… with only a 1600 contract increase in open interest … suggestive the bankers are not stepping in front of the rally.

Metals Daily Exchange Volume & Open Interest – CME Group

This week could still see some giveback however depending on broad liquidity conditions.

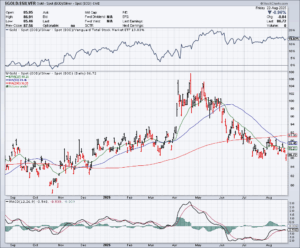

That said, the Fibonacci signature on the Gold / Silver Ratio is suggestive silver could move to $50 rapidly under the right conditions.

What’s more, the head and shoulders pattern in the trade measures to 66, a 20 point move from here, which could propel silver well above $50 even if gold remains rangebound.

Matched with breakouts in several silver stock indexes this past week, one can lean on the bullish side until the Gold / Silver Ratio is vexing the 70’s if the bankers continue to allow silver to run.

Mornin all