Posted by goldielocks

@ 9:29 on October 30, 2025

I’m kind of glad gold didn’t make it to it next target yet. The market might perceive it as a top when the market is at its current highs when the economy is struggling and appears in a tentative state of a possible sell off with only a few over bought stocks holding it up. It looks similar to a house of cards. If these few stocks go what’s to hold the rest of the market up? The only thing that seems to be keeping it up is Fomo. Talking heads calling for higher highs. It isn’t gonna be housing.They totally screwed that up. Once the bubble or as Pento says bubbles burst and think housing already did once these few stocks go where is money gonna go. Probable to safe havens and defensive stocks. They’ll have to take a real hard look at the economy now. All the companies becoming distressed.

I also think about the mid terms. What would be a better time for a melt down? Way before the election with likely QE steps although I hope they think harder than that, or right before the election.

Posted by Bob

@ 8:20 on October 30, 2025

I was passing through northern Quebec about 20 years ago en-route to a remote canoe trip when I passed the Canadian Malartic Mine. I was at that time exclusively in PM investment and was intrigued by this mine. Checked it out when I got home a few weeks later and was impressed by the company potential and especially its management. After some initial small scale investiture I bought a quantity of warrants: they turned out to be a 23 bagger and constituted my single best investment during the previous PM bull.

Posted by goldielocks

@ 7:47 on October 30, 2025

I’m not that into the mechanics of computers but isn’t these search engines specifically made for that purpose, like a vast open library that I think Musk wanted for himself for profit but some good natured people actually left in the world that go unrecognized wouldn’t let him and covered the initial cost to make it non profit.

Posted by Buygold

@ 7:22 on October 30, 2025

Agnico Eagle Mines Q3 Adjusted Earnings, Revenue Rise

17:44:54 PM ET, 10/29/2025 – MT Newswires

05:44 PM EDT, 10/29/2025 (MT Newswires) — Agnico Eagle Mines (AEM) reported Q3 adjusted earnings late Wednesday of $2.16 per share, up from $1.14 a year earlier.

Analysts polled by FactSet expected $1.97.

Revenue for the quarter ended Sept. 30 rose to $3.06 billion from $2.16 billion a year earlier.

Analysts surveyed by FactSet expected $2.96 billion.

For 2025, the company reiterated its forecast of producing 3.3 million to 3.5 million ounces of gold at a total cash cost of $915 to $965 per ounce. It also expects all-in sustaining costs to range between $1,250 and $1,300 per ounce.

The company said its board maintained a quarterly dividend of $0.40 per share, payable Dec. 15 to shareholders of record on Dec. 1.

Posted by Buygold

@ 7:15 on October 30, 2025

to yesterday’s rate cut, although gold has been fading off the highs of the overnight and struggling to retake $4K. Silver had been lagging but is up a steady 1%. Hard to say if either will hold. Plat and Pall are up over 1% as well.

Shares up modestly.

The dollar and rates are flat. Oil back below $60 at last check.

Kind of nice not worrying about echo data these days.

I’d like to think this is the beginning of the big snap back rally, but it looks awful tentative.

Posted by Bob

@ 7:15 on October 30, 2025

Why do you describe LLM AI users as ‘dross’?

Posted by ferrett

@ 6:45 on October 30, 2025

Small Language Models will dominate the revenue earning AI applications. Specific databases for specific purposes, such as writing legal contracts, researching medical issues and other research topics. An LLM isn’t effective for these applications with trillions of data units to sort through rather than the SLM which has only the relevant 10bn to 15bn data bits, and runs on a desktop computer.

LLMs will only be for limited commercial applications, and the internet dross of people using it as a super google search engine, or as a companion. Which won’t pay. Massive mis-allocation of capital will crash the AI and chip stocks, and nuclear power companies.

Posted by goldielocks

@ 1:58 on October 30, 2025

A fault off the coast of North Calif all the way to Canada is showing activity. It may be slowly dying but will the activity have any ability to move the rocks or set off a quake? This zone can cause a long lasting powerful quake followed by a tsunami that can get as high depending on data 100 to 1000 ft high.

That would eliminate a lot of Democrat antifa.

Last time parts of the cost sunk down as rocks beneath that were moved up dropped back down then swallowed up by the ocean. That was in 1700. The indigenous people who survived back then still carry story’s about it. They had no tsunami warning and they couldn’t see it coming because it came at night. It was like a wall of water they couldn’t see the top suddenly appeared. Near term it’s still there but apparently it’s starting to break apart. Question is what new thing will appear.

https://www.sciencedaily.com/releases/2025/10/251025084611.htm

Posted by goldielocks

@ 0:57 on October 30, 2025

Fwiw dyodd I noticed this on a commercial. Another medication to decrease flair ups for your friend. I noticed the side effects but coincidentally I noticed that the vita E I started taking and mentioned the other day , one of them, the tocotrienols reputable brands have shown protection to some of these side effects.

There’s different forms of vita E. I took both of the ones I mentioned a couple of days ago and by the second day I had a lot more energy I used to have partially because joint and back pain was gone. Didn’t take them yesterday and today pain was back. They really worked, for me.

If your wondering why I’m not worried about the PMs is because I’m in phyzz. What’s good for stacking is not for stocks. I did read the charts going up for the ones in stocks and for me when to stop buying .

Anyways new medicine.

Posted by goldielocks

@ 0:20 on October 30, 2025

I am looking for ways to buy from local suppliers, particularly food. Especially if they deliver. 🙂 I found through life extension they have virgin olive oil from California. Other states may grow them too but closer than Europe. It’s not only good for brain health and some forms of cancer but virgin olive oil not the others helps bones too amongst other things. But if it sits around it can go rancid and become cancerous just as well. I read that Amazon gets old supplies. Same with peanut butter, a storage food for kids it can go rancid. I want things like that with a harvest date not just use by date. They could be sitting on ships for months in all kinds of weather and shelves just as long. Fortunately we have a lot of farmers markets around here too since weather allows longer growing seasons. For things we can’t store long term if the stores run empty.

Posted by goldielocks

@ 22:04 on October 29, 2025

Which they’re not mentioning while they talk about equities and tech tech tech AI AI AI which they’re also going to use AI to monitor workers. Might be some good in that but potential for abuse. Hey I know your busy delivering one order to that table right now and taking another order right after but go get that other empty table ready right now.

I decided I can have multi bank accounts without having accounts which might protect you from the Trudeau’s of the world of one bank or having your eggs in one basket through CDs. Might be a good idea for Europe especially after what they did to Vietnam erasing bank accounts if they didn’t get their digital ID. For now till they get wind of it anyways. Maybe Starmer might get that idea from Vietnam himself. Confiscate or delete accounts.

Posted by goldielocks

@ 21:11 on October 29, 2025

Its not just what he does tell you which is pretty much predictable at this point, nothing to see here everything fine, but what they don’t tell you people better be looking for and have their own plan on what they’re next moves will be.

Posted by goldielocks

@ 20:59 on October 29, 2025

Things are changing a bit where what Power says may not hold much weight especially knowing his bias and how they have made the mistake of driving housing prices through the roof keeping interest rates too low too long even buying mortgage backed securities up to first raise and tightening in 22 one more time, the wasteful cost of their new Fed resort that what ever they have in mind doesn’t benefit the economy but the CE0s of bankers and stock boards not for balance but for unfair profit and outright theft to the economy.

Posted by goldielocks

@ 20:39 on October 29, 2025

A good move taking profits off the table while those who are buying the ETFs and funds are told to buy them instead of gold right now maybe so they can sell left in the dark.

Posted by deer79

@ 15:59 on October 29, 2025

Totally agree. Powell is trying to save face with his anti Trump constituents. With approximately $1 trillion of debt needing to be rolled over in the near future, the knee jerk reaction by the algos is insane!

JMHO

Posted by Buygold

@ 15:16 on October 29, 2025

He’s bluffing. The dollar is screaming higher and despite the scum’s best efforts we are fighting them off.

Posted by ipso facto

@ 14:56 on October 29, 2025

Posted by ipso facto

@ 13:29 on October 29, 2025

I’m sure it’s a good move. Who would know better than the insiders!

Posted by Buygold

@ 13:13 on October 29, 2025

To see how the pm’s react to the Fed. Maybe more importantly is what Powell says, if they are ending QT, if he sees inflation moderating. In other words-dovish. It would be a change for him.

Posted by goldielocks

@ 13:02 on October 29, 2025

I got this in a email today from a reliable source.

Palantir’s Alex Karp has lined up nearly $2 billion in stock sales. Nvidia’s Jensen Huang has already sold around $40 million of his own shares, and plans to liquidate another $800 million.

Posted by ipso facto

@ 12:10 on October 29, 2025

NVDA’s market cap now equals 16% of the US GDP

Chart

Posted by deer79

@ 11:41 on October 29, 2025

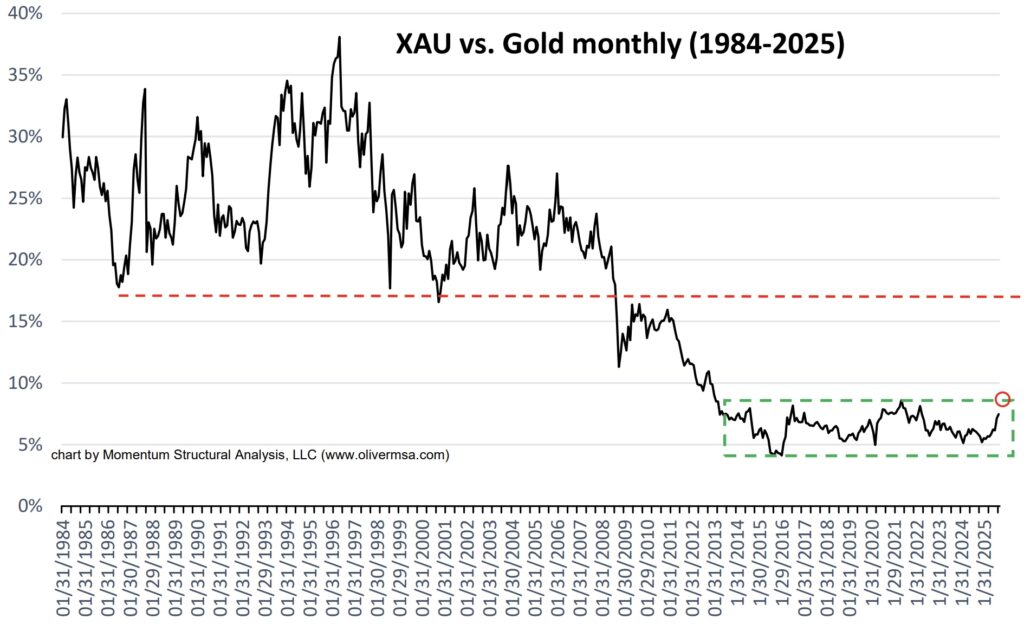

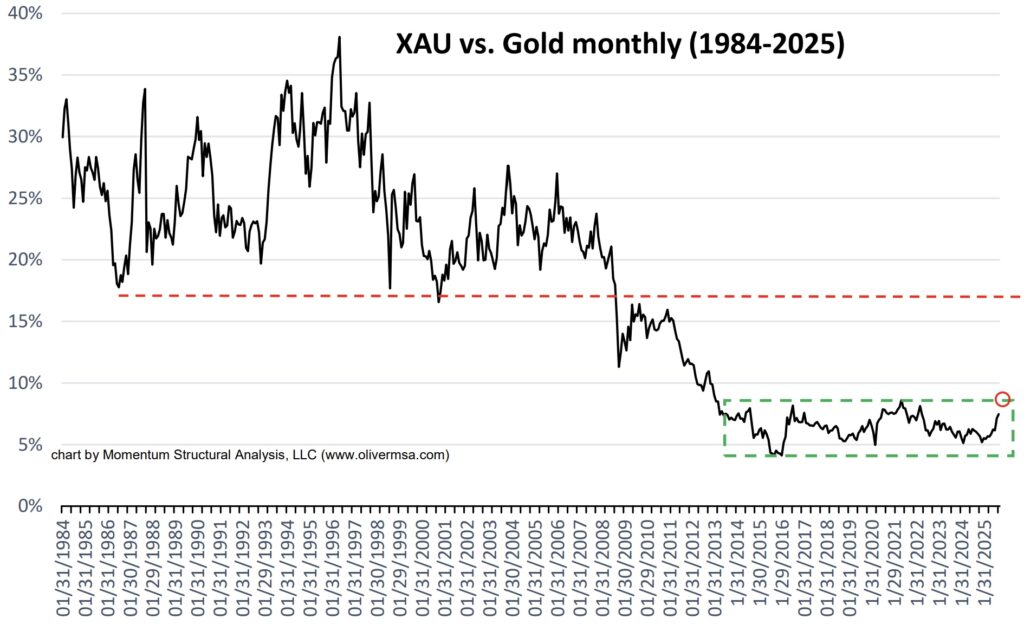

Communication from Eric King to Mark Lundeen:

Mark, King World News has been featuring the attached image over and over again of the XAU vs Gold. Because when you look at the XAU chart, it appears that gold stocks have had some type of incredible run, which is patently false when measured vs Gold (see attached chart). Yes, they have risen, in some cases quite dramatically, but vs Gold, the entire complex remains at the most historically undervalued level or range ever seen in history.

Posted by ipso facto

@ 11:35 on October 29, 2025

Are we bottoming?

Yes I know that’s an unfair question! 🙂

Posted by ipso facto

@ 11:30 on October 29, 2025

Posted by ipso facto

@ 8:26 on October 29, 2025

The Kobeissi Letter

@KobeissiLetter

Recent Layoff Announcements:

1. UPS: 48,000 employees

2. Amazon: Up to 30,000 employees

3. Intel: 24,000 employees

4. Nestle: 16,000 employees

5. Accenture: 11,000 employees

6. Ford: 11,000 employees

7. Novo Nordisk: 9,000 employees

8. Microsoft: 7,000 employees

9. PwC: 5,600 employees

10. Salesforce: 4,000 employees

11. Paramount: 2,000 employees

12. Target: 1,800 employees

13. Kroger: 1,000 employees

14. Applied Materials: 1,444 employees

15. Meta: 600 employees

The labor market is clearly weakening.

https://x.com/KobeissiLetter/status/1983209896721236139