Those are all good observations and lend credence to the theory this is official US buying.

Judy Shelton, who is likely to be installed as the next Fed head, wants to issue gold backed Treasuries by the 250-year anniversary of Independence Day on July 4, 2026.

In order to do this, an audit of US gold holdings is in order – she stated this.

So, the US is now a gold buyer in need of a sh*t-tonne of gold instead of a seller/suppressor – leaving the international bankers in London blowing in the wind. There is a YouTube video showing an LMBA official unable to come up with a good explanation of why they can’t deliver gold for many weeks now. This means they possibly don’t have any more unincumbered gold not leased out – which incidentally – is possibly the same problem on Comex as well.

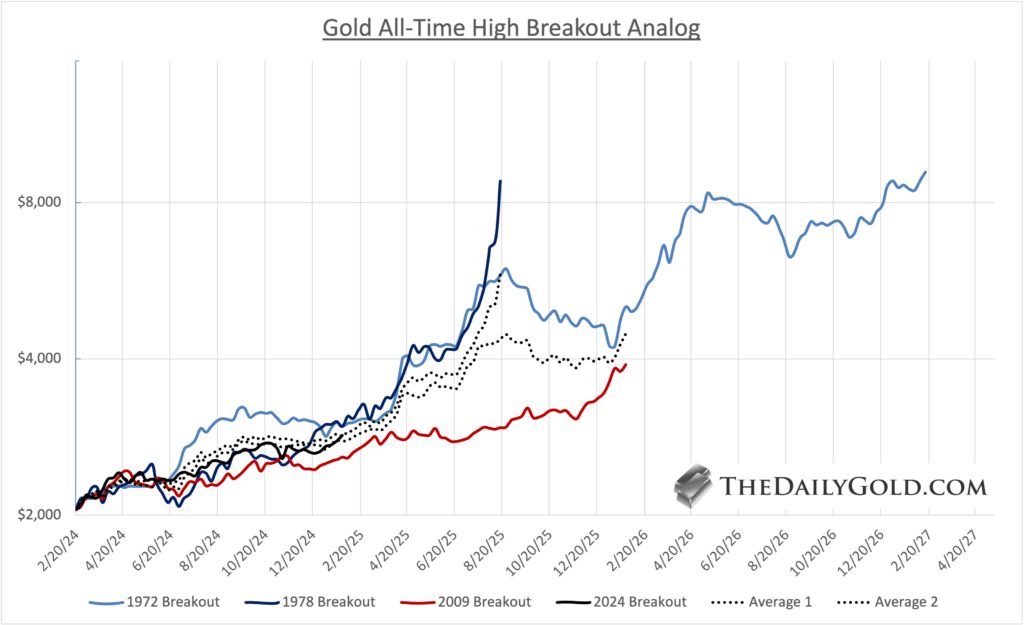

Thusly, if the US keeps buying – along with BRICS countries, etc. – well – you can see the problem they have. This makes a repeat of what happened to gold in 1979 possible as per this chart I put up the other day – suggestive gold could hit around $8,000 later this year or early 2026.

And even if it doesn’t, it should still hit somewhere over $3,000 – likely pushing $4,000 later this year worst case scenario. On top of all this, it looks like inflation stats are set to start trending upwards again with M2 ripping higher in its latest freshly released data (see here).

Because if Trump and company truly want to make America great again – they must keep buying gold in a world that will destroy its credit and currency if they don’t – and they know this.

It’s of course amazing so many people don’t.

Cheers mate