No doubt. Things are squirrely. I like the resilience though, especially in the silver shares. Makes me think silver will start to play catch-up later today.

I’m not sure I agree with Oliver. Certainly, a bet on a pullback or pause in gold is always the higher percentage bet.

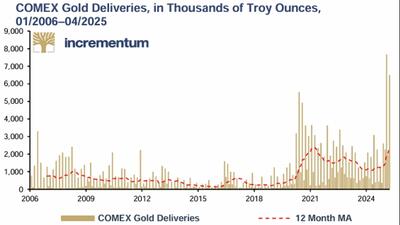

Gold had that quick break below the 50 dma and now it’s bouncing back above. That could have been a head fake to the downside. I don’t know how to account for the deliveries in terms of their effect on the price. Obviously, they put upside pressure on gold, but the uptrend has been intact since the beginning of the year, slow and steady. I thought they were going to break it this week, but so far it looks like it might re-assert itself. If so, I could see gold move another $3-400 higher from here.

Silver is a hot mess. I have no clue what that’s going to do.

Seems to me that rates and the dollar are the wild card. The dollar is getting near oversold, but it could continue to drift lower for a while. Trump needs a weaker dollar for his exports, the world needs stronger fiat to buy them and pay the tariffs. Rates are coming down one way or another unless something blows. It’s all a shell game.

I’ve tried to ignore the prognosticators, it’s very hard to find anyone who’s been consistently right in this sector. Most aren’t any better than you or I at reading the tea leaves.

Strange day, they sure beat the crap out of tech in short order, and it looked like they rotated straight into the DOW. This is the first time I’ve seen NFLX actually take a good hit. That stock has been ridiculous.

and then there’s silver…:)

Cheers