Eagle Eye is about to pass at 88yo. Maybe a day or two. I wish he could have seen this.

Crimex silver

We may be looking at a new high close today.

rno

Definitely appears

that Crimex paper silver is being pushed toward the Shanghai physical price to eliminate any ideas one might have about arbitrage. So let’s hope that Shanghai stays elevated. As long as there is a supply problem, I don’t see why this changes.

Nice bounce back $77.38

Shares getting half their losses back from yesterday in most cases. At least among the ones I watch.

Why Mining Stocks Are This Decade’s Best Opportunity

While most investors and the financial world are fixated on tech stocks, they’re foolishly overlooking the best investment opportunity of the next decade: gold and silver mining stocks.

I believe this opportunity is so tremendous, it’s like buying Amazon, Google, or Nvidia back in 2010—just before their massive surge.

Moreover, tech stocks are now overly discovered by the public, making them a crowded trade.

Let’s put it this way, the proverbial shoeshine boy and his buddies are all-in on tech stocks right now.

As a result, tech stocks are overpriced and I believe they will deliver meager returns in the years ahead, while mining stocks will outperform them significantly.

One of the main reasons I’m so bullish on mining stocks is that, unlike tech stocks, they are criminally undervalued based on numerous valuation metrics, including their valuation relative to gold as shown in the chart below.

The Philadelphia Gold and Silver Index tracks gold and silver mining stocks and is currently hovering near multi-decade lows relative to the price of gold.

I believe miners are poised for a strong comeback, and if they simply return to their historical relationship with gold, they should quadruple from current levels.

This does not even take into account the continued rise of gold as its bull market continues to unfold.

Additional confirmation that gold and silver mining stocks are deeply undervalued comes from comparing them to the S&P 500, the benchmark index of the U.S. stock market.

These stocks cannot stay this cheap and overlooked much longer in the middle of a powerful bull market in precious metals, which, based on historical trends, has at least another eight years to go.

I strongly believe investors are about to wake up to the fact that gold and silver mining stocks are the cheapest investment opportunity on the planet in a world filled with overpriced assets, and they will rush in quickly and send miners to the moon.

Finally, for further confirmation of my bullish outlook on gold and silver mining stocks, I want to share the chart of the S&P/TSX Venture Composite Index.

This is a broad market index of Canadian micro-cap securities, many of which are junior gold and silver miners.

This index has spent more than a decade trading in a range between support at 400 and resistance at 1,000.

The index is now approaching a breakout, and I believe it will happen soon.

When it happens, I expect it to mark the beginning of an explosive bull market in mining stocks, particularly junior gold and silver miners.

This is a very exciting setup that I’m closely watching and waiting for.

I believe I’ve made my case that gold and silver mining stocks are the absolute most promising investment opportunity of the coming decade.

As the sector rises significantly, savvy investors will build generational wealth, with many individual miners delivering 10x, 20x, 50x, or even 100x returns.

This is not far-fetched, as those kinds of gains occurred during the mining stock bull markets of the 1970s and the 2000s.

If you found this free report valuable, it’s just a sample of the in-depth content that premium subscribers to The Bubble Bubble Report receive on a regular basis.

click here to claim your discount

Kind regards,

Jesse Colombo

Precious metals analyst and investor. Advocate for free markets and sound money. Recognized by the London Times for predicting the 2008 Global Financial Crisis.

AU/AG

56.56 and sinking…

Bollinger bands

The upper band is at 76.60 in Crimex silver. The slope is up. Silver has bounced off this upper band all the way up on this latest rally.

So far. The moving averages in the metals has provided good support.

Th3 higher we go, the more intense the volatility will become.

rno

Silver miner stocks

I have always looked at the shares as having a lot of similarity to metal futures. The value of the stock share is partly based on expectation of future earnings. Future earnings are mostly based on the price of the metal at that time. If you look at the silver futures backwardation, it shows that the metal is needed now not so much in the future.

aurum

Ipso

Yes, nice that we’re not continuing down after yesterday’s beating. The shares are pathetic though and shouldn’t be. Maybe they’ll get better after the first hour or next week when everyone gets back from vacation. If not then, when?

The paper kings are really doing battle in the silver pits this am while gold inches higher.

Deer79

Just a few flags on A.G. I ran across one he was encouraging people to have 500 oz and continually buy. Red flag one telling them to sell gold in one and now buy a certain amount because that’s the amount the government looks at, 500 oz or more also those who continue to buy large numbers. So some AI telling you what to buy now?

Also is it a distraction while China is trying to corner the market in all metals and rare earths. Also in smelting. Also If I were a big business that needed any of these metals or rare earths I’d be sending experts out to find mines to buy their metals from before China gets to it next. Happy New Year..

Buygold

The giant silver shorts have got to be a tad disappointed! They used all this firepower, thousands more shorts and the price is recovering already. Entities that want more physical just said: Thank you very much and resumed buying.

It sucks to be a silver short! 🙂

KOW knock on wood

Trader Ferg Platinum and Silver

China also cornering the market in Platinum.

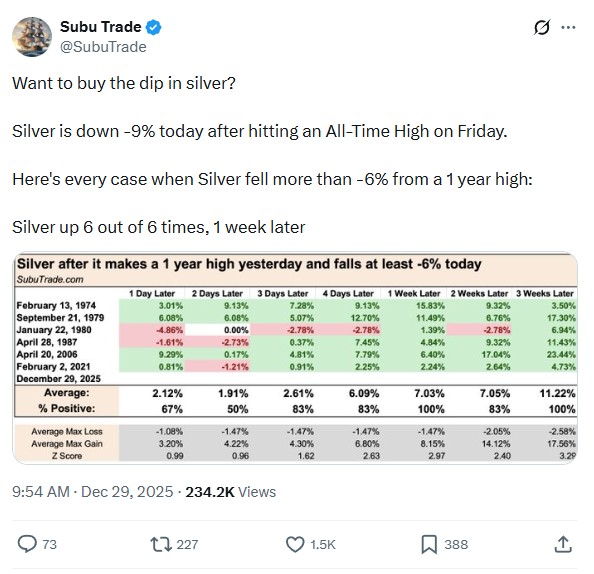

Someone posted on Twitter

I’m of the opinion that we were down about 9 or 10%

https://x.com/SubuTrade/status/2005683855530037284

Tavi Costa

Otavio (Tavi) Costa

@TaviCosta

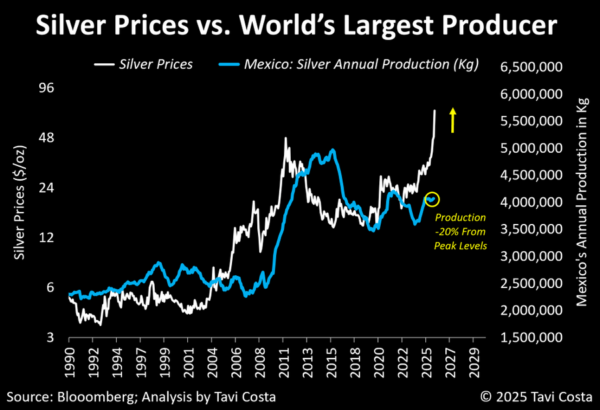

A lot has been said about silver over the past 24 hours and I want to offer a longer-term perspective on a theme I’ve followed closely for years.

1) Bubbles in monetary metals don’t form with tight supply and rising structural demand while the global fiat system is in crisis.

2) Silver rarely moves in straight lines. Volatility is part of the process and should be embraced, not feared.

3) The low-price metal environment of the past decade is unlikely to return. The inflation genie is out of the bottle, and central banks lack the ability to put it back in.

4) Despite trading near prior nominal highs, silver remains materially undervalued in a world of fiscal dominance and a structurally weaker dollar.

Let the dust settle and the hype fade.

In commodity bull markets, leadership rotates.

This game is far from over, in my view.

Silver up 5.3%

Yet I’m not seeing any silver shares up more than 3%.

At some point these silver shares are going to explode aren’t they? They have to.

Gold loses $200, bounces back $56. It will take gold a week or two to get that $200 back.

Check that, we’re getting the standard Crimex 9 am paper dump.

Forgive my impatience, I guess we are lucky to be bouncing back at all this am.

Yesterday I asked grok and chat GPT

about the coke. ChatGTPT just denied it outright and said, this is conspiracy stuff.

Grok goes much deeper and explores many avenues chat dismisses.

Saudis and UAE in a tussle

South Asia Index

@SouthAsiaIndex

·

9h

Saudi Arabia has just bombed a UAE weapons shipment in the port city of Mukalla in the South Yemen.

Saudi Arabia also publicly announced that this weapons shipment originated from UAE and was meant to fuel to the conflict in Yemen.

The shipment was meant for Southern Transitional Council which is trying to create a new state in Southern Yemen namely “South Arabia”. It also claims some territories of Saudi Arabia.

Saudi strike signals rapidly increasing tensions between the Kingdom & UAE who are now indulged in a proxy war in the region.

Goldielocks

I totally agree with your idea of the Chinese trying to “weaponize” Silver.

I’ve always felt that this is ultimately a financial war as well. And it wouldn’t surprise me if this Asian guy posting all of this information is some sort of AI entity, to use as another weapon against the West in this war.

Happy New Year to all!!

last attack being seen off……looks like ystdys sell off has alerted buyers…..

so whoever sold 10,000 lots of silver in 15 mins……is staying close to their nearest dunny.

Asian guy

2 hrs ago. Check the comments. People selling gold for silver. I wonder though who buys gold? The Central banks.

The silver contagion is growing. Kevin OLeary, Ron Paul, many other familiar names all coming out on silver. I’m worried if it grows too big will government go after stackers for silver. . We are a small group maybe too small to worry about if not holding in big numbers but if everyone starts buying. will it be worth it for them to restrict or confiscate. Sure it’s likely going up but so are the others. It just happens to be a big target of manipulation and the day of reconning has come.

Another thought is it China weaponizing it to bring down the western economy knowing supply’s are low they made lower shutting down exports and now encouraging everyone to buy it.

Still using the carrot on a stick and FOMO on silver but other metals and rare earths are also important. Is it a distraction,,? Trying to figure out motive

He mentions Australia in this one Someone said the perth mint was closed a few days ago..Was that on Christmas lol

Thinkorswim says silver is up over 8% this morning

Up $5.77. Must suck when the paper shorting kryptonite doesn’t work anymore

Grok says

Where Did All That 1934 Silver Go? A Timeline of Uses and Disposals. The acquired silver wasn’t just hoarded; it served monetary, industrial, and strategic purposes. Over the decades, it was gradually depleted through coinage, wartime lending, industrial releases, and sales. By the early 2000s, U.S. government silver stockpiles were essentially gone. Here’s the breakdown:

quora.com +8

1930s–1940s (Initial Uses): Much was minted into silver dollars or used to back silver certificates (paper currency redeemable in silver, helping expand the money supply). Some supported wartime efforts; e.g., during WWII, ~300 million ounces were lent to the Manhattan Project for electrical conductors in uranium enrichment (later returned). Additional silver was lent to allies under Lend-Lease (e.g., to the UK). The Act was repealed in 1946, but stockpiling continued for strategic reasons under the Strategic and Critical Materials Stockpile Act.

reuters.com +4

1950s (Peak and Industrial Drawdowns): Treasury holdings peaked at 3.9 billion ounces (1959). Rising industrial demand (photography, electronics) led to releases; e.g., silver was sold or allocated to defense needs.

1960s (Depletion Begins): Silver prices surged due to global shortages, prompting the 1965 Coinage Act, which eliminated silver from dimes/quarters and reduced it in half-dollars (saving ~1 billion ounces over time by switching to clad coins). In 1968, 165 million ounces were transferred from the Treasury to the new Defense National Stockpile for strategic materials (stored at West Point and San Francisco Mints).

usmint.gov +4

1970s–1980s (Sales and Auctions): In 1970, 25.5 million ounces were removed from the strategic stockpile (for industrial sales), leaving 139.5 million. By 1979, silver was deemed non-essential for defense. The General Services Administration (GSA) auctioned Treasury bullion in phases (e.g., 105 million ounces authorized for disposal by 1983, leaving ~34 million). Much went to industry or investors, e.g., sales to cover coin production or stabilize markets amid the 1980 Hunt Brothers price spike.

quora.com +3

1990s–2000s (Final Depletion): The strategic stockpile declined steadily (e.g., to ~49 million at West Point by the late 1990s). By 2002, it was fully depleted, with remnants sold to the U.S. Mint for American Silver Eagle coins. Today, the U.S. government holds virtually no silver reserves—any remaining is negligible and for minting commemoratives.

Shanghai PM fix price is $80.25

about a $6 gap from the LBMA fix.

It is interesting that the physical price followed the paper price down, although the gap has closed to $5 now.

RE AG guy

I checked the $ 34 billion Fed borrowing …not true and not true that anyone is in trouble…..according to Grok.

The Fed has to report borrowing on a daily basis, so not easy to hide , if it can……Who ever is behind the AG guy can check this as easily as anyone …..why bother to lie.

Sng

Besides that back to the content..all the info is not accurate. For instance is Gold a better conductor than silver? The mysterious bank? Russia is taking resources from Europe as retaliation of them stealing theirs. Truth is they have only threatened to at this point. Prices on China aren’t accurate.

I saw a other one with the same words of A,G. But who was a elder white man that sounded a lot like a economic YouTuber Professor Wolff but AI.

That leaning towards fear porn type or propaganda. Who ever it is wants followers piling into silver and suggesting selling gold. They are bringing attention to silver and don’t trust the times he asked to say where the watchers are from. I don’t think the attention to stackers it’s bringing would be welcome attention from governments.

FEAR OF MISSING OUT PORN.

That said, one thing he said is close to the truth but I won’t mention it until after the clock strikes 12 am on Dec 31.