Otavio (Tavi) Costa

@TaviCosta

A lot has been said about silver over the past 24 hours and I want to offer a longer-term perspective on a theme I’ve followed closely for years.

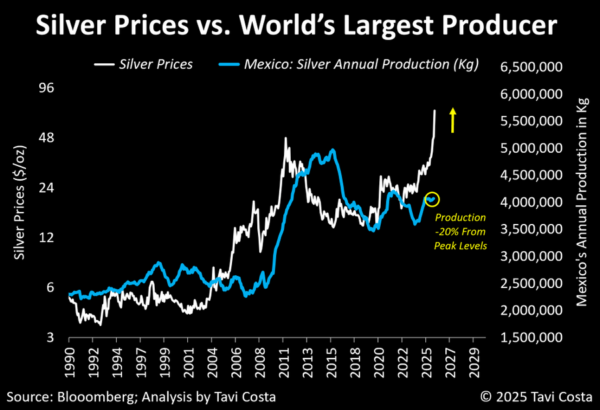

1) Bubbles in monetary metals don’t form with tight supply and rising structural demand while the global fiat system is in crisis.

2) Silver rarely moves in straight lines. Volatility is part of the process and should be embraced, not feared.

3) The low-price metal environment of the past decade is unlikely to return. The inflation genie is out of the bottle, and central banks lack the ability to put it back in.

4) Despite trading near prior nominal highs, silver remains materially undervalued in a world of fiscal dominance and a structurally weaker dollar.

Let the dust settle and the hype fade.

In commodity bull markets, leadership rotates.

This game is far from over, in my view.