Interesting

Neil Ringdahl

@NeilRingdahl

Worlds biggest open pit blast.

11 million tonnes, 6,410 detonators, 51ha.

Sorry, Alex😉 but at least its still in Aus.

Fun Fact for non miners: The perimeter holes going off first is called the pre-split. The top of these holes are not blocked, increasing the blowout & reducing the shockwave (which breaks rock), instead creating a single crack or “split” between them. This split prevents the rock outside the blast perimeter defining the pit limit from being smashed by the shock from all the other blast holes. The reason for this is so that the walls of the pit do not get too fractured and present stability problems when the pit gets deeper.

Maddog 10;05

I intended to.post more you may want to know then and hope they don’t mess up the crypto holders but it didn’t copy right.

They are investing in.mines. I looked up this mine and it had a name change. ELE. Like End of Life Event? Maybe it was a sign. I have a feeling because crypto is such a large group from all walks if life bigger then bugs but more or less on same page if they mess them over there will be no place for them to hide.

- Investments in mining companies: Tether, through its investment vehicle, acquired a significant minority stake and invested a further $100 million in the Canadian precious metals royalty company, Elemental Altus Royalties Corp..

- Executive role: Following the initial investment in June 2025, Sartori was appointed as the Executive Chairman of Elemental Altus Royalties.

- Broader strategy: These moves are part of a larger plan to leverage the convergence of real-world assets and digital assets, with the ultimate goal of blending blockchain-based finance with hard-asset backing.

Convenient server failure this morning

Ben Rickert

@Ben__Rickert

Silver’s Bull Run Hit a CME Circuit Breaker—But the Cycle Won’t Stop.

There’s a point in every monetary cycle when the truth becomes too expensive to suppress and too volatile for the system to process. Silver just reached that point.

As silver ripped through key resistance levels with the momentum of a freight train, the CME’s silver futures market was abruptly halted. The official explanation was that a “server cluster overheated.”

That may be technically true but in markets, surface explanations often conceal deeper realities and the deeper reality is this:

Silver is beginning to reprice the world’s monetary distortions — and the infrastructure built to suppress volatility isn’t designed to handle honest price discovery.

A server didn’t fail.

The narrative failed.

Maybe it’s time to start calling silver the Missouri metal…. after his namesake, the SHOW ME state…

I believe we’re in a new paradigm folks…

Isn’t it great

to see the short silver players who have been illegally vexing us for years get their comeuppance! It’s friggin wonderful! ![]()

goldielocks

Re Tether

I was reading up on it the other day and they are v close to the City of Lugano,they hold conferences there and seem well in bed with the City…..Now Lugano is the Kiev of Switzerland….dodgy is it’s middle name……Just one of their specialities was washing vast amounts of Lira, in the old days and probably still do…..Italy is across the lake, so v easy to fill a speed boat up and wizz it across and on the way back, is one of the best restaurants I have ever been to…..which just happens to be in a Principality, that is Sovereign……so no questions there.

When I say vast amounts…..they didn’t count it, they weighed it before they took it to be counted……and it was like 50 tonnes a week of paper money in large notes !!!!

Breakout yes….backtest done….and real rally is on

Except xau/Au….never made break out and but is v close

Also buying commodities

I believe but can’t be sure yet another sort of ETF he wants redeemable physical without the storage fees.

- stored in a vault in Switzerland.

- Gold-backed token: Tether also offers XAUt, a digital token that is 100% backed by physical gold and can be redeemed for the physical metal in Switzerland.

do we walk straight through $ 4200 and $ 55

Wow yes is the answer !!!!!!

Except NEM is only up 0.3 %…..when do the scum attack…..

Buygold 9;10

I don’t think it left and this last run left them in a precarious position with their sources are now also in low supply. It went from paper trades to calls for delivery from here to over there, and there, and there,…

On.my.post below.

No one’s talking about all this. Perhaps they’re still buying but this surprised me the most I think near the end of my last post.

Consultancy Metals Focus estimates that 83% of silver held in London vaults had been allocated to ETFs as of end-September.!!!!!!!!!!

Ferret

Metals and Miners excellent catch…….what is also noteworthy, is that huge price projections are being talked about …..which makes them much more achievable and says you still have time .

Oh wow….silver takes out the all time Hi and thus negates the Hammer from last month……

Looks like silver shortage has returned

New all-time highs in the works. breakout from triple top?

Maddog

Well that explains more about India competing with London for silver other than their wedding seasons. Now the Arabs bought silver for industrial purposes. Europe apparently doesn’t have anything China needs so had to trade with silver.

This supply shortage isn’t getting better but looks like it’s just getting started.

More trouble in Europe..

+9

Yes, the physical silver market in London experienced a severe liquidity squeeze in October 2025, meaning the amount of readily available “free float” silver was critically low. This was driven by a long-term global silver deficit, a surge in demand from both industrial and investment sources, and a recent outflow of metal to the U.S. due to tariff fears. While large inflows of silver from the U.S. and China have since helped to ease the immediate crisis, the underlying structural deficit remains.

-

Long-term supply deficit:Global demand for silver has outstripped supply for several years, leading to a total shortfall of hundreds of millions of ounces.

-

ETF holdings:A large portion of the silver in London’s vaults is held by exchange-traded funds (ETFs) and is not available to the physical market, significantly reducing the “free float”.

-

Recent outflows:Before the squeeze, many traders moved silver out of London to U.S. vaults in anticipation of potential tariffs.

-

Increased demand:A recent surge in demand from India, coupled with investment buying, hit the market when the physical supply was already low.

-

Historic price surge:The shortage and subsequent scramble for metal caused the price of silver in London to spike dramatically, temporarily trading at a significant premium to U.S. prices.

-

Market stress:Traders described the market as “all but broken,” with banks struggling to quote prices due to a lack of available physical metal for lease or delivery.

-

Reversal of flows:The high premium in London made it profitable to ship silver from the U.S. and China to London, and significant inflows have since occurred, easing the immediate tightness.

-

Liquidity improved:The large inflows of physical silver have alleviated the immediate, acute shortage and the market has stabilized from its panic state.

-

Underlying issue persists:Despite the recent improvement, the long-term supply deficit remains, and the structural problem of a low “free float” in London has not been resolved.

Maybe a good revolution will wake people up … publically televised firing squads might do the trick

General Flynn Calls For National Address From Trump On Color Revolution Threat

Whether it’s the protest-industrial complex run by left-wing activist groups and bankrolled by unhinged progressive billionaires’ dark money NGO networks, nonstop leftist corporate media campaigns designed to delegitimize Trump and sway sentiment polls, judicial warfare waged by radicalized judges, constant orchestrated scandals and leaks, the involvement of foreign-aligned NGOs, student-driven pressure movements, or even the weaponization of far-left militant groups – all of these elements function as interconnected spokes in a much larger color-revolution wheel – a regime change operation orchestrated by leftist billionaire kings and Democrats.

The latest example – the scripted “Seditious Six” video urging the military to “refuse illegal orders” without specifying any – fits textbook color-revolution pressure messaging.

It reads as if the script were lifted straight from a CIA playbook for overseas regime change operations, using pressure campaigns so obvious now that even the average American can recognize what’s going on:

- delegitimization campaign against Trump;

- framing normal authority as “illegitimate”;

- attempting to mobilize military disobedience;

- attempt to trigger defection in the military and intelligence world.

Recall that riots in Los Angeles earlier this year were manufactured by leftist groups that were a form of pressure campaign to sow chaos against the administration to sway sentiment polls – yet that backfired.

New York Times bestselling author Peter Schweizer, along with his lead researcher Seamus Bruner, Jennica Pounds (known as “DataRepublican”), and others such as Mike Benz, have been moving the needle with their observations and bombshell findings on how the dark-money NGO ecosystem operates to conduct color revolution operations not only abroad but increasingly inside the U.S. since Trump’s 2016 election.

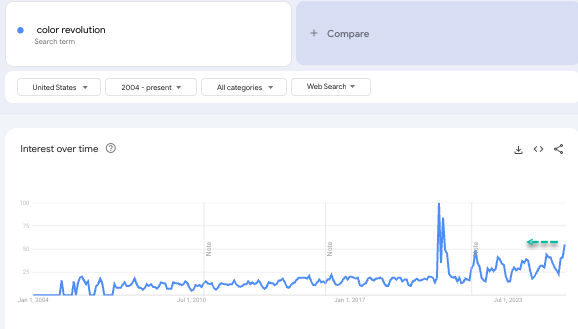

The search term “color revolution” has risen to the highest levels since the Marxist BLM riots in 2020.

The constant pressure campaign is worsening – from riots in Los Angeles to Antifa attacks on ICE and Border Patrol. The latest example, the scripted “Seditious Six” video urging the military to “refuse illegal orders,” shows the Left growing more desperate as it finds its back against the wall with funding networks being cut.

A big-picture view of the Left’s color revolution operation comes from retired Lt. Gen. Michael Flynn, who described it on the Alex Jones Show. Flynn urged the Trump administration to immediately address the nation to expose this plot and outline countermeasures (reform the NGO world).

Key Points from Flynn’s Remarks:

- Seditious Conspiracy and Military Incitement: Flynn accuses the “Seditious Six” of releasing a scripted video encouraging U.S. military personnel to disobey lawful orders from Trump if they deem them unethical, calling it “textbook sedition” under federal law (18 U.S.C. § 2387). He highlights Rep. Elissa Slotkin (a former CIA officer) as a key figure, suggesting the group is part of a larger, pre-planned operation involving NGOs, the State Department, and intelligence agencies. Flynn questions who authored their “script” and demands investigations into potential mutiny incitement.

- History of Lawfare and Deep State Operations: Flynn recounts a timeline of “illegal investigations and lawfare” against Trump since his 2016 victory, including the Russia hoax, impeachments, and recent probes. He frames this as “unrestricted warfare” by the deep state operatives, designed to create chaos and shield figures like Obama from accountability. He warns that opponents “will not roll over” and will escalate with new plans.

- Flynn emphasizes that Trump must publicly confront this “seditious conspiracy” to rally supporters, protect National Guard troops, and prevent violence. He stresses transparency to counter the “double standard” in the justice system and warns of risks if Republicans in Congress delay cabinet confirmations or fail to act decisively.

Revelations about left-wing NGOs and activist groups, color-revolution tactics aimed at Trump, riots, and the broader chaos emanating from the Democratic Party, only show the party has no real economic agenda beyond socialism with a sprinkle of toxic Marxism – all point to one core objective: regime change and the destruction of the America First movement.

“People need to understand that if this operation succeeds, things will move quickly – Trump would be removed from the scene almost immediately. Elite defection isn’t an early warning sign of an overthrow; it’s the final stage before one,” DataRepublican told us, adding, “This is why the ‘Seditious Six’ must face the most severe penalties the law allows.”

Zerohedge

Ferret

I reckon they tried to smash silver to stop it talking out the all time Hi and closing on a new Monthly all time Hi and thus negating the Hammer tops they created last month.

If it does negate this fast, then this thing is truly awesome…..it could go way up.

Goldielocks

The big news in Silver is the Indians allowing it to be used as Collateral for loans……You can buy yr wife a nice new necklace and then borrow 85 % of the value back from the bank, to fund yr business etc…..she can’t wear it,,,but pay off the loan and she gets it back….

India was one of the biggest exporters, it started importing last year I think, which in itself, was huge, but now they will be importing loads more , especially if it keeps going up…..

And then there is this …

Decoding the True Stage of the Gold Bull Market By Minding The Allocation Gap

“Gold is in the final stages of its bull market.” It’s a sentiment echoed in headlines and analyst reports, a cautious whisper that has grown into a confident chorus. After a stunning run that has seen gold more than double from under $1,700 to over $4,000 in roughly two years, the consensus is building: the top is near.

But what if the consensus is profoundly wrong? What if, instead of the final innings, we are just hearing the opening notes of a symphony?

A single chart suggests the narrative of an exhausted bull run couldn’t be further from the truth. The data indicates that this gold bull market isn’t maturing; it’s just waking up.

The fundamentals that ignited this rally are not only intact but intensifying, and the one metric that truly matters; investor allocation, shows that the world is still massively underinvested in gold.

This widespread skepticism is, paradoxically, one of the most bullish indicators for gold. True secular bull markets are born in pessimism, grow in skepticism, mature in optimism, and die in euphoria.

The cacophony of cautious voices and premature calls for a top are not signs of a market peak; they are the classic sounds of a “wall of worry” that every great bull market must climb.

The time to be fearful is when your taxi driver is giving you stock tips and gold is on the cover of every magazine. We are nowhere near that point.

The current sentiment is one of disbelief, not delusion, which is fertile ground for a continued, powerful ascent.

The Allocation Gap: The Single Most Important Chart in Gold

The chart above is perhaps the most compelling piece of evidence for a multi-year gold bull market. It shows the implied allocation to gold ETFs as a percentage of all ETF assets.

During the peak of the last major gold bull market in 2011, this allocation surged to over 8%. Today, after a historic price run, where does that allocation stand? Less than a mere 2% and still not yet even to the level seen in 2006-2008 before the great financial crisis. There is still a long way to go before this gets to be called a “bull market top.”

Let that sink in. At the height of the last cycle, for every $100 invested in ETFs, over $8 was in gold. Today, that figure is not quite $2, or less than 25% of what was allocated at the peak in 2011.

This isn’t the behavior of a market in its final, euphoric stages. This is the behavior of a market in the early phase of discovery, one where the vast majority of investors and institutions are still sitting on the sidelines, holding little to no gold.

As the bull market continues to assert itself, a simple reversion to the mean; let alone a push to new allocation highs, would unleash a torrent of capital into a relatively small market, with explosive consequences for the price.

This data reveals a tale of two buyers. The so-called “smart money;” sovereign wealth funds and central banks, primarily in the East, are accumulating physical gold at a record pace.

Meanwhile, the Western retail and institutional investor remains conspicuously absent, their portfolios still heavily skewed towards traditional stocks and bonds. This is the core of the opportunity.

The party has started, but the majority of the guests have yet to arrive. When they do, they will find a limited supply of chairs, and the price of admission will be significantly higher.

|

|

||||||

|

goldielocks @ 6:03

Ya … and they raided the futures overnight in an attempt to take advantage of light Black Friday holiday volumes.

And it backfired in their collective face in spectacular fashion … right back to critical resistance levels for both gold and silver.

If you were ever looking for a strong buy signal … this is it … especially with such low Comex inventory levels.

Metals Daily Exchange Volume & Open Interest – CME Group

So I wonder if it’s possible to spike silver $5 in the other direction now.

That would be fun … no? (not for short bullion banks, fedsters, BIS, etc.)

Mornin all

Maddog

I’m not sure what’s going on with China and London but..

Chinese silver inventories have dropped significantly following large shipments to London to ease a recent supply squeeze, creating market tightness. The silver market is currently in its fifth successive annual structural deficit, where demand outstrips supply.

silver bullet

Yes, it’s pretty wild