… especially concerning silver drivers … which is vital if the bull is to kick into second gear.

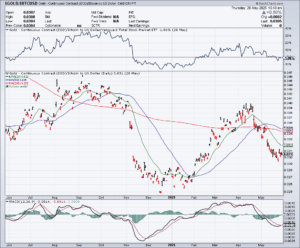

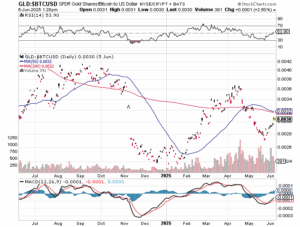

Earlier in the week I posted the above chart suggesting bitcon had topped in relation to gold. This is what this chart looks like now.

Gold is breaking higher against bitcon – meaning gold is getting more liquidity – signaling the trend should continue. More important however, the GDX just put in a 5 wave advance against bitcon – confirming PM shares have truly joined the party.

And now, we also have the final element – silver – joining the party – as measured by the breakdown of the Gold/Silver Ratio back below 100 shown with an island top in the GLD/SLV Ratio.

Given it would not be surprising to see some backing and filling soon, these breaks are very encouraging signs new capital rotation events (CREs) are now in full swing – with silver now breaking above $35. A weekly close above this threshold today would be a major buy signal.

A break above $37 – quarterly based resistance – should bring an accelerated move to $50.

And silver won’t stop there.

Mornin all