Just saw silver. This is another unexpected rally. I guess we don’t have to wait.

I honestly didn’t think I’d see $60 silver in my lifetime.

Just saw silver. This is another unexpected rally. I guess we don’t have to wait.

I honestly didn’t think I’d see $60 silver in my lifetime.

Who was it that had the rally monkey years back? Was that Wanka?

Someone needs to unlock that dude‘s cage and let him out!!!

he suffered enough, don’t you think?

Looks like we’re getting a follow through kinda cup and handle formation. 70s next?

trading economics shows $60.002 @ 10:40, a quick backtest to $59.78, then running up again…

ZUBAZOOM !!!!!!

$60.25 and counting…

PS Eff the shorts!

$59 breached, backtested, running for new highs. $60 by the end of the day???

before lunch ???

Everyone is a photographer with a smartphone. So we have thousands of planes that fly the sky everyday and now we have these sneaky guys that can’t be caught with a camera phone. Well smart guy, you can’t catch them because it’s being sprayed from the trailing edge of the wing. No wait, it’s mixed in the fuel and it’s burned. We’re not sure who’s doing it. We can’t get governments around the world to agree on jack crap but they’re definitely in on the chemtrails, pfft

Course gold not helping after being up earlier.

Never underestimate the ability of the shares to suck on any given day.

Hopefully this B.S. is over by the end of the week and we can rally for a while.

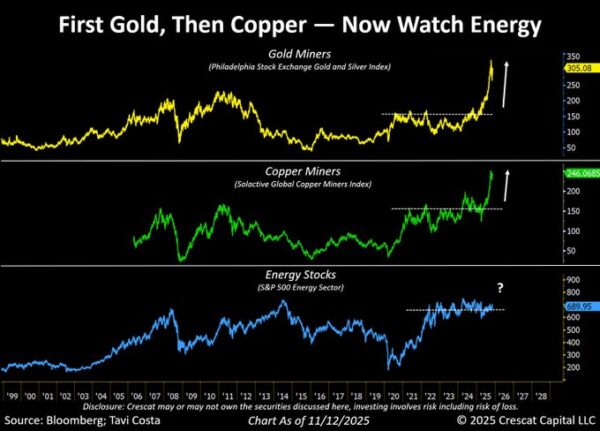

Otavio (Tavi) Costa

@TaviCosta

·

Dec 7

Energy stocks keep inching higher, quietly building the pressure for what I think could become a sharp, decisive breakout.

You can’t perfectly time these inflection points, but the macro pieces are falling into place:

▪️Positioning remains deeply bearish.

▪️U.S. oil and gas rigs are contracting meaningfully.

▪️Oil is trading near one of the cheapest levels in history relative to the money supply.

▪️Energy’s weight in the S&P 500 is hovering near record lows.

It reminds me of when people said I was crazy for buying mining stocks, insisting metals would never move.

While my conviction in miners hasn’t changed one bit, I also see energy equities as one of the most fundamentally attractive corners of the market right now.

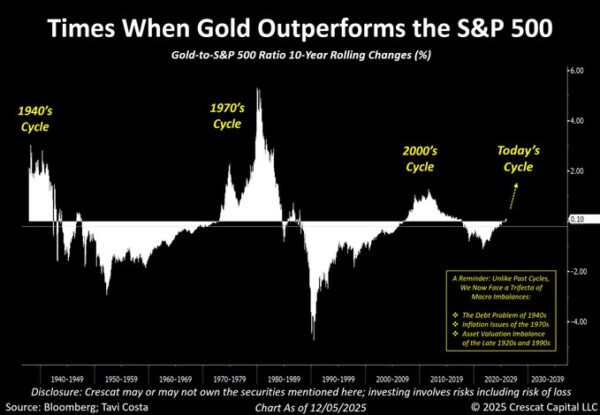

Otavio (Tavi) Costa

@TaviCosta

·

15h

Some argue that gold’s recent outperformance relative to the S&P 500 was a temporary anomaly.

I disagree.

This dynamic follows very long-term cycles, and I believe we’re likely only in the early stages of this one.

A key reminder:

Unlike past cycles, however, we now face a trifecta of macro imbalances:

▪️The Debt Problem of the 1940s

▪️Inflation Issues of the 1970s

▪️Asset Valuation Imbalance of the Late 1920s and 1990s

That’s an incredible tragedy. It’s time for the US to pack up and leave the place entirely. No more troops in Europe, no intelligence sharing, no starlink, no nothing for the war.

I saw that and no surprise. He’s like in checkmate but won’t concede and hope removing him is enough to stop the neocons in Europe even if they did after ruining their economies and country.

this will only end with the removal of the comedian. Or nuclear war.

Well there’s something we can agree on. Putin is the only wise adult in the group who’s looking at the welfare of millions of people not like the shady neocons looking at the millions dollars they can purloin from the millions along with their lives.