Lotto billionaire, but with new debt.

EU raid X’s office in Paris. What the eff do they expect to find in a regional office of an internet chat site?

Trump backs off Iran. Russia backs up Cuba. China backs up the tankers in Iran. Modi backs out of not buying Russian oil (if he was eveer in).

So much news!

When giving out those GDP numbers in 23 Biden was in office. It just shows all our money going over the border is a black hole and will not get reimbursed or even get things like peace in Gaza done. Same for Ukraine. Gaza needs outside intervention as well as Ukraine to the point of needing a third party to take over because in both cases they historically hate each other and why you cant play games just mixing people when their religion and or culture and its survival are at odds.

The globalist in europe don’t just want slaves they want genocide of their own to get what they want and should of learned a lesson already that no good deed as they see it, they should be grateful right, goes unpunished and how ignorantly blind they are to that fact. Darwinism in motion.

I fear to count how many countries our tax dollars are going out of our country needed here every year like some sort of entitlement at the expense of our people.

It has a new resistance now it has to sell out those wanting out at around 90 now.. I believe in true valuation of the metals because good earnings of miners is where the real gains should be in paper. At the same time there has to be some balance on the phyzz and not let it get out of control through greed and Fomo that they sell the phyzz and give it to China while leaving them with devaluing paper promises for fear it will drop at that rate as well as for our economy and it’s industries that need it and where paper trading comes in on both mines and industries.

Like I said these institutions are not good investors just greedy who would sell their mother if they could make a buck but don’t have to follow the laws or rules set for everyone else and bail themselves or get bailed out every time they get themselves underwater at everyone else’s expense.

I was looking into Trumps where at least he’s concerned where this is going project Vault on what is on the critical minerals list, and quite a list. Silver is on that list.

Those Asian guys, I’m not sure who they are but they’re all saying the same thing, the others are copying them. Chinas famous for copying but then so are the talking heads. Your right at least they’re not trying to cover things up or down play it. Even Armstrong didn’t have much to say about it or what’s really going on. To get information you dont have to join a party to do it but it helps to check it out. I found each different one but not all have information we have not gotten here or only partial information and here appear to know less or not telling the truth. Excuse typos

…. are hard at work for you … no really … just ask your congressman … chuckle.

US Approves New Massive Arms Deals For Israel, Saudis – Bypasses Congressional Review | ZeroHedge

And it’s no joke how much better off their economy is than America’s … as it’s being plundered.

Go ahead … leave the commies in DC in charge … don’t build better local political structures and economies that actually work for you.

Why bother right?

Back to our version of normal market action. I mean if tech goes down, why wouldn’t the normal response be to sell metals and mining?

… measuring down to 25K …

Bombs away.

Chuckle

…as the DJIA goes lower, the $ creeps higher and G&S get sold off……..

They waited until noon and the SM finally fell apart. Not a good reason, but reason enough to slap the shares and silver down a rung. Gold is holding better, maybe dollar weakness is helping.

Bitcoin down $3K.

Silver trying to come back now. We’ll see if they let us, they are relentless.

I’m grokking to that …

Cheers

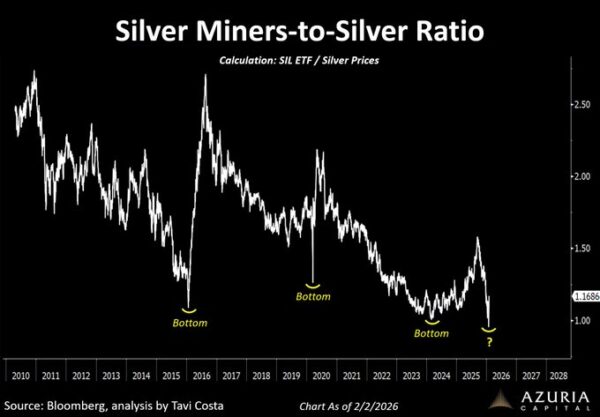

Re ratio’s the AU shares tried….to break up…but they too remain bargain basement…though not as cheap as the Ag ones…the fact that neither went on a real run, suggests v strongly this is not over…..

Otavio (Tavi) Costa

@TaviCosta

·

18h

As the market fixates on silver’s volatility:

The silver miners-to-silver ratio is currently at one of its lowest levels in history.

Not long ago, investors were dreaming of silver trading above $50/oz.

Today, with prices well above that level, some producers are operating at sub-$15/oz costs.

These are the mining industry’s equivalent of tech- or software-like margins.

What a moment to deploy capital, even as the market remains distracted by volatility.

Game on.

We will have to see how this plays out…but the lack of volatility says Friday was a deliberate mugging, that caught the mkt perfectly…..we don’t have huge punters throwing vast Volume around, which says we are nowhere near the top.

Early days but looking better, long term.

Re volatility. We want this advance to be orderly and channel well to indicate it is an impulsive up wave and not a corrective b wave.

aurum

Yeah really. “I hope I have enough govpoints on my phone to open the door and go for a walk today.” ![]()

“Justice” Would be nice although in this world it’s not likely.

That’s definitely a different kind of slavery than we experience here. That’s the new world order type stuff, that’s what the EU trash want their people to live like and the left here want us to live like.

I’m not for China, but I am for some justice for the folks that have been stealing from us for a long time.

it seems to be kind of the same today so far. No big swings. Seems it should be a little crazier with gold up $250+ and silver up over $8. But they are just drifting back and forth, lower at the moment but not violent. You wouldn’t think that would be the case.

“normal market action” LOL LOL Totally sold out!

I tellya I sure wouldn’t want to live in a place where the gov has so much power like China. The citizens are really under the bootheel!

… the new range now extends from $10 to $30 … where a $30 move to the upside might suggest some degree of exhaustion for now.

All one can think is will the ranges extend further and when.

Chuckle

PS when you screw with markets the blowback can be harsh … chuckle … considering silver has 50 years plus of suppression to correct … the beachball analogy appears to be playing out … silver is vexing escape velocity.