is day #2 of the BOJ meetings….

30 year Japanese bond yield was up 3 basis points today to 3.38%. 3.44% was the high back in early December…..

is day #2 of the BOJ meetings….

30 year Japanese bond yield was up 3 basis points today to 3.38%. 3.44% was the high back in early December…..

Yes the metal stocks are know. Not a growth or buy and hold stock and general news sensitive.

But this time as far as the phyzz and shortages phyzz leading the sector it seems one of the safest places to be amongst the turmoil. Besides the shorts which can be anywhere in any sector anyways it basically doesn’t have any enemies and the dollars can’t blame or sue it, it’s neutral and only reflects it.

Right now the other sectors have a plethora of man made problems. AI is being sued for influencing people as in causing depression and suicide. This will continue for different reasons. Oil is being blamed for climate change and Philippines is suing Shell for a typhoon

One thing after another.

It’s been major cloudy here too. If it keeps up I’m getting a sun lamp.

It would seem that paying off the debt with gold might be a bit further out in the future. The gold chart actually looks really good, just a slow, steady advance for the last couple of months. Silver has basically doubled since June. Unprecedented for us. I wonder if the slowing of the move in gold has to do with getting the GSR back in line. Whatever, you’re right, if gold is going to be used as a debt instrument it needs to be racing toward $20K.

What bothers me here is the way the shares have performed over the last 4 days. Silver was up 4% yesterday and the shares didn’t move, we should be getting 2-3 to 1 ratio in the shares, and we’re not getting anything close. The HUI chart looks identical to the gold chart. We’re getting par. Maybe that will change when earnings come out next month. That would be in line with what deer79 says about running after the first of the year.

It’s hard at this time of year because volume is off, but the shares look like they’re going to roll over to me. No bueno. Hope I’m wrong.

Where i see a concern, is if they are going to let Gold help bail out the debt problem, it needs to be way more expensive than this…….in times past, there was no doubt PM’s were sat on to maintain the facade that inflation/the world was all under control etc…..

it certainly looked like that during the big runs, the control was stopped/turned off…..yet now we see signs of it being turned back on…like today…the 4340 level in AU, was certainly defended heavily ystdy and today, then we get a break out and the mkt runs 35 bucks straight up….as little selling was around…..then above 4370 the selling comes right back and eventualy the mkt is beat back sub 4340…..that makes no sense, especially the manner of the selling…as u say same old pattern buy why here…if prices need to go much higher….a real conundrum.

As we’ve talked about in the past, timing is always a key component of the smashes.

Firstly, we’ve known for a long time that breakouts are always meant to be SOLD in the PM arena.

Secondly, starting next week, I have to think that the “JV” trading staff ( on the institutional banking desks) will be in charge, whilst the “Varsity” will be off prancing around during the holidays.

Then, we have a big year end “mark” for the scum, with the goal of minimizing as much as possible, the mark-to-market has incurred on their balance sheets ( for the past several months).

Perhaps we have to wait until after the New Years to get the PM train back in gear and moving in the right direction again…..

All over the map today. That chart of silver is pretty scary. Could easily see gold drop $20 from here. If the paper kings have their way, it’ll happen. Hard to know how long and where the silver supply constraints end. I get worried when I’m giddy and buy into the $150 – $600 projections. Even if we get there, we can’t go straight up can we?

As for the shares, they’ve still got a grip on them. Seems a lot of them should be doing better. Makes it feel like a pullback is coming and that seems too soon.

It’s volatile, that’s for sure.

Ukraine war: Trump ally declares Russia assets plan for Ukraine “dead”

I think the beast just ripped the door off it’s cage and is now useing it as a club…..with it’s eye firmly fixed on a new all time Hi……

Still early, but so far the shares seem to be hanging in there. I just think every kamikaze attack is a buying opportunity????

The inflation numbers were much lower than expected, so that should have been good for the metals. The SM is rallying like nobody’s business. Funny how pm shares always move down with the SM but don’t always move up with it.

Bitcoin is ripping, up $2500. Rates are slipping 3 bips, dollar flat.

Who needs pm’s? Silver starting to get shredded.

That sucks! It’s too rainy and cloudy here to know what they’re doing up there. Maybe they don’t spray when it’s storming?

They have been spraying the crap out of our skies the last couple of days. Of course, this is after DiSantis said they were going to have it stopped and would punish the evil doers.

and here we are back to 4340….will the same line be drawn here as ystdy.

Wall Street Mav

@WallStreetMav

·

8h

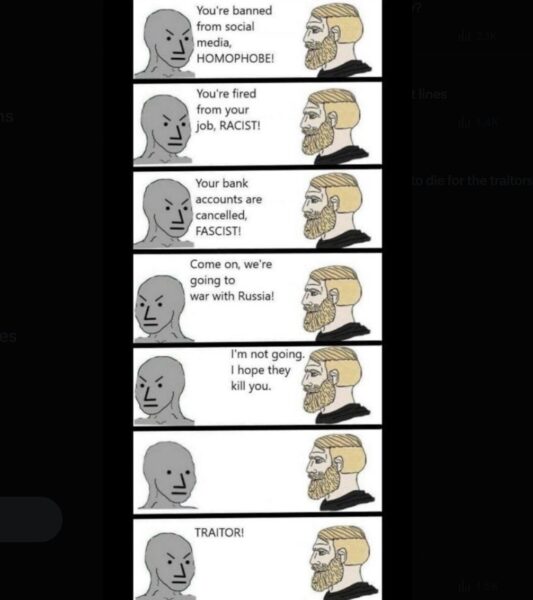

German and British governments are having difficulty recruiting white men to join the military to fight a war against Russia.

It’s a mystery why …

Not sure how much of that Video about the UK is real……a lot of this is AI .

He should have abdicated and passed the title straight to William (and Kate).