Re Flynt……Tommorow he is going to the woodshed….The Donald is due to make a speech in Davos…..where I think he is going to read that lot the riot act……it could be epic…one for the ages.

THE LARRY FINK/BLACKROCK $14+ Trillion Pivot (I’m don’t trust these people but it makes sense they are being forced into it considering what is coming and they want to own the world)

How the Architect of the ESG Movement Just Jumped Aboard The Metals and Mining Super-Cycle Freight Train!

In the world of global finance, there is noise, there are signals, and then there are seismic shifts. What we have just witnessed from BlackRock CEO Larry Fink is the latter.

In a stunning admission that reverberated from Wall Street to the world’s energy capitals, the man who, more than any other individual, architected the corporate Environmental, Social, and Governance (ESG) movement, has publicly conceded that the forced transition to renewable energy will cause a global power shortage. wait, what?! Watch HERE.

This is not a subtle hedge or a minor course correction; it is the chief ideologue of the green transition admitting that the core of his design is fundamentally flawed and no longer applicable to our world.

For years, Larry Fink has been the most powerful and influential voice pressuring companies to divest from fossil fuels, embrace stakeholder capitalism, and prioritize sustainability metrics, often above profitability.

His annual letters to CEOs became a Pope-like communication for the ESG religion, setting the agenda for boardrooms across the globe. Armed with the unprecedented power of BlackRock’s ever-growing mountain of assets; now a staggering $14+ trillion, Fink wasn’t just suggesting change; he was, in his own words, “forcing behaviors.”

The irony is staggering. The very transition he championed has, by his own admission, sabotaged our power supply, raised electricity bills for millions, and left the world dangerously short of the reliable, baseload power that underpins modern civilization.

Make sure you hear his words. Go back and click on the link and listen if you haven’t yet. This isn’t just a change of heart; it’s the most powerful financial signal in the world that a historic capital rotation is not just coming, but is already underway.

BlackRock’s $14+ trillion war chest is pivoting, and to understand where the world is going, we must understand why and where that capital is about to flow. And to appreciate the magnitude of this moment, one must understand the sheer scale of BlackRock’s influence.

- You need to understand Blackrock is not merely the world’s largest asset manager; it is a financial superpower that rivals many nation-states in its economic clout.

- You need to understand its Aladdin risk management platform processes over $21 trillion in assets globally, giving it unparalleled visibility into the world’s financial markets.

- You need to understand that when Larry Fink speaks, the entire financial world listens.

- You need to understand that when he shifts strategy, trillions of dollars follow.

- And you need to understand that Larry Fink’s admission that the green transition is failing is not a minor footnote in financial history; it is a watershed moment that will be studied for decades to come.

We have just witnessed the Larry Fink/Blackrock $14+ trillion pivot! Now we have the architect of the ESG movement also jumping aboard the metals and mining super-cycle freight train! Toot-Toot..

LET’S DIG INTO THE FOLLOWING:

- Today’s super-cycle story begins will Blackrock helping to starve the world of energy and critical minerals through the ESG crusade. Larry Fink’s now-infamous 2017 declaration, “You have to force behaviors – at BlackRock we are forcing behaviors,” was not hyperbole. It was a statement of intent, a doctrine that has guided the deployment of trillions of dollars and has reshaped the global corporate landscape. The ESG movement, with Fink as its high priest, effectively demonized entire sectors of the economy. How the ESG movement didn’t just delay new critical minerals supply; it effectively destroyed the seed corn of future production!

- But now has come Larry Fink’s great pivot, forced upon him of course, as ideology has met financial reality. The ESG crusade has run headlong into two immovable objects: political reality and the non-negotiable need for reliable energy. The backlash has been both fierce and effective. Republican-led states, viewing the ESG push as a politically motivated attack on their economies, began to pull billions of dollars from BlackRock’s management and the narrative began to crack. This was only the beginning. I will detail this fissure further below. Why Blackrock was forced to choose between ideological purity and financial survival, and, predictably, it chose survival!

- Fink’s new crusade is A.I, data centers, and baseload power. Just as the ESG narrative was collapsing under its own weight, a new, even more powerful narrative emerged: the Artificial Intelligence revolution. The buildout of A.I. and the data centers required to power it represents one of the largest infrastructure projects in human history. And this new revolution has one non-negotiable demand: massive, reliable, and inexpensive electricity. Why Fink is, once again, preparing to “force behaviors,” and this time, those behaviors will involve massive investments in the very sectors he spent a decade plus trying to destroy!

- Now we need to understand his $14+ trillion weapon, so we can skate to where the puck is going, not where it has been. It is difficult to overstate the scale of BlackRock’s influence. With $14+ trillion in assets under management, the firm is not just a participant in the market; it is a market-moving force in itself. When this behemoth of capital begins to rotate, it doesn’t create ripples; it creates tidal waves. Why for us investors, the choice is simple: we can stand either on the sidelines and complain about Fink’s hypocrisy and the damage his last crusade caused, or we can skate to where the world’s largest asset manager is directing the next wave of capital!

- It should be abundantly clear by now about what the official U.S. government policy is. Larry Fink and BlackRock’s ESG crusade was so successful that it created a massive, structural deficit in the supply of energy and critical minerals. Now, faced with the hard realities of a global power shortage and the non-negotiable demands of the A.I. revolution, Fink is pivoting. Blackrock is now in alignment with the U.S. government. He is redeploying the immense power of his $14+ trillion firm’s war-chest to solve the very problem he helped create. Why the world’s largest and most influential asset manager is officially joining the party, bringing with it the promise of a tsunami of institutional capital!

- And now we just need to see the whole system for what it is. We need to have “Neo” moment, where the lead character in the movie “The Matrix,” finally sees the code underlying the simulated reality. Everything that once appeared solid and real is revealed to be a construct, a system of control. Neo sees it for what it really is! This Larry Fink/Blackrock pivot offers a similar moment of clarity for us investors. The ESG movement, for all its moral posturing and lofty rhetoric, was never really about saving the planet. It was about control; control over capital allocation, control over corporate behavior, and ultimately, control over the trajectory of the global economy. Larry Fink and BlackRock wielded this control with ruthless efficiency, using the threat of divestment and proxy battles to force companies to comply with their vision. And now, with equal efficiency, they are abandoning that vision and pivoting to a new one. Why the lesson is not to get angry or to feel betrayed, rather the lesson is to “see the system for what it is” like Neo: a mechanism for concentrating and deploying capital in service of the goals of the financial elite!

|

|

||||||

|

Committing suicide a little faster

Wall Street Mav

@WallStreetMav

·

1h

20 million Indians with fake degrees are about to flood European labor markets.

Quote

Disclose.tv

@disclosetv

·

3h

NOW – Ursula von der Leyen says EU is “on the cusp” of making “the mother of all deals,” with India, “Europe will always choose the world, and the world is ready to choose Europe.”

Silver company?

Wall Street Mav

@WallStreetMav

·

10m

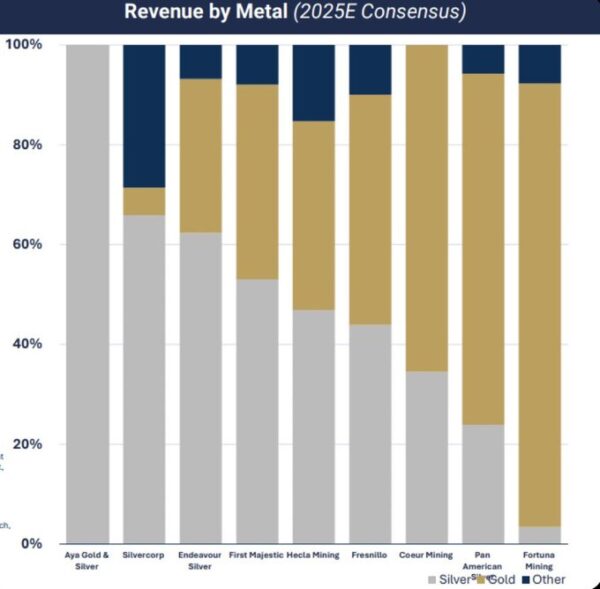

Lots of people are talking silver mining stocks lately.

Most of the stocks being mentioned as “silver miners” are not mining much silver. They mine gold or lead or zinc or copper, with a small portion being silver.

Or they are exploration companies that don’t mine anything.

There are perhaps 5 stocks that actually mine silver and it represents more than 50% of revenue.

8 am shenanigans arrive

This is where my Schwab real-time quote system goes haywire, and the bids/ask of SLV start going all over the place. This is also where they like to start testing the stops and softening up the metals before the Crimex opens. Anything they can do to stop the momentum.

Shanghai pm fix dropped a little to $103.57 I’m surprised we’re doing as well as we are.

The dollar is down almost 1% with rates higher. Not supposed to work that way. More trouble in bond land?

Morning winedoc

Good to see you’re fighting the good fight.

we won Winedoc

“HODL bro,” they type through tears,

As gold and silver leave the peers.

No glitches, forks, or laser eyes—

Just real weight… and moonward skies.

Coffee With Buygold ……..

I miss Wanka and many others

Wish they could be with us

On ward Pilgrims

Winedoc

Big test for the shares today

I guess every day is a test, but usually it’s a test for our patience with them.

PM shareholders are waking up to portfolio’s up around 5%. I really hope they can hold up, especially in a weak SM. Hopefully it will turn out to be the beginning of the real bull market, where the shares provide leverage to the metal price. They did it back in 2001-02 when the HUI ran to 600 the first time from 35. I’ll never forget it because we had to hear from “ment” about how his mother-in-law’s account made so much money because he bought at 35.

I guess if there’s one thing that pm’s have made me aware of – it’s my age, and just how long I’ve been riding this train. This is “the blessed hope” of every gold bug. Some of us didn’t live to see it. Wanka, floridagold, Farmboy?, Some old names. This is where we square up with the phony markets by holding “real stuff.” this is where the music stops and we take a seat.

Let’s hope “THIS IS IT!” as Wanka used to say.

ferret

10 yr. here also up to 4.28% was 4.13% last week. Dollar getting hit as well. They are piling into the Euro and Sterling – good luck with that.

PM shares are blowing up on the Globex, as the SM gaps down. No doubt they’ll hit the sell button on pm’s at the open to see if they can tamp things down with the SM.

Silver $95.50. Gold $4730 – What’s not to like?

I’m sure I’ll change my tune at the open. 🙂

Nope.

JGB yields. Vertical. New PM says “Print, print, print”.

SM futures are shaky tonight

Rates rising. Now 4.27%

Gold is the lone superstar and silver still maintaining most of yesterday’s gains.

Greenland?

Maddog and everyone

You should watch this especially near end. Tarriffs over Greenland start Feb. 1.

Prices could possibly go so high for silver it calls for looking for alternatives

.

John ag

Pretty good.

Apmex

Eagles are 116.49 before taxes not free certified depending how much cert or just free. If I didn’t stop buying right now I wouldn’t be mentioning it on line.

Maya

Yep at Provident eagles are 105.25 if with a card, 102 via check before tax if your state taxes. If only buying less than 20. I’m guessing people are not going to send checks in this climate but order fast as they can. I’m surprised at the price of copper. Heard back I bought a pound bar for near 10 dollars. Now they want about 22 across different online dealers when prove let pound is less than 6 dollars. Its like they’re selling futures prices but it’s sold anyway but I wouldn’t buy it for that.

Maya 21:53

You beat my last price bought with premium and taxes free certified shipping of 80 for about 14 maples at Provident metals. But for a graduation. So they’re over 100 now? Hopefully they’ll hide them away.

I saw on some comments on a PM video in Canada the maples were going for 140 something a few days ago. I think it was the billion dealer I posted. He said that dealers are having a hard time getting orders filled and had to stop selling.

Grad Gifts

I admit I paid too much recently when I got three 2026 silver eagles for grad gifts from APMEX on eBay. But the point is, I have them already in-hand, and if I waited until graduation season the price will be MUCH higher. I paid $106/each. APMEX is a reliable supplier, IMO, and they price in the eBay fee they must pay, too, so I don’t mind paying the premium now. What will the price be come june? This will look like a bargain then.

[Just like my five $39 Morgans look like now! lol ]

Shanghai am $104.20

Maybe paper is pushing phyzz higher…🤔

Maddog

I’m afraid with the volatility of the metal as far as stocks. They would have to learn what stocks to buy.. Not sure exactly what you meant with part not all the first paragraph. It would be easier for me to copy paste yours so I stAy out of it lol I haven’t talked to him much about gold stocks other than dead against it, he has equities and has done well. When he asked me for my email to send me some info on something yrs ago well my email has goldbug in it and got back via text a lol lol lol like I guess you really are a gold bug aren’t you. .

So I can say another gold bug wrote this. :).

It looks like D Hunter 20k gold 500 Silver is a 40 ratio. Depending on the demand of both it’s hard to say for sure ratios. As buying either gold or silver it looks about even, 50 50 lol For now anyways.

goldielocks

Re Yr Freind

Tell her to buy the shares, they are way undervalued vs the metal, …the metals now are at prices where swings of 20 % plus can easily be seen, maybe way more…..the shares will also move mightily, but the downside here, as long as the metals stay hi, ie around here, is pretty small.

The ratio’s can move 5 times back to old Hi’s while the shares do nothing……the metals still have a 5 times chance, ie Gold 20 K, Ag @ $ 500/…..those prices with a ration adjustmentm give a 25 multiple chance to the shares……she ain’t too late …she is just in time…..