I saw the story of Liverpool ending their 30 year wait for a win in Football. It was a few years back now but their team winning meant a lot for that city.

True, but they play with words all the time!

Gotta try to understand what they mean.

OK, you’re right, we don’t have to understand. It’s been a waste of time for the last 25 years trying to understand. We know we’re right, we just need to sit tight and watch the fun!

ferrett @ 16:06

Ya you are just playing with words.

It’s a ‘free for all’ at this point.

Make no mistake. It’s a free for all.

Get your physical and hang onto it.

Then figure out how the whole barter thing works.

This is why we must support State initiatives to make precious metals currency again.

The commies are trying to steal that from us right now.

We must fight them with every fiber in our bodies on a local level folks.

They are just idiots trying to make more worthless fiat.

They must be stopped.

Cheers brother

silverngold

Re Insects……Tks for that……why do I think the Berlaymont ( name of EU Building ) in Brussels, will not be mixing that shiite with their caviar !!!!!

Cap’n, 13:07 Feb 7th

But, if it is the US govt buying, they would be doing so in absolute secrecy, so “they” wouldn’t know about it and wouldn’t react.

The gold flowing from Britain to the US is under the guise of “repatriation”, which sounds quite innocuous, leads to claims that there is an arbitrage on the POG between the two locations. I doubt that exists, especially as the time taken, and costs involved, make it a very high risk trade. OK, so there might be some repatriation of already owned gold across the Atlantic, but I suspect most of the flow is gold purchased and then ‘repatriated’. Or I guess patriated is the word. It makes sense for the US to be bolstering its reserves if China and Russia are doing so but the impact on the market if it was done openly would be, well, “to da moon”. Trump listens to Ron Paul. And Trump has so many in your face projects going after only three weeks that no media has the resources to look at something like pet rocks being traded under the counter.

If it turns out that the US has joined China, Russia and India, along with several other countries, in buying gold, then that puts pressure on every country to do likewise. Be right, and sit tight.

Whitney’s take on who took over Epstein’s empire.

She believes it moved to technology.

.

Aufever

Clinton’s unelected bureaucratic class exercising influence over government actions that are often in opposition to the elected challenging the status quo. This is the entity that Trump is now trying to confront as the product of the Clinton’s reshaping the governments federal workforce.

In case you’re not up on this yet! “The WEF C40 Smart Cities initiative is a dystopian future under the guise of Sustainability”

2 minute video.

Buygold…its looking like a Groy payday this year especially if copper keeps going…Ukraine needs rewired

Peter Behncke on Gold Royalty Corporation’s Future Cash Flow…. Assets & More! ~ VIRC

Estimated share price by December 23, 2025 will hit $3.27 ↑170.45%.

“According to the 3 analysts’ twelve-month price targets for Gold Royalty, the average price target is $3.67. The highest price target for GROY is $5.75, while the lowest price target for GROY is $2.50. The average price target represents a forecasted upside of 203.03% from the current price of $1.21.”

https://www.marketbeat.com/stocks/NYSEAMERICAN/GROY/forecast/

https://finance.yahoo.com/quote/GROY/analysis/

“Based on 3 Wall Street analysts offering 12 month price targets for Gold Royalty in the last 3 months. The average price target is $3.42 with a high forecast of $5.50 and a low forecast of $2.25. The average price target represents a 182.64% change from the last price of $1.21″

Buygold @ 9:32

Those are all good observations and lend credence to the theory this is official US buying.

Judy Shelton, who is likely to be installed as the next Fed head, wants to issue gold backed Treasuries by the 250-year anniversary of Independence Day on July 4, 2026.

In order to do this, an audit of US gold holdings is in order – she stated this.

So, the US is now a gold buyer in need of a sh*t-tonne of gold instead of a seller/suppressor – leaving the international bankers in London blowing in the wind. There is a YouTube video showing an LMBA official unable to come up with a good explanation of why they can’t deliver gold for many weeks now. This means they possibly don’t have any more unincumbered gold not leased out – which incidentally – is possibly the same problem on Comex as well.

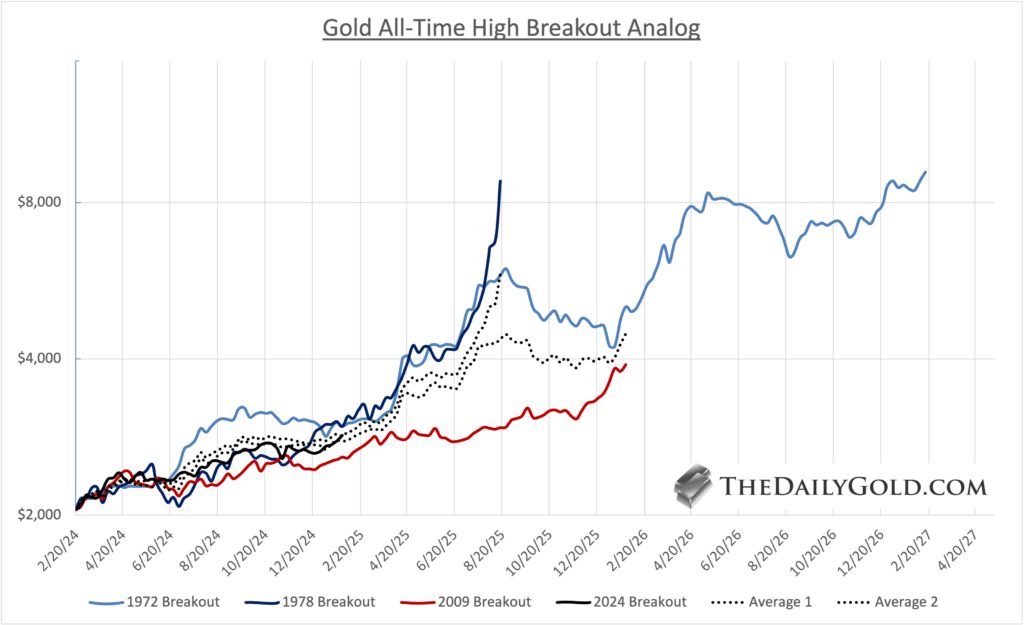

Thusly, if the US keeps buying – along with BRICS countries, etc. – well – you can see the problem they have. This makes a repeat of what happened to gold in 1979 possible as per this chart I put up the other day – suggestive gold could hit around $8,000 later this year or early 2026.

And even if it doesn’t, it should still hit somewhere over $3,000 – likely pushing $4,000 later this year worst case scenario. On top of all this, it looks like inflation stats are set to start trending upwards again with M2 ripping higher in its latest freshly released data (see here).

Because if Trump and company truly want to make America great again – they must keep buying gold in a world that will destroy its credit and currency if they don’t – and they know this.

It’s of course amazing so many people don’t.

Cheers mate

Captain

A couple things jump out at me in that Lynch article.

He he says customer accounts, assuming that is multiple accounts and they must be larger customers to have been able to purchase a large amount of contracts in the first place. If they were smaller, it would seem they’d be limited in size of the contracts. I don’t know. The other thing is that we haven’t seen the margin increase games at the Crimex yet, at least to my knowledge. That would indicate to me that there is enough respect/fear of pissing those particular customers off.

Finally, if the banks aren’t also taking delivery or covering shorts, are we to assume the Fed will not be doing QE and that when delivery winds down there will be the mother of all sell offs? Or are the banks just going to throw in the towel and pay cash on the contracts?

Either way, it doesn’t hurt to have a treasury secretary who has his largest holdings in gold. Might make the Crimex vulnerable to some of the shenanigans.

goldie 11:50 am

Well said