My wife and I help our neighbors as well as our farmer and rancher friends, so unless we can’t travel the few miles to them we should be okay food wise, at least to start. A caution I have had for some time is to keep a low profile, at least until the dust begins to settle and we can see their intent . I think the true colors of our politicians will quickly surface and we’ll then be better able to navigate these coming AI driven 6G satellite regulations. Luck to all. We’re all blazing our own trails. SNG

ferret and all

so let’s say silver hits $100-$125, do you then sell and buy gold with it? If I were to sell now, that’s what I’d do with it.

That’s the thing, you don’t want to put it into dollars and the bank right as the dollar is fading into the sunset.

Selling is where this becomes hard, ideally it would be nice to trade it for real estate, but it’s too early for that.

Is silver going to hit a top of $100+ and just hang there, or is it going to do what it has done in the past and drop back to $50-$60?

I have an old friend who bought with me way back at $10, he had some friends who also bought there. He called me tonight wondering when to sell. They’ve done well finally after all these years – up 700%. He’s worried about it crashing back to $20. Valid concern from the way pm’s have acted the last 15 years.

I had no idea what to tell him. Just said I’m holding it as insurance, or until I can get something I want for it. But I also told him there’s nothing wrong with selling at a 700% profit.

I keep going back to what the billionaire David Bateman said about why he bought almost a billion dollars worth in the last six months. Because this is it, this is the great reset. If that’s the case, then these metals will be priceless.

silverngold and ferret

Perhaps in this chaos the NWO will try to insert the CBDC regime? Beyond that for sure we know there will be a blizzard of dollars produced at some point. Not looking forward to what is likely to come …

AU/AG ratio

57.24

!!

ipso, yes, the lack of trust will be infectious.

Gold is the obvious sequel. Whether they can shuffle bars around, selectively exhibit the same bars in different places to ‘prove’ they all exist or not will be critical. Maybe Fort Knox could lend them some – if they have any left.

How can you tell if a ton of copper is rehypothecated though? No serial marks. The reason it is so easy to rehypothecate is that it is so bulky which is why it is stored in warehouses. So firms would need to take delivery themselves and find somewhere to store it. Likewise pork bellies. So go long private warehouse space and large freezer rooms.

I can imagine it will not be a restful weekend for some executives and traders. What a shame.

{edit} I wonder what will happen if the lack of trust extends to crypto holders? After all, if you can’t trust Trust Wallet, what can you trust?

Is the end of the fiat system imminent?

Bill Holter

“People say if they can’t deliver, and I am going to tell you at some point they will not be able to deliver, when that moment happens, it’s game over for the entire financial system. Silver, and I believe it will be silver that fails to deliver, silver is the blasting cap to the gold nuclear bomb. When silver fails to deliver, then immediately there will be a pile into COMEX gold, and they will not be able to deliver the gold. Once that happens, you have failures of contracts that are proven fraudulent. They are zeroed out and cannot perform. Then it spreads to cattle, pork bellies, grains and you name it. This is not to mention the financials of stocks and bonds. Once you prove fraud in silver, that’s going to spread to all the derivatives, and we will have a derivative meltdown. . .. The world wants gold and silver because those are the only two monies that cannot default.”

Buygold @ 15:54 reChina’s higher Silver prices to break the west’s paper pricing mechanism.”

How about this idea. If people are buying Silver in the USA, and then selling it to China, the net result is they are accumulating our USA Silver. I noticed decades ago, most foreign countries just keep on taking things of value away from the USA.

Before 1971 they were cashing in US dollars that Americans spent overseas at $34 per ounce when it was worth $140/oz. After we cut the world off from taking our Gold, in 1971, they switched into taking our wealth creating tax paying manufacturing jobs.

They were replaced by wealth absorbing sales and service jobs and tax payer gov’t jobs and those STUPID wealth absorbing EPA jobs just to keep Americans working? Doing unnecessary work. It would have been cheaper to just give unemployed people the money they need and save money on all the material costs.

Even my son sold a few collectible cars that went overseas. Than God for Trump being born.

Lithium bonanza

40 million tons from 16 million years ago: a US mine puts China at a disadvantage https://share.google/

illuminatibot

@iluminatibot

·

Dec 24

NEW WORLD ORDER UN Agenda 2030 Mission Goals:

-ONE WORLD GOVERNMENT

-END OF NATIONS

-ONE WORLD ARMY

-ONE WORLD POLICE FORCE

-END OF FAMILY UNIT

-ONE WORLD CENTRAL BANK

-ONE WORLD CASHLESS CURRENCY

-END OF ALL PRIVATE PROPERTY

-WORLD DEPOPULATION AND FERTILITY CONTROL

-END OF HOME AND CAR OWNERSHIP

-MANDATORY MULTIPLE VACCINES YEARLY

-UNIVERSAL AUSTERITY INCOME

-SOCIAL MEDIA DIGITAL ID

-MICROCHIPPED FOR HEALTH, SHOPPING AND TRAVEL

-IMPLEMENTATION OF CHINESE SOCIAL CREDIT SYSTEM

-GOVERNMENT-RAISED CHILDREN

-ALL BUSINESSES RUN BY STATE

-END OF NON-ESSENTIAL AIR TRAVEL

-HUMANS CONCENTRATED INTO 15-MINUTE ZONES

-END OF PRIVATE FARMS AND VEGETABLE GARDENS

-END OF ANIMAL OWNERSHIP

-BAN ON ALL NATURAL MEDICINE

-AI COURTS AND END OF INDIVIDUAL RIGHTS

-LIMITED ACCESS TO WILD SPACES

-END OF FOSSIL FUELS AND MODERN CONVENIENCES

I think we can thank Trump for finally making this happen

Or who knows how much longer they’d drag the suppression of the metals out. China has been quietly been buying up all the metals and mines they could get for decades not calling attention to themselves or wanting prices going up while they’re buying as much as they could.

But now with further technology needing the metals to make their products at the same time Trumps economic plans and America first to bring jobs back home and stop giving our resources away was the straw the broke the choke hold by the paper traders on the metals and rare earths which is also linked to plans of future economic growth in these sectors that needs them.

Buygold 11:44, that’s harsh, very harsh!

Gold is the one that blazed the trail, fighting tooth and nail through all the doubters, paper contracts and trash talkers, so that the others can charge through with ease. Gold, a slacker? Shame on you! 🙂

re confiscation. I think the ETFs are a very good thing. One ETF alone ‘held’ 16,600 tons of silver as at 23/12/25. If governments need to grab stuff for strategic, or any other, reasons then why bother with mum and dad investors?

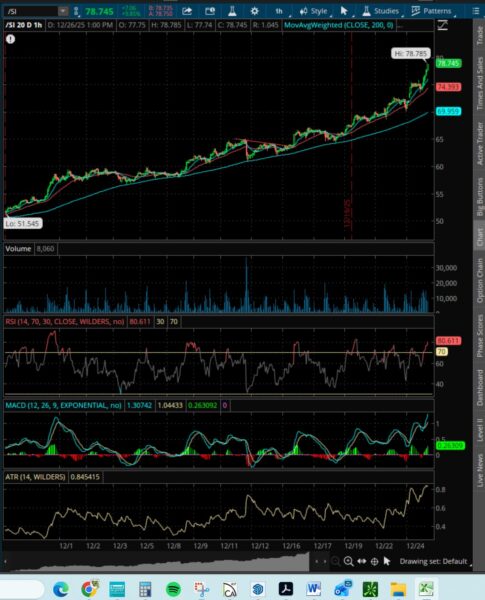

“new target $80 by new years eve?”

scratch that! …By 5:00 p.m…. ?

Ag shares vs AG

Just keep selling PM shares and buying AG, as long as the D/T holds…….Algo’s go home v happy…..but what happens when this turns….

FWIW – SLV

Traded 2.5 x’s average volume today. Hardly a thin trading day.

@Buygold

I agree 100%. Plus western bankers and or the Federal Reserve have been losing control. Long lived the king of holding metals down.

Yeah maddog

It’s a real pisser what the scum is doing with the silver shares in particular with the metal up 8%. These things should be flying, up 10-15%. First Majestic is sitting on 753K ounces and they’re struggling to stay up 1%.

I kind of think gold should be doing better as well, although I know the ratios are getting squared up. Still, I’d think there would be some folks contemplating a run at the paper gold market after what’s happened with silver.

$78 Silver

Mr. Copper – The only thing Chat GPT said there that mattered is “in short, because Shanghai trades in real metal, not in paper contracts.”

Besides hoarding silver and freezing exports, this is why I don’t think it’s China that is panicking. I think it’s possible that they could even be encouraging higher prices to break the west’s paper pricing mechanism.”

$100 silver

Back in the early 2000s many of us thought silver would hit $100 long before 2026. As it should have.

Sadly, many are no longer with us.

That day no longer seems far off. And $200 and more no longer seems like crazy talk.

We also wondered if it may be part of and a catalyst for world changing events.

Well, it seems we are finally on the verge of something big, compadres. Hopefully it will be positive.

God bless us all

I asked ChatGPT Why is the silver price so much higher in shanghai

Silver often trades noticeably higher in Shanghai (the Shanghai Gold Exchange / SGE) than in London or New York for a mix of structural, regulatory, and supply-demand reasons, not because the metal itself is different.

Here are the main drivers, from most important to least:

1. China tightly controls silver imports

China does not allow free import/export of silver.

-

Only licensed banks and firms can import silver

-

Import quotas and approvals can be slow or limited

-

When domestic demand rises, foreign silver can’t flow in quickly to arbitrage the price

This breaks the usual “buy low here, sell high there” mechanism that keeps global prices aligned.

2. Strong domestic demand

China is one of the largest silver consumers in the world, driven by:

-

Solar panel manufacturing

-

Electronics and semiconductors

-

Industrial alloys and chemicals

-

Jewelry and investment demand

When Chinese industry ramps up (especially solar), local demand spikes fast, pushing prices up inside China.

3. SGE prices are physical, not paper-based

Shanghai prices mostly reflect physical silver delivery, while:

-

COMEX (US) and LBMA (London) are dominated by paper contracts and derivatives

Paper markets can suppress prices during periods of heavy short selling, while physical markets respond more directly to real shortages.

Result:

👉 Physical premiums appear in Shanghai first

4. VAT and transaction costs

Silver traded in China usually includes:

-

Value-added tax (VAT) (often ~13%)

-

Local logistics and financing costs

These alone can add a noticeable premium versus Western spot prices.

5. Currency effects (RMB vs USD)

Shanghai silver is priced in RMB, not dollars.

-

RMB depreciation or capital controls can make metals more attractive

-

Precious metals are a popular hedge inside China when confidence in financial assets weakens

6. Limited arbitrage

Even when Shanghai prices are much higher:

-

Exporting silver out of China is restricted

-

Importing large amounts quickly is difficult

So the premium can persist for months, instead of disappearing in days like it would between London and New York.

What the Shanghai premium usually signals

Historically, a large Shanghai silver premium suggests:

-

Tight physical supply

-

Rising industrial demand

-

Stress or distortion in global silver markets

It does not automatically mean global prices will jump—but it often precedes periods of volatility.

In short

Silver is more expensive in Shanghai because:

China has high physical demand, strict import controls, and a market focused on real metal—not paper contracts.

If you want, I can also explain:

-

How big the Shanghai premium is “normally”

-

Whether it’s a bullish signal for global silver

-

How arbitrage sometimes happens anyway

-

The difference between gold vs silver premiums in China

Crazy

Buygold that’s a good point on SLV as well as GLD according to Andy who mentioned not safe near the end of that video with who they store it with, where are they going to buy it? Like that one IA ASIAN guy who talks like a white guy voice actor said the ones who work for these managed finds they’re gonna come back from the holidays and gonna have to buy silver or get fired. Things w myill be crazy next few months and it seems the general population hasn’t woke up yet either.

I think I will start wearing band-aids over my couple 18k rings I don’t want to take off and lose when out and about pretty soon.

Zero Hedge

Running a subscriber article that says China is panicking over high pm and copper prices in the thinly traded holidays.

Are they sure it’s China that’s panicking? Seems to me they’d just halt the Shanghai market if they were worried.

I actually expect a trading halt on the Crimex if this continues Monday.

Wow $77.20

Is this a dream?

Wait until the shares wake up.