Posted by goldielocks

@ 23:36 on December 30, 2025

I decided I’m not worried about what games there gonna play other than watching them make fools out of themselves. They are going to hurt the mines. In turn the mines just might sell their inventory to China and India and it will be these button pushing indoor fools fault. Thanks for the update.

It would be nice to see gold and silver up at the end of the year but they can no longer set the price to suit them in their disconnect with the real world when there’s better offers for the miners out there. It will become a different message this time to who are they going to sell to..

Posted by Buygold

@ 22:55 on December 30, 2025

silver down 5%, plat down 7.7%, pall down 5+%

Gold is up a few bucks though.

LBMA open will be interesting. Giving them an opportunity to cover or smash harder?

Posted by goldielocks

@ 21:52 on December 30, 2025

It’s seems obvious they want to buy since their restricting sales. Maybe Mr Coppers right. They’re liquidating their dollars into PMs while their at it.

Posted by goldielocks

@ 21:39 on December 30, 2025

I know what you mean. I decided not to wait and started passing the phyzz around. I stated slow with one or two ounces to see what they do. Then I increased it and told them hold it for me but if something happens keep it and don’t talk about it or tell anyone you have it. Hopefully I can protect them by a revocable trust that becomes non revokable at time of death where any value to any assets except maybe stocks starts the day I leave not when I bought them. Even a friend and her grandson years back kept hers I have her. When I told her last week what was going on she said she packed it away and is now gonna look for it. That’s one thing less to worry about now or later. Right now it’s getting interesting.

Posted by Buygold

@ 21:22 on December 30, 2025

$2 higher than yesterday’s pm fix and $4 higher than the am fix.

That about a $7 difference from the paper market right now.

Something has to correct.

Posted by Buygold

@ 21:15 on December 30, 2025

It doesn’t matter to me, because I’ve just held the phyzz for so long, I wonder if it won’t end up being my kids who sell it.

But you’re right, this could be some sophisticated hedge fund guys putting out all this info trying to enhance their positions before they dump. Over the years we heard from so many prognosticators, I’m not sure anyone really knows what comes next.

Posted by goldielocks

@ 21:05 on December 30, 2025

Although I would love to see silver fall back so accumulation numbers and buy as much as I could do would every stacker world wide. So lower prices probably wouldn’t be good for the industrials. It would just cause a tighter market.

From our fellow GBs site not only China has been out trying to buy from the miners now groups from India are too.

I hope these business get busy and not wait for it to come to them.

Below this post there was another that a CEO said China approached them and offered them 8 dollars over spot.

That’s why shorts bringing down the price can only be a fake out.

https://vblgoldfix.substack.com/p/breaking-silver-crisis-spreads

Posted by goldielocks

@ 20:03 on December 30, 2025

Brush up on your skills in Chinese Chinese Checkers – mates.

Posted by goldielocks

@ 19:42 on December 30, 2025

Watch out with that number. The real last resort support after breaking through to new price discovery’s is previous decades long prior resistance.

Even so they want it down to try to technically signal a top and reversal And if they can’t do that try to signal a not able to reach 3 digits by next year. Even so in the face of supply and demand shortages China would use higher prices there to lower prices here to continue to accumulate from the hand to mouth thinking easy money traders like sugar to flys continuing to accumulate to corner the market while halting their exports. So would that be a fake out and get people to sell.. to them?.

Posted by Buygold

@ 18:50 on December 30, 2025

We’ll see what Shanghai says. Asian Guy said $74.50 – 75.26 was the floor based on some Fibonacci lines.

He’s been pretty solid on the way up in terms of his targets. We’ll see if he’s right this time.

I have a hard time seeing the scum letting us close the year on a positive note. They are the scum after all.

Are the market open on Friday Jan. 2nd? Full day? Half day?

Just edited his Fibonacci level – it was 70 not 30.

Posted by goldielocks

@ 17:34 on December 30, 2025

1000 that’s crazy. When Trump was elected I knew immediately metals would profit vs demos where greens okay just not the mines stupidity and particulary platinums but was side tracked on a death and health issues and wasn’t sure there was gonna be a later but managed to save myself that token

Finally decided to buy some miners for later after the move including the American mine just Incase Trump looks at it. I identified MP right away before the move took but cest la ville. Then I started noticing China like blackrock into everything then these prices and verified by the Trader Ferg who’s been doing his homework they are aggressively cornering the market in more than just silver and why platinum was moving up so fast. The higher prices are bait like the spider to the fly and these paper traders it might have been going right over their head selling for higher prices decoupling from reality they want the phyz and there not gonna sell it back. It says these metals will cost a lot more down the road or not be able to. Get it at all..weaponizing it. And you wonder how wars start.

Maybe worse they expect they can buy it back for lower prices after they play their paper games. Oh they’re so smart. Not gonna happen. So now China has 80 percent of the platinum?? They’ve been going after everything for years. It will be copper, tin, steel, Aluminum and rare earths next.

The new battery keeps silver as a immediate priority among a larger demand from multi sectors of manufacturing but also a distraction away from the others.

Trump isn’t sleeping either he’s checking out the mines and explorers.

Posted by redneckokie1

@ 17:01 on December 30, 2025

The 10 year has a head and shoulder top on the daily and weekly chart.

Looks like more inflation coming which should support the metals.

rno

Posted by Buygold

@ 15:50 on December 30, 2025

Silver stocks should be the best buy of any asset class. Just not today I guess.

Gold sucked all day, pretty much drip sold all day.

One more day and 2025 is toast.

Posted by Mr.Copper

@ 15:35 on December 30, 2025

I think China et all are just printing money, and getting rid of it for metals. The old methods of saving money, putting it into regular stocks bonds and real estate will gradually end. Who the hell needs people hoarding houses? Driving prices higher. Its ok to hoard gold and silver, it won’t hurt anyone, except jewelers.

Posted by Maddog

@ 15:22 on December 30, 2025

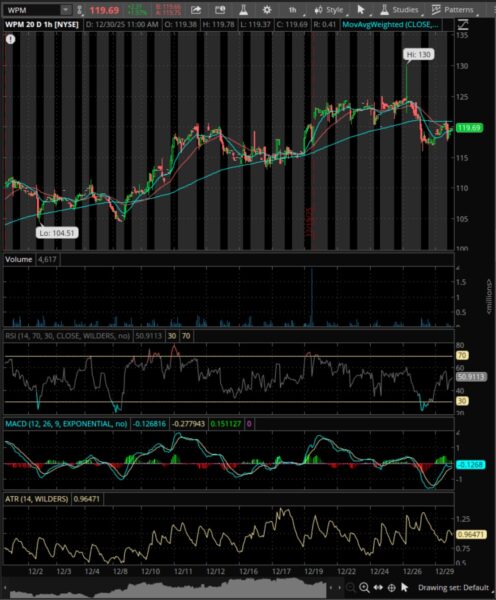

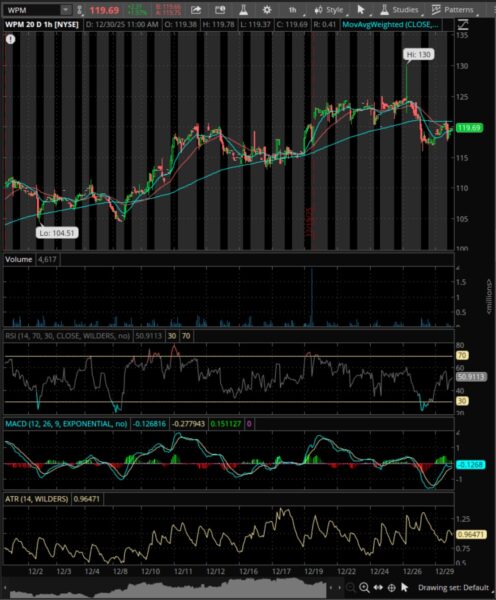

Note the D/T….once that goes….AG shares shud fly

Posted by Maddog

@ 15:17 on December 30, 2025

So China is buying anything and everything spare. !!!!!!

Got this from Grok

The “dollar premium” refers to the difference in USD per troy ounce between platinum prices on Chinese exchanges (primarily Shanghai Gold Exchange/SGE or Guangzhou Futures Exchange/GFEX spot/physical-equivalent) and the NYMEX (COMEX) futures/spot benchmark in New York.

NYMEX Platinum Price: Approximately $2,158 USD per troy ounce (front-month futures/spot benchmark).

Shanghai Platinum Price: Recent reports indicate trading north of $3,100 USD per troy ounce on Chinese platforms amid strong industrial stockpiling and physical demand tightness (similar to the ongoing silver squeeze).

Dollar Premium: Shanghai is trading at a premium of approximately $900–$1,000+ per ounce over NYMEX (based on late-December data where Shanghai exceeded $3,100 while global benchmarks were lower).

Posted by Maddog

@ 15:14 on December 30, 2025

Tks v much for that trader Ferg….huge amount of great info tks again.

Posted by redneckokie1

@ 14:51 on December 30, 2025

Sorry to hear about Eagle Eye. We have watched many oasis and gold tent members pass on. I would guess most people on this site are of advanced age.

i have been wondering if Trump is going to pull the rug out from all those folks who have money offshore that was illegally obtained. If we get a new currency which requires the old dollars to be exchanged for new ones, lots of folks are be holding an empty bag if they can’t prove they got it legitimately.

The best example of this is when the Japanese devalued the yen. The insiders bought wheat on the CBOT on Friday and sold it back on Monday after the devaluation. Another was when the Euro was implemented. Government and crooks (is there a difference ?) can manipulate and hoard paper. Metal in your hand is one of the few diffences.

It appears we are getting our inside day up along with a new high close on the Comex.

rno

Posted by Mr.Copper

@ 14:39 on December 30, 2025

I thank you for pointing that out. I just corrected the post.

Posted by MetalsGuy

@ 14:05 on December 30, 2025

These days in my area houses are $700,000 (plus) divided by the old 50 ounces of gold puts gold at $14,000/oz.

Posted by ipso facto

@ 13:52 on December 30, 2025

Posted by Mr.Copper

@ 13:26 on December 30, 2025

I remember Gold hit $800/oz. A house back then was $40,000. Divided by $800 gold comes out to 50 ounces of gold to buy a house.

These days in my area houses are $700,000 (plus) divided by the old 50 ounces of gold puts gold at $40,000.

Today houses at $700,000 divided by gold at $4,387 comes out to 159 ounces of gold to buy a house today.

Also back around 1980 silver at $50/oz made a $1000 face value bag of junk silver (715 oz) at $35,750 so a silver bag could buy a house.

Today with houses at $700,000 here a $1000 face value bag of junk silver (715 oz) a bag of silver would have to be $700,000 or silver at $979/oz.

So, unless houses start dropping, the AU AG peaks should be $40,000/oz gold and$979/oz Silver. I also suspect after Gold gets back above $4400 we will never see $4400 again.

Posted by eeos

@ 13:12 on December 30, 2025

They saw the spike in bids during after-hours (light grey shade), and they were like, ‘Cool the Silver complex off.’

Posted by eeos

@ 13:07 on December 30, 2025

Eagle Eye is about to pass at 88yo. Maybe a day or two. I wish he could have seen this.

Posted by redneckokie1

@ 12:44 on December 30, 2025

We may be looking at a new high close today.

rno