Otavio (Tavi) Costa

@TaviCosta

·

Dec 7

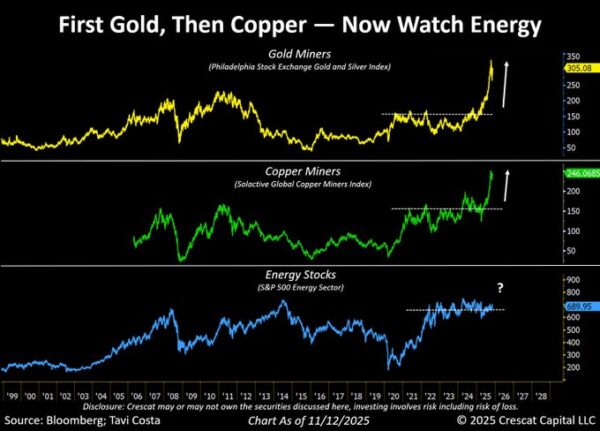

Energy stocks keep inching higher, quietly building the pressure for what I think could become a sharp, decisive breakout.

You can’t perfectly time these inflection points, but the macro pieces are falling into place:

▪️Positioning remains deeply bearish.

▪️U.S. oil and gas rigs are contracting meaningfully.

▪️Oil is trading near one of the cheapest levels in history relative to the money supply.

▪️Energy’s weight in the S&P 500 is hovering near record lows.

It reminds me of when people said I was crazy for buying mining stocks, insisting metals would never move.

While my conviction in miners hasn’t changed one bit, I also see energy equities as one of the most fundamentally attractive corners of the market right now.