Posted by goldielocks

@ 22:04 on October 29, 2025

Which they’re not mentioning while they talk about equities and tech tech tech AI AI AI which they’re also going to use AI to monitor workers. Might be some good in that but potential for abuse. Hey I know your busy delivering one order to that table right now and taking another order right after but go get that other empty table ready right now.

I decided I can have multi bank accounts without having accounts which might protect you from the Trudeau’s of the world of one bank or having your eggs in one basket through CDs. Might be a good idea for Europe especially after what they did to Vietnam erasing bank accounts if they didn’t get their digital ID. For now till they get wind of it anyways. Maybe Starmer might get that idea from Vietnam himself. Confiscate or delete accounts.

Posted by goldielocks

@ 21:11 on October 29, 2025

Its not just what he does tell you which is pretty much predictable at this point, nothing to see here everything fine, but what they don’t tell you people better be looking for and have their own plan on what they’re next moves will be.

Posted by goldielocks

@ 20:59 on October 29, 2025

Things are changing a bit where what Power says may not hold much weight especially knowing his bias and how they have made the mistake of driving housing prices through the roof keeping interest rates too low too long even buying mortgage backed securities up to first raise and tightening in 22 one more time, the wasteful cost of their new Fed resort that what ever they have in mind doesn’t benefit the economy but the CE0s of bankers and stock boards not for balance but for unfair profit and outright theft to the economy.

Posted by goldielocks

@ 20:39 on October 29, 2025

A good move taking profits off the table while those who are buying the ETFs and funds are told to buy them instead of gold right now maybe so they can sell left in the dark.

Posted by deer79

@ 15:59 on October 29, 2025

Totally agree. Powell is trying to save face with his anti Trump constituents. With approximately $1 trillion of debt needing to be rolled over in the near future, the knee jerk reaction by the algos is insane!

JMHO

Posted by Buygold

@ 15:16 on October 29, 2025

He’s bluffing. The dollar is screaming higher and despite the scum’s best efforts we are fighting them off.

Posted by ipso facto

@ 14:56 on October 29, 2025

Posted by ipso facto

@ 13:29 on October 29, 2025

I’m sure it’s a good move. Who would know better than the insiders!

Posted by Buygold

@ 13:13 on October 29, 2025

To see how the pm’s react to the Fed. Maybe more importantly is what Powell says, if they are ending QT, if he sees inflation moderating. In other words-dovish. It would be a change for him.

Posted by goldielocks

@ 13:02 on October 29, 2025

I got this in a email today from a reliable source.

Palantir’s Alex Karp has lined up nearly $2 billion in stock sales. Nvidia’s Jensen Huang has already sold around $40 million of his own shares, and plans to liquidate another $800 million.

Posted by ipso facto

@ 12:10 on October 29, 2025

NVDA’s market cap now equals 16% of the US GDP

Chart

Posted by deer79

@ 11:41 on October 29, 2025

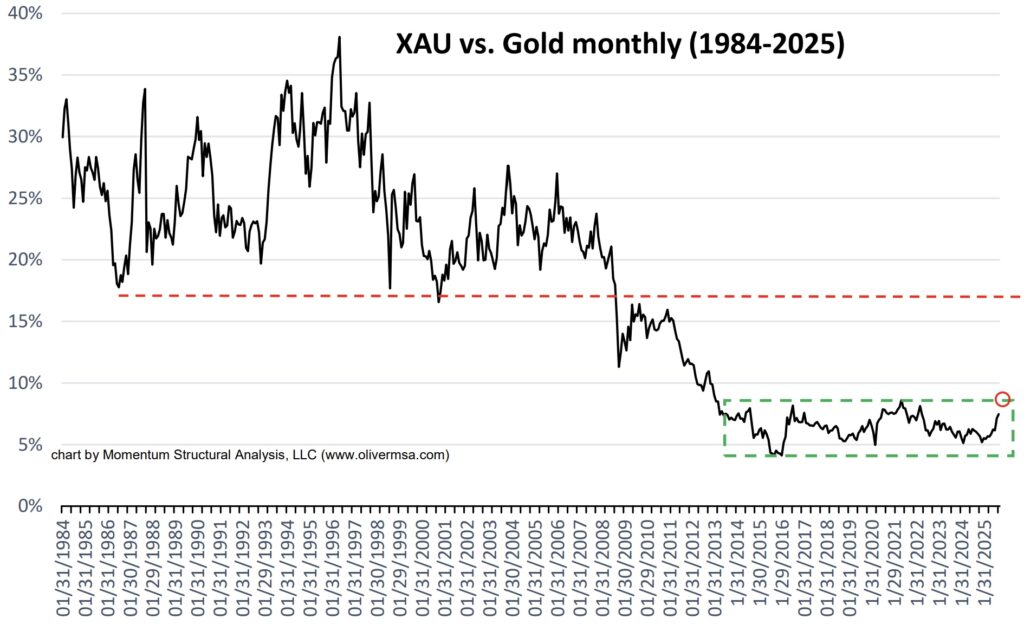

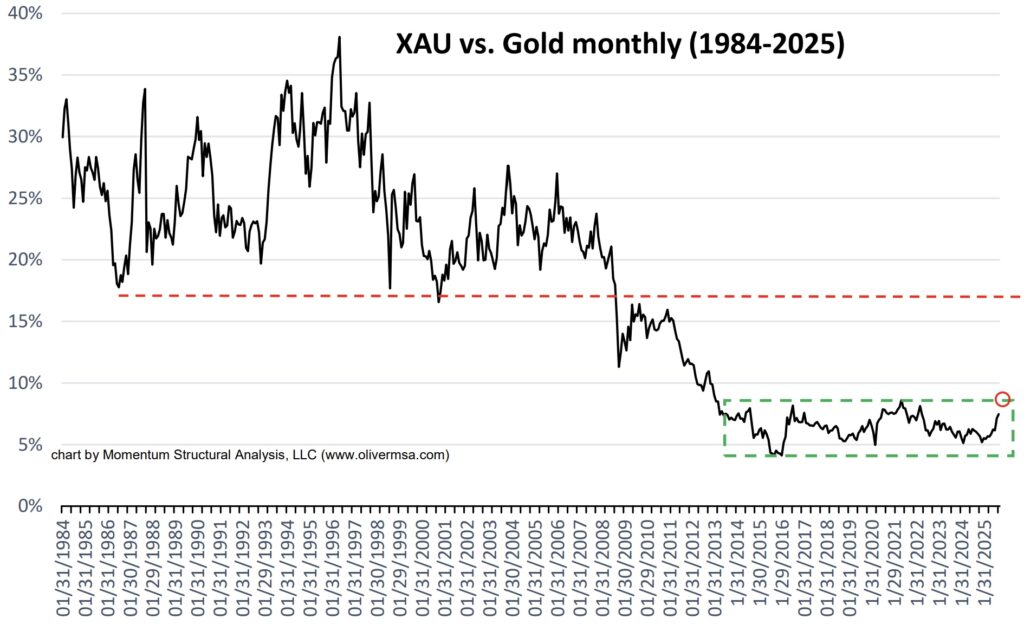

Communication from Eric King to Mark Lundeen:

Mark, King World News has been featuring the attached image over and over again of the XAU vs Gold. Because when you look at the XAU chart, it appears that gold stocks have had some type of incredible run, which is patently false when measured vs Gold (see attached chart). Yes, they have risen, in some cases quite dramatically, but vs Gold, the entire complex remains at the most historically undervalued level or range ever seen in history.

Posted by ipso facto

@ 11:35 on October 29, 2025

Are we bottoming?

Yes I know that’s an unfair question! 🙂

Posted by ipso facto

@ 11:30 on October 29, 2025

Posted by ipso facto

@ 8:26 on October 29, 2025

The Kobeissi Letter

@KobeissiLetter

Recent Layoff Announcements:

1. UPS: 48,000 employees

2. Amazon: Up to 30,000 employees

3. Intel: 24,000 employees

4. Nestle: 16,000 employees

5. Accenture: 11,000 employees

6. Ford: 11,000 employees

7. Novo Nordisk: 9,000 employees

8. Microsoft: 7,000 employees

9. PwC: 5,600 employees

10. Salesforce: 4,000 employees

11. Paramount: 2,000 employees

12. Target: 1,800 employees

13. Kroger: 1,000 employees

14. Applied Materials: 1,444 employees

15. Meta: 600 employees

The labor market is clearly weakening.

https://x.com/KobeissiLetter/status/1983209896721236139

Posted by ipso facto

@ 7:44 on October 29, 2025

Posted by Buygold

@ 7:42 on October 29, 2025

I think you’re right. There’s nothing really working against pm’s right now other than the paper players.

The timing for them was good before a Fed meeting, and the fact that we were so overbought. They temporarily brought in enough physical silver at the LBMA to pull it off I guess, but demand should still be strong, and if you wanted silver at $54, you’d surely want it at $48.

I wonder if there is any available silver in India yet. Doesn’t seem like supply problems get solved overnight like that.

Posted by deer79

@ 6:18 on October 29, 2025

If the Fed cuts 25 basis points ( and leans slightly dovish), it will give us a good tailwind.

Exactly why the correction was so quick and violent; the scum knew what was going to happen this week, and wanted the metals to be climbing out of a hole instead of launching higher from the $4200/4300 range.

Posted by Buygold

@ 6:13 on October 29, 2025

Despite the dollar and rates being a little higher. Was just about that time I guess.

Shares look strong premarket.

Everything could change after the Fed speaks this afternoon.

May the bounce back be every bit as violent as the selloff!! 🙂

Posted by Maya

@ 3:02 on October 29, 2025