Promethean on Charlie Kirk secret service find and more.

Maddog, Mr. Copper

Maddog – that would make sense that the swings would get wilder as the price increased, unfortunately it would probably be the case at a top as well. I don’t necessarily think we’re topping here, but I don’t get the warm and fuzzies that we’ll snap right back either. One thing never changes with pm’s, the moves down ALWAYS dwarf the moves up. Wherever we land may take a little while to recover from. You called it with the shares, they are capped and not responding to any swings. Maybe there will be some short covering in the last hour.

Mr. Copper – I’ve thought the same with Palladium. I don’t think that can happen with gold because the central banks have been doing most of the buying. Silver is tough. If somehow, they get the supply problem fixed (or the appearance it’s fixed), I could see them dismantling silver all the way back to $30. They’ve done it time and time again.

At least we’ve relieved the overbought condition. 🙂

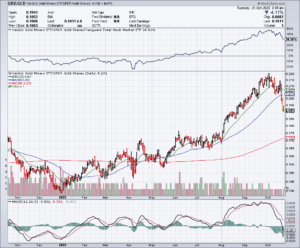

The Long Au short PM shares trade is back and may account fpr a lot of the share weakness today

as far as the Alogo’s and that trade go, we have just had another bear mkt bounce that was stopped right on the downtrend, therefore time to pile back in/add way more…..except soon those shorts are going to be paying out huge dividends……all the way down they paid less and less….but Algo’s can’t think they just follow the numbers….

Buygold

In the 80’s mkt Sinclair was right, huge swings and they got bigger the higher we went and bid offer spreads were huge…Silver at the top had $ 5 spread, between buyer and seller and that was for a 10,000 oz LME contract, the LME contact was twice Crimex’s size…..which was @ $ 40 a $ 50,000 difference !!!!!

So far the wave swings are fairly normal…..in Gold

waves a and b were @ $ 192, the c wave $ 301….1.6 times a and b…1.6 is THE Fibonacci number for an extension….lets see of this low holds

Goldie

I thought you were talking about the Kirk coins only, but when I went back to re-read your post, I couldn’t find it. Weird.

I didn’t buy them to make money, just a novelty with a donation so I didn’t care that it took a week. Other than that, I’ve never bought anything from them.

I’ve bought a lot from eBay and it’s been fine, but it’s been a long time, and only from reputable players. I’ve sold a lot of Morgans and baseball cards on eBay as well, but their costs have ballooned, and it doesn’t make sense anymore.

And of course, your buying and selling, and from whom, is your prerogative.

There’s a new video out by Promethean

That said they found a tree house in that forest area that was in sight of Charlie where they found the gun that allegedly killed Charlie Kirk. Question is what side was it on.

Mr Copper

Interesting that u saw huge Vol on the opening…which says someone is trying to smash the mkt…also I not the range today has been lousy…..yes the shares are well down, but they are not flying around, like if there are large numbers of buyers and sellers…, it’s like the mkt is capped. not a free flowing market.

I liken this PM Takedown to the COVID19 Pandemic (“OMG, Gimme the jabs and then the boosters….. FIRST!”)

If they can get you scared….make you afraid….They OWN you and can and will then do anything with you that they want!

If you’ve got the real thing, IN YOUR HAND, none of these fear tactics mean ANYTHING!

If you don’t already own the real thing, take this opportunity to load up; then go back to sleep….Man plans and God smiles, but Life is SNG!

goldielocks

Re Buffett no way was that real, he never says things like that….his old mate Charlie Munger did and worse, but Buffett has always been quite cryptic/delphic, often hard to decipher.

Which suggests this is a planned attack in front of earnings…..I may well be very wrong, but sense we have some huge shorts very badly caught.

Drb2 11:16

I’m glad you saw the warnings. It does make you wonder though why they were taken down than considering two of them so close together when a businessman like him has so much on his plate. Plus he’s bought both gold and silver before himself. Last time was B sold just this last year. He kinda got out of everything early and sitting on a lot of cash waiting for a crash. Plus I can’t remember a time he has done dedicated don’t invest, not just don’t buy right now but don’t invest in gold or anything for that matter announcement especially when he’s bought it himself. Kinda off character.

In the future we’ll see how these anti commodities only business investors do when things will be changing on this current path when commodities that make them run will be needed more and more.

Investors in junior minors or produce nothing yet explorers is risky though and all about timing not buy and forget about it but then no matter what it is cuz times like 2008 should of told them that, not all will survive especially with political corruption involved.

Buygold 11:07

I’m not sure what your talking about. The place I order delivers in 3 days. Apmex and that other one you with the Kirk coins takes a week or more. No one said you buy to flip nor me although I could easily by charting and would be my prerogative but I’m not paying 10 or more over spot in silver just so they can play futures or take advantage of people who can’t read charts.

Also if you notice is a sign buying for the little guys will slow pricing them out if they can’t buy at quantities of big money. eBay you can’t trust if their real less from a shop. I bought one fake coin years ago and made him take it back or I would of destroyed his ebay business and should of been anyways.

what I find truly offensive

is the fact that today’s drubbing is conveniently being pigeonholed into the same old argument that precious metals act the same way time after time, and that they’re not a good overall investment.

No where ( I admit that I don’t watch CNBC) is the truth mentioned that precious metals have been going up ( or the value of the dollar is going down) because the existing usurping financial model is about to go extinct, and this whole ponzi scheme has been a giant farce.

I have an old friend who sent me a chart today of patterns that Gold should now follow. I try to tell him that it’s different now, and I know he thinks I’m a cool-aid drinking certifiable “Gold Bug”.”

@Buygold

You make a lot of sense. Especially the earnings reports. The one thing that bothers me is palladium went up to $3000 and went back down.

Going Downhill

Jim Chimirie 🇬🇧🎗

@JChimirie66677

A Jewish lawyer has been arrested for wearing a Star of David on a London street. Not for assault. Not for provocation. For wearing a 2cm symbol of his faith – because an officer decided it might “antagonise” pro-Palestine protesters. The man was handcuffed, held for ten hours, questioned about his “political beliefs,” and told that his necklace could offend.

There it is: the quiet death of equal citizenship. The symbol that once marked Jews for persecution in Europe now marks them for arrest in England.

The police call it “keeping the peace.” In truth, it’s cowardice turned into policy. It’s what happens when the state becomes more afraid of offending the offender than protecting the victim. “Antagonising” has become a crime. Translation: if a mob hates you enough, you lose your rights.

Mr. Copper

I don’t know what it means, other than they were trying to induce panic selling. Mission accomplished. Now they’ve either covered or picked up some shares at a nice discount.

If I looked at the price of the HUI right now, I would never expect the price of gold to be up at near $4200, would you?

PM’s have risen for a reason, hard to believe that reason ended overnight. But what do I know? 😉

One thing though, I literally can’t wait to see earnings, they probably won’t matter if the metals are down, but they should be blockbuster. I think NEM kicks us off on Thursday.

Captain Hook @ 11:04

I think you’re right Captain. There’s going to be oscillations to the upside as well!

Looking forward to it!

Re This Drop Today

I think we all knew when they start talking too much on TV, about something that’s been roaring, its goes down the next day. I noticed every one of my stocks had a huge volume bar on the open at 9;30 am. I don’t know what that means.

drb2

and who was it ( from the LBMA?) that called the Treasury ( Beasent?) and pleaded for some Silver to be flown into London?????

Captain – good point

I remember Sinclair talking about the swings in 1980. I think he said there were $100+ swings on the way to $800.

If this is really “it” then I would expect $2-300+ swings will be the norm eventually.

@ Goldi – RE: those Warren Buffet Ai Clips you posted

Boy, does this make me think about our conversation. I still think it was altered. Brings up some questions.

- If it wasn’t Buffet who put out the video – who was it, and why isn’t Buffet suing them?

- Qui Bono?

- Did the Central Banks; COMEX; refiners etc. coordinate this?

- There had to be lots of insiders knowing this hit was coming up. Was the video their “cover”?

Just another brick in the ‘Wall of Worry”?

Goldie

I got mine in a week. If you’re looking for a “deal” they’re not for you. eBay has plenty of silver for cheap. I didn’t buy them to resell and turn a profit.

ipso facto @ 10:53

They are not going to like this range expansion once things turn around.

This is a two-way street.

Hang on to your shorts (pun intended).

Something tells me we got a whole lot of covering going on today.

Chuckle

A lot of damage

HUI has lost 100 points in 3 sessions. OTOH, six months ago if you told me gold would be around $4K and silver $47, I’d be pretty happy.

Will be interesting to see how the metals respond and where they find a bottom.

Shares are a bargain but not if the metals have much more downside.

The thing is …

… PM share to gold ratios are already in the buy zone … and will be heavily oversold in no time if this keeps up …

Rid’em cowboy.

Chuckle