Scenic Frankenstein

https://www.railpictures.net/photo/889231/

Now that the numbers are in, seems like they are definitely in some very serious trouble… Total of 180,000 contracts were put into that event totaling a little over 900,000,000 ounces…. All things considered I’d consider that a definite win for the good guys… Meanwhile, we get fined for not wearing a seatbelt…lol

Can you believe this BS?

Where is RFK?

That’s true in both metals. In silver increasing uses is increasing a demand that’s not temporary like in the days of the Hunt Brothers cornering the silver market. It was still basically a byproduct of mining back then. Now the demand is increasing and it’s not temporary but a constant and likely increased demand in the future years making it also more profitable to refine.

Because if industry needs it they might be willing to pay more to get it.

Addendum Of course we know about the paper shenanigans trading what they didn’t have driving silver down. Well what’s miners gonna say. Sorry all you folks who need silver we can’t afford to refine it. There just might be some accountability and a lot of angry people wanting to investigate them coming their way

It would be fair to say or declare you own stocks when telling others not to.

Wether it be phyzz or stocks and kinda late although not too late if looking years out and already been buying it but late to buy phyzz for short term profit vs stocks in the last months. The premiums on phyzz seemed to go up in one day the other day.

Oliver is right on momo. Gold vs silver was about 90 to 1 at the beginning of the year and has moved back towards 80/82 to 1 now. The percentage would have to change and watching the cup and handle Momo because if golds/silver ratio still 80/1 gold 5000 won’t yield silver at a hundred but 62.5 it would have to be 8000. So momo or catalyst is from the increasing demand for silver where even central banks are buying it and this demand is not temporary but growing. Closing the gap.

China Expels 9 Top Generals, Including Two From Communist Party Leadership, In Sweeping Purge

Just another part of a diversified life’s portfolio in which if at least one of my diversifications survive, I survive…but I put my faith in SNG to get me through. FWIW!

Do you own any stocks?

Gold 8000 silver to 200. 2 days ago.

Whatever you buy through your online broker belongs to your broker, unless you hold stock certificates which are almost never issued anymore since everyone has become a day/swing trader. Skipping many unforeseen events, I see many defaults coming when TSHTF! and the bottom line….if it’s not in your hand, you lose! IMO!

He’s a goat. Knows the metals in detail like the back of his hand.

They’re finding more and more uses for silver so they’re growing demand. There’s also growing demand for tangible gold. Not just from inflation in the currency but the want to change to cashless non tangible digital. Either one, currency or digital it can lose value. With currency it’s inflation increasing the money supply or economic instability, With digital it’s dependent on buyers and sellers, can be stolen out of thin air in someone’s basement, it’s value can be manipulated by being controlled by governments.

Re shares/ vs Metal

I beg to differ…..that idea may work if the metal prices are fairly static and way lower than this…up here the miners are going to be earning like bandits , thus the dividends will be massive, as will be the yield….as soon as those yields go north of Treasury rates , the demand for the shares will be enormous, plus shorts have to pay that dividend and face a rising price from dividend hunters and the longs ….who are mainly hard core bugs still, who will not sell at such cheap prices…..thus keeping the mkt thin.

Meanwhile we may well have continued rising metal prices, driving profits even higher……as of now the shares are dirt cheap vs the metal…and we are in a super bull, no way do shares stay lagging this badly in a super bull.

In a stock market that is very, highly valued the one sector that is dirt cheap is PM shares, but potentially paying a better yield than anything else with a super bull mkt in the metals.

IMO good exposing 18 minute video of Alex Jones telling how the justice system is screwed.

Our shares may not turn around immediately but earnings season is coming soon and they should be stellar! The good producing cos will have lots of cash for dividends or for acquisitions. Juniors who have lots of ounces in the ground should get a re-rating. The skies are blue for us!

Cheers

This time you better get the real thing while you can. The shares will NEVER attain what they did in either 2008 or 2011, and this is why IMO. Recall that your Broker notified you that they were going to loan out your shares unless you specifically told them you would not allow it? Otherwise they consider your silence to be permission to do so. IMO this is the reason the shares are underperforming.

IMO, BlackRock and ALADDIN, their Super Computer….have made an agreement with your Broker to borrow your shares (for a fee paid to your Broker) so they can use your shares as proof that they “possess” the shares they are shorting and they are not NAKED short and do not have to report it as such. So you buy, say, 1000 shares of XYZ , then your Broker loans (for a fee) your shares to BlackRock/ ALADDIN who shorts your XYZ 1000 shares. The volume doubles, and XYZ goes almost nowhere! Meanwhile Physical gold and silver skyrocket while you miss the boat and sit there scratching your head. ???????

Better get physical silver and gold while you can. Once you see it you can’t un-see it. SNG

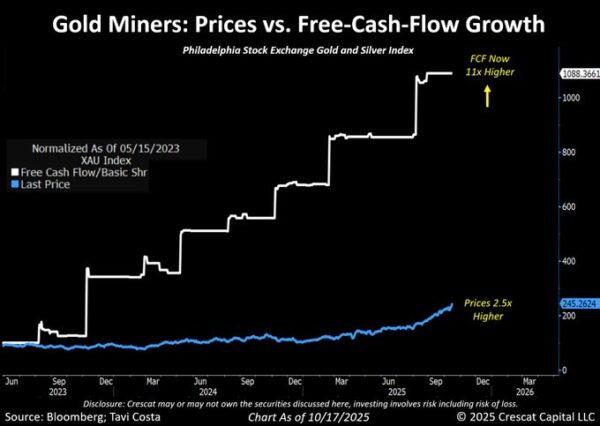

That chart should be flashing in bright lights!!!!

Perhaps we’ll start to get more rotation into the miners, in earnest, after the upcoming earnings cycle.

For the junior explorers ( which I have quite a few shares in), I feel that the overall success that these companies have achieved raising $ in PP’s, has been phenomenal…….I guess that, in itself, is a measure of success for these little guys…..

I think Tavi is right.

The only thing that gives me pause is that volume in GLD and GDX were monstrous. OTOH, volume has been heavier on the big down days pretty much all the way up. I guess that will continue as we move higher. RSI on GDX now manageable at 58. SLV is 69, GLD still up at 75.

Monday is going to tell us a lot. It’s hard for me to see us selling off into the year end. If we head south Monday am, I think it will be bought.

Dalio has an article on ZH, he is recommending 15% portfolio allocation in gold. I can’t even imagine what the gold price would look like if people followed that advice.

I’m hopeful that we’re going much, much higher.

Otavio (Tavi) Costa

@TaviCosta

·

16h

Mining stocks are likely overreacting today, in my view.

Put loosely, these companies are effectively printing money at current gold prices.

Yes, mining stocks have performed incredibly well recently, but the aggregate free cash flow of the Philadelphia Gold and Silver index has surged 11x.

In short, fundamentals have far outpaced the rally, leaving these stocks even more undervalued than before.

Land of the midnight sun. This line was built

To take miners up to the Yukon.

https://www.railpictures.net/photo/888699/