Tyranny … How long will the German’s allow it?

GERMAN GOV’T WARNS POLICE: JOIN AfD, LOSE YOUR JOB

Interior Minister Nancy Faeser has threatened federal police officers with dismissal if they join or support the AfD, despite the party representing over 20% of voters.

One officer called it a “massive attack on freedom of choice” and a “blatant violation of basic rights” for civil servants.

Critics argue this isn’t about neutrality, as the head of federal police, Dieter Romann, is a CDU member.

Sources: Junge Freiheit

Blackrock giving us a break?

Aladdin easing up on the sale of the miners? We deserve a break from those criminals, they’ve been robbing the shares all week long.

Just hope the SM stays up, otherwise we’ll collapse.

Deer79

Ditto here

Murphy and GATA do good and honorable work, but they’ve been ringing alarm bells for 25 years. Doesn’t mean they’re wrong, just that they’re outgunned and underestimate the strength of the opposition.

I bought into all that stuff way back then, with other good men like Sinclair, Von Greyerz, etc. They just don’t seem to get the manipulative lengths the criminals are willing to take.

HUI sitting right on the 50 dma for the 3rd straight day. Ridiculous, but at least it’s not getting crushed just yet.

No disrespect intended

….But the likes of Bill Murphy and GATA have been spouting off about “shortages” of the metals being a factor, for many years now. And let’s not forget, that when the rats seem to be cornered, they can, and have, change the rules with the flick of a pen…….

Don’t get me wrong Captain Hook; I hope you’re right and I’m in your camp as far as this goes. Just don’t have the patience that others seem to have…….

Well, maybe tech will help us

I would love to be as wrong as rain in the desert.

Maddog @ 16:20

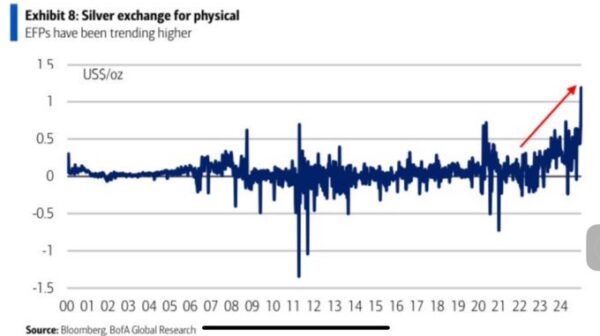

I agree supply constraints will play a part in the big picture, with The Silver Institute’s 2024 numbers out now at greater than a quarter billion-ounce deficit. But clearly, the elephant in the room is going to be the exchange deleveraging coming down the pike – quite possibly sooner rather than later.

The Silver Institute | The Global Resource

Therein, and as explained in the attached below, silver exchanges (particularly the LMBA) are in jeopardy of what is known as a ‘stock out’, explained by the Senior Commodities Strategist at TD Securities, which is a fancy way of saying they are about to run out of physical silver.

Silver Market Sleepwalking into Stock-Out

If stocks top out soon, it’s possible prices could fall back first with liquidity becoming challenged. Once any such occurrence is completed however, likely the result of central bank prolificity, silver prices should take off above $35, spike high yearly resistance on the long-term chart.

Have a nice day.

Cheers

Look at that tech go

No help to the pm shares. But when tech goes down, pm shares get blasted with them regardless if the metals are up.

What a sector. So fun.

and there you have it

despite all the shortages and demand, and whatever else anyone can think up, the silver price can still be trashed by the scum any time they want.

Paper covers rock.

SILVER MOUNTAIN ANNOUNCES SPECIAL MEETING OF SHAREHOLDERS FOR PROPOSED SHARE CONSOLIDATION

https://ceo.ca/@newswire/silver-mountain-announces-special-meeting-of-shareholders

TDG Gold Identifies Copper-Molybdenum Porphyry Target at Bot, Toodoggone District

https://ceo.ca/@accesswire/tdg-gold-identifies-copper-molybdenum-porphyry-target

Goldshore Intersects 79.0m of 1.28g/t Au at the Southwest Zone of the Moss Deposit: Extends Mineralization from Current Resource Model in the Top 100 Meters from Surface

https://ceo.ca/@newsfile/goldshore-intersects-790m-of-128gt-au-at-the-southwest

Silver Storm Closes Third Tranche of Its Non-Brokered Private Placement Offering Including Participation by Eric Sprott, and Engagement of Whittle Consulting

https://ceo.ca/@businesswire/silver-storm-closes-third-tranche-of-its-non-brokered

Salazar Resources Announces Final Closing of Private Placement

https://ceo.ca/@newsfile/salazar-resources-announces-final-closing-of-private

Nova Minerals Quarterly Activities and Cashflow Report – 31 December 2024

https://ceo.ca/@GlobeNewswire/nova-minerals-quarterly-activities-and-cashflow-report

i-80 Gold Announces Pricing of Prospectus Offering

https://ceo.ca/@newswire/i-80-gold-announces-pricing-of-prospectus-offering

Lundin Mining Announces Record Production Results for 2024 and Provides 2025 Guidance

https://ceo.ca/@newswire/lundin-mining-announces-record-production-results-for-70209

ELECTRUM SILVER US LLC DISCLOSES OWNERSHIP OF SECURITIES OF FIRST MAJESTIC SILVER CORP. FOLLOWING CLOSING OF FIRST MAJESTIC’S ACQUISITION OF GATOS SILVER, INC.

https://ceo.ca/@newswire/electrum-silver-us-llc-discloses-ownership-of-securities

Kingfisher Announces Closing of Upsized Private Placement

https://ceo.ca/@accesswire/kingfisher-announces-closing-of-upsized-private-placement-32949

Underground Mining Halted at Kombat Mine, Namibia

https://ceo.ca/@businesswire/underground-mining-halted-at-kombat-mine-namibia

Providence Gold Mines Inc. Announces Extension of Private Placement

https://ceo.ca/@thenewswire/providence-gold-mines-inc-announces-extension-of

CMC Releases a New Valuation Report

https://ceo.ca/@GlobeNewswire/cmc-releases-a-new-valuation-report

Impact Silver Intersects 14.13% Zinc over 2.2m Including 26.06% Zinc over 0.9m at the Plomosas Mine

https://ceo.ca/@newsfile/impact-silver-intersects-1413-zinc-over-22m-including

San Lorenzo Completes Initial Phase of Drilling and Extends Program with Additional Hole at Cerro Blanco Target of Salvadora Project, Chile

https://ceo.ca/@thenewswire/san-lorenzo-completes-initial-phase-of-drilling-and

Goldgroup Announces Acquisition of Loan Facility

https://ceo.ca/@thenewswire/goldgroup-announces-acquisition-of-loan-facility

Sixty North Gold Updates Its Drilling Plans on the Wholly-Owned Mon Gold Property, Yellowknife, NWT

https://ceo.ca/@newsfile/sixty-north-gold-updates-its-drilling-plans-on-the

First Majestic Completes Acquisition of Gatos Silver

https://ceo.ca/@newsfile/first-majestic-completes-acquisition-of-gatos-silver

Silver Bullet Mines Corp. Reaches Target Underground at Washington Mine in Idaho

https://ceo.ca/@newsfile/silver-bullet-mines-corp-reaches-target-underground

Pegasus Resources Expands Gold Mountain Project with Strategic Land Acquisition, Doubling Project Area and Unlocking High-Grade Polymetallic Potential

https://ceo.ca/@accesswire/pegasus-resources-expands-gold-mountain-project-with

Robex Extends Life of Mine for Nampala Gold Mine With Updated Technical Study

https://ceo.ca/@GlobeNewswire/robex-extends-life-of-mine-for-nampala-gold-mine-with

Ashley Gold Corp. Summarises 2024 Accomplishments and Defines Objectives for 2025

https://ceo.ca/@thenewswire/ashley-gold-corp-summarises-2024-accomplishments-and

Decade Intersects 2.07 m of 3.18 % Copper and 43.48 g/t Silver

https://ceo.ca/@newsfile/decade-intersects-207-m-of-318-copper-and-4348

Puma Samples 601.33 g/t Gold at its McKenzie Gold Project

https://ceo.ca/@GlobeNewswire/puma-samples-60133-gt-gold-at-its-mckenzie-gold-project

Winshear Reports Drilling Results from the Coritiri Zone, Gaban Gold Project in Peru

https://ceo.ca/@GlobeNewswire/winshear-reports-drilling-results-from-the-coritiri

Orogen Royalties Creates a New Royalty on the Si2 Gold Project

https://ceo.ca/@accesswire/orogen-royalties-creates-a-new-royalty-on-the-si2-gold

Andean Precious Metals Reports Initial Results from Phase 2 Exploration Drilling Program and Management Changes at Golden Queen

https://ceo.ca/@newsfile/andean-precious-metals-reports-initial-results-from

Scottie Resources Intercepts 59.2 g/t Gold over 2.50 m and 35.2 g/t Gold over 2.00 m at Blueberry Contact Zone

https://ceo.ca/@newsfile/scottie-resources-intercepts-592-gt-gold-over-250

Putting it to the test

Yesterday I pondered that pm shares will not go up unless the SM goes up. We may get to test that theory today if the metals can square themselves up – big “if”.

SM is up, Bitcoin blasting thru $102K up 3%. Oil flat. Dollar up firmly but 10 yr down 3 bips.

Whenever pm shares do nothing for a few days while the metals move higher, as has been the case for the last 4 days with the HUI, the metals have a tendency to get whacked. That appears to be the case today, at least with silver. No doubt gold will follow.

BTW – HUI was stuffed right at its 50 dma big surprise.

No eco data that will matter today.

Prepare for some suckitude

ferret

This is another 1980…when u could buy 20/30 year debt above 18 %…..

Still with the way some of are being run if we are patient, we may well see well above 10 % on UK gilts…..see below for the latest act of utter madness.

Against Russia Forever: UK, Ukraine Leaders Sign ‘Landmark’ 100-Year Pact

Or Russian bonds

10yr Russian bonds yielding 15.8%.

But the debt is only US$200bn.

Moscow SM

From the Low @ 70 in Oct 22 ….5 waves up, 3 waves down, to a near 50 % retracement but closed just above the 38 % level….up wave was exactly a Fib 21 months and down wave 7…only one short of a Fib No

AI

Apparently AI needs two things, great tech people and vast amounts of energy…the cheaper the better ….who has that in abundance…..Russia….is it time to buy the Rouble…and the Russian SM.

ferret

Re War premium…..it sure looks like you’re right…..though I am surprised.

Maddog,

I was never really sure if we had a war premium for those conflicts in the POG. There was a blip over $2,000 when Ukraine started, but then it dropped back almost to $1,600! No, I think the long steady climb from October ’22 has been driven by world financials. The realisation that the current system is unsustainable, Chinese and Russian buying, the money printings of 2020 – 2022 coming home to roost, etc. etc. and now uncertainty about what a Trump presidency will really mean with tariffs, sanctions, DOGE etc. So I don’t think that peace will affect the POG, as I don’t think the wars, which the POG seems to regard as localised in nature, affected it in the first place.

From $1,600 to $2,700 in 27 months, and still a long way to go!

Worth thinking about

Thankfully we are looking at the potential end of the Ukraine war and peace in the ME, yet Gold is holding/going up….!!!!

Ferret…Captain Hook

I can’t ignore the super bullish TA in Silver, especially long Term…which says we take off straight up…that is how Saucers/Cup and Handles resolve….a battery would not create such demand, well not overnight…..but what would is finding out the price has been suppressed for decades and damn all is in the ETF’s ….Booom !!!!

ferrett

Tks re the Aus Dollar…..i did think at the time I saw the line, that Trump has always said he wants/is happy with a strong Dollar…..

Cap’n, sorry to add a dampener, but

if they are telling you that silver, or solid state batteries will “literally take over all battery / energy storage / energy production functions moving forward” then we know that they’re lying to us. Because they are expensive, and they have a limited life. There will be recycling problems. We still don’t have a commercial method of recycling lithium batteries.

Maybe they will be suitable for mobile applications – cars, tools, planes etc., but for the last hundred years the go to battery for static energy storage has been iron nickel batteries. With a little bit of maintenance including regular (say every 20 years) replacement of the alkaline electrolyte these batteries last forever. Some of Edison’s originals are still in use. They don’t care about cycling. They aren’t so fussy about charging voltages, compared to every other type.

Over the last 25 years there have been many promises of new battery technologies, sodium, magnesium, redox, etc, so forgive me if I park the silver battery along with them in the “wait and see” category. Even the now ubiquitous lithium battery took 25 years from invention to commercialisation.

Maddog 4:47 Aussie dollar.

Not this time, methinks. There’s a reason for that precipitous fall – AUD was way overvalued and the fundamentals are still awful. Heavy reliance on China, huge green energy push rocketing electricity prices, inflation still hot (core inflation looks low, but state and federal govts have subsidised electricity with one off subsidies {more inflation!} such that we won’t be paying anything for over a year), unemployment still very low, housing still hot and much pressure for a cut in rates. The RBA is, of course, a non-political arm of the govt, but this is an election year. That last green candle looks to me like intervention, buying AUD to make it strong enough to justify a February rate cut. But the Aussie 10 year bond is hovering near its post GFC high – not a sign that rates are too high.