Yes, I did watch that Kahn video. It’s all very disturbing.

Still, I trust that Jesus has not forgotten us.

Yes, I did watch that Kahn video. It’s all very disturbing.

Still, I trust that Jesus has not forgotten us.

But at least we have some hope with the new highs in gold. Silver getting pulled up nicely. HUI right along with it.

Can only hope this is just the beginning.

edit: NVDA is certainly not ready to rollover, but when it finally does, I expect these markets to get really ugly. Hopefully then, gold and silver will really shine.

Would be nice to see some 5-6% up days that went on for weeks like Bitcoin.

Been saying that #gold look strong, that it has a blue breakout, that it is holding its backtest, that it is holding above black 2000 level.

Did you see gold this Friday..?

Go with the service that offers real guidance and has been on track all along https://t.co/4UZSX4ro0M pic.twitter.com/kVCzcUktoF

— Graddhy – Commodities TA+Cycles (@graddhybpc) March 4, 2024

per bubblevision

I agree. It’s a real minefield out there! Even with the majors nothing is certain or risk free. Look at what happened to SSRM recently.

Will risk be rewarded? Stay tuned …

Thesis Gold Inc. Completes Vertical Short-Form Amalgamation with Wholly-Owned Subsidiary

Harmony Gold Mining First Half 2024 Earnings: EPS: R9.56 (vs R2.98 in 1H 2023

Dennis Bristow Bought 1.6% More Shares In Barrick Gold

Pan American Silver Announces Normal Course Issuer Bid

Rupert Resources Reports New Results From Winter Drilling Campaign Including 16G/T Over 25M at Heinä South and Extension to Mineralisation at Ikkari

GALIANO GOLD REPORTS AN INCIDENT AT A MINING LEASE OWNED BY THE ASANKO GOLD MINE

Galantas Gold Announces Sampling Program for Gairloch Gold-Bearing VMS Project in Scotland, in Collaboration With University of Edinburgh

New Found Receives Initial 3-D Seismic Interpretation, Initiates Deep Drilling at Queensway

Probe Gold Announces Acquisition of the Beaufor and McKenzie Break Properties in Val-d’Or, Quebec

Eloro Resources Amends Payment Schedule for Iska Iska Silver-Tin Polymetallic Project, Potosi Department, Bolivia

West Red Lake Gold Intersects 25.12 g/t Au over 5.5m, 39.46 g/t Au over 2m and 18.60 g/t Au over 4m at South Austin Zone – Madsen Mine

Puma Announces a Creative Deal to Unlock Value of its Assets in New Brunswick

Goliath’s Updated Model Confirms Six New Gold Veins for a Total of 10 Demonstrates Increased Tonnage Potential at Surebet Discovery on Golddigger Property, Golden Triangle, British Columbia

NEVADA KING ANNOUNCES FULLY ALLOCATED UPSIZING OF NON-BROKERED PRIVATE PLACEMENT TO $9.94-MILLION

Labrador Gold Intersects 10.63g/t Au Over 5.9 Metres at Big Vein, Includes 46.72g/t Au Over 1 Meter

Lion One Provides Update on Tuvatu Operations in Fiji

Turmalina Arranges $1.5 Million Financing

https://ceo.ca/@globenewswire/turmalina-arranges-15-million-financing

Mundoro Marks a Transformative 2023 and Outlook for 2024

https://ceo.ca/@newsfile/mundoro-marks-a-transformative-2023-and-outlook-for

Newmont Announces Offering of Notes to Repay Outstanding Borrowings Under Revolving Credit Facility

https://ceo.ca/@businesswire/newmont-announces-offering-of-notes-to-repay-outstanding

Ashley Gold signs LOI to Acquire Advanced Utah Uranium – Vanadium Asset

https://ceo.ca/@thenewswire/ashley-gold-signs-loi-to-acquire-advanced-utah-uranium

ArcWest Provides Exploration Update on 2023 Todd Creek Program, Funded by Freeport-McMoRan Mineral Properties Canada Inc.

https://ceo.ca/@newsfile/arcwest-provides-exploration-update-on-2023-todd-creek

Tower Resources Renews 5-Year Permit and Unveils Future Drill Plan at Rabbit North

https://ceo.ca/@newsfile/tower-resources-renews-5-year-permit-and-unveils-future

Founders Metals Attends PDAC Core Shack and Intercepts Gold Vein at Froyo

https://ceo.ca/@newsfile/founders-metals-attends-pdac-core-shack-and-intercepts

Strategic Metals Options 11 Tombstone Gold Belt Projects, Yukon

https://ceo.ca/@accesswire/strategic-metals-options-11-tombstone-gold-belt-projects

Dixie Gold Inc. Initiates Lawsuit Against Omnia Metals Group Ltd., Provides Related Notice to Market Regarding Takeover Transaction

https://ceo.ca/@thenewswire/dixie-gold-inc-initiates-lawsuit-against-omnia-metals

Elemental Altus Royalties Announces Record 2023 and Q4 Revenue, Beating Top End of Guidance

https://ceo.ca/@newsfile/elemental-altus-royalties-announces-record-2023-and

Austin Gold Provides Update on Initial Drilling Program at Stockade Mountain Project

https://ceo.ca/@newsfile/austin-gold-provides-update-on-initial-drilling-program-d8493

EGR Exploration Announces TSXV Approval of Option to Sell Urban Barry Property to Harvest Gold

https://ceo.ca/@thenewswire/egr-exploration-announces-tsxv-approval-of-option-to

GoldHaven Enters Exclusive Due Diligence Agreement

https://ceo.ca/@newsfile/goldhaven-enters-exclusive-due-diligence-agreement

Outcrop Silver Announces $3 Million Public Offering of Units

https://ceo.ca/@newswire/outcrop-silver-announces-3-million-public-offering

Benjamin Hill Mining Corp. Announces Private Placement of Units

https://ceo.ca/@globenewswire/benjamin-hill-mining-corp-announces-private-placement

Osisko Development Secures US$50 Million Funding to Commence Underground Development at Cariboo Gold Project

https://ceo.ca/@globenewswire/osisko-development-secures-us50-million-funding-to

Volcanic Gold update on drilling at Mila Gold Discovery, Guatemala

https://ceo.ca/@thenewswire/volcanic-gold-update-on-drilling-at-mila-gold-discovery

Luca Mining Reports Record Production at Tahuehueto, Consistent Positive Operating Cash Flow Achieved at Campo Morado, Management Updates and Retention of Market Maker

https://ceo.ca/@newswire/luca-mining-reports-record-production-at-tahuehueto

Talisker Intersects 129.99 g/t Au over 2.00 Metres from the Bralorne Gold Project Resource Conversion Program

https://ceo.ca/@globenewswire/talisker-intersects-12999-gt-au-over-200-metres

Magna Mining Announces the Filing of the Amended Crean Hill Closure Plan

https://ceo.ca/@newsfile/magna-mining-announces-the-filing-of-the-amended-crean

Monarch Sells Mining Assets to Probe Gold and Bullrun

https://ceo.ca/@globenewswire/monarch-sells-mining-assets-to-probe-gold-and-bullrun

Meridian Drills High-Grade Zone Grading 11.3m @ 3.7g/t AuEq at Santa Helena.

https://ceo.ca/@accesswire/meridian-drills-high-grade-zone-grading-113m-37gt

Jaguar Mining Provides Positive Results from Its 2023 Exploration Program

https://ceo.ca/@accesswire/jaguar-mining-provides-positive-results-from-its-2023

Starting to strengthen a little even as the dollar is flat.

NVDA is making new all-time highs in the premarket, last closing high was around $823, but the QQQ’s are shaky and the DOW is struggling. Dare I say it, if NVDA finally reverses, the whole SM is in trouble IMHO.

What will pm’s and their shares do if the SM slips? Something to watch, because it could be the beginning of the great unraveling. Who knows?

You said: “But, I listen to it because I really do believe that it will take Divine Intervention to clear the mess we are living in.”

I couldn’t agree more, and it is coming. I’m not sure whether pm’s will even matter all that much when it comes. We are approaching a time that the Bible talks about more than any other topic in both the Old and New Testaments. Folks can scoff if they want, I get it.

The information/message is there for anyone that has eyes to see. I have spent the last six months studying with the aid of biblical scholars – Missler, Heiser, Lennox and it is nothing short of astonishing the level of prophecy that has and is taking place.

People throughout history thought that the end was nigh, certainly those who lived through WWI & WWII must have thought so. I might have too if I’d been there, but these times could not take place until Israel became a nation again. They really are the key, and yet, most of them don’t even know it.

I would challenge anyone to watch the video from Jonathan Cahn that silverngold posted a week ago. If you think God isn’t around and paying attention, watch what happens to the statue and let me know what you think the odds are that it could happen at that time, in that way, with the rods surrounding it. The first event he shows about the guy in the Turkish parliament is better known, the second of the statue – not so much. I find it sad that less than a million people have seen this, here it is again.

If you’re a science guy, look up the asteroid “Apophis” NASA has discussed it. If their calculations are off just a small amount…. The wisdom of men, such foolishness.

As long as Pols like Shittforbrains keep getting elected we have serious problems…we have creatures like him….no-one sane shud vote for such people….they are so obviously only in it for themselves and will do and say anything to keep power…

Posting a link to Greg Hunter interview with Bo Polny.

Not really sure about everything said/discussed.

But, I listen to it because I really do believe that it will take Divine Intervention to clear the mess we are living in.

That’s discouraging. If someone as knowledgeable and experienced as he is can be taken for a ride, what chance do we everyday investors have? It’s even more of a crap shoot than we expected when we bought in.

We got a Republican going against shifty eyed Schift. All they say is to let a Democrat area know he lied in Congress. That’s kinda useless. Do Demoncrats care if he lied against a Republican? I doubt it. Repubs might but not demos. They need to talk about the economy, the wars and the mess they made and Schift is not only a compulsive liar but voted and was part of this mess and will continue to be voting for the problems they created.

Definitely could be a bumpy year. As for our metals we unfortunately have to contend with the paper kings on the Crimex and then of course their games with the various ETF’s. I guess we’ll know what’s coming when the shares really take off. Really tough when the controllers of our currency and banking are hellbent on keeping our metals down.

I think we can surmise that Bitcoin is not a threat to the fiat regime because they just let that thing run better than the old dot com stocks in their heyday. Even now that they have an ETF to manipulate, they’ve left it alone.

Not sure how gold breaks free, but most definitely I think our fiat regime is in its last throes, and the bond market and the lack of foreign buyers is confirming it.

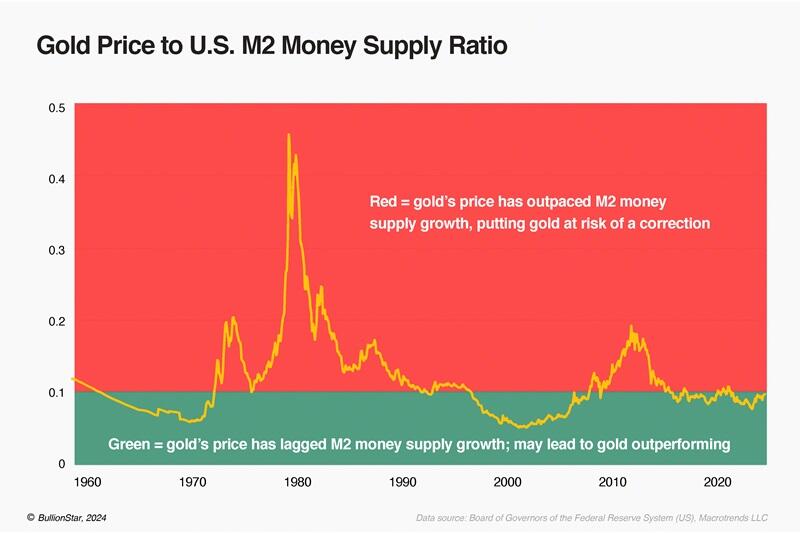

Which has a v clear Cup and Handle, that says we will get a runaway Gold price relative to M2 at some point soon….just like back in 1980…..

https://www.zerohedge.com/commodities/evidence-and-insights-about-golds-long-term-uptrend

Silver Bullet Firing Blanks

http://www.321gold.com/editorials/moriarty/moriarty022224.html

I, too, found it interesting, and pretty much the same as my thinking. I’ve been expecting breakdown for quite a long time, but I have not seen/felt conditions so ripe as they seem now, and going forward through the year. Perhaps time to heed Bette Davis’s admonition in All About Eve: “Fasten your seat belts. It’s going to be a bumpy night.” I’d say, “year.”

With the Fed still talking rate cuts, the market responds more to weak data than to strength. Two-year Treasury yields dropped 16 bps this week to 4.53%. I’m skeptical that the economy is downshifting. But when it does, rest assured that bond yields will decline, as the market swiftly prices imminent rate cuts. And this inflationary bias in bond prices will work to sustain loose conditions, while underpinning economic activity and inflationary pressures.

It has been intriguing to watch a resilient gold price in the face of a bullish narrative of disinflation and booming securities markets. And then to see bullion break to the upside this week, as Fed officials blatantly disregard loose conditions and runaway speculative Bubbles. In the “old days,” the Fed would take note of such unmistakable manifestations of overly accommodative monetary policy. The fixation these days is on the next inflation data.

The Truth is there will be a huge price to pay for all the craziness. Powell and Fed officials repeatedly assured us that they had learned from history. They understood the risk of resurgent inflation in the event of premature loosening of monetary policy. But that’s exactly what they’ve done. Sure, they can contend that they have held firm with a “restrictive” policy rate. But the Truth is they orchestrated a dovish pivot and attendant dramatic loosening of conditions. Plain and simple: they stoked a historic super-cycle market speculative blowoff. And they apparently cannot refrain from more stoking.

There aren’t many, but a few analysts are willing to Speak Truth to Crazy.

March 1 – Bloomberg (Simon Kennedy): “The US national debt is rising $1 trillion every 100 days, helping to explain why assets such as gold and Bitcoin are trading at around all-time highs, according to strategists at Bank of America Corp. The pace of the debt swelling is also accelerating, the strategists led by Michael Hartnett said in a report… They estimate it will take just 95 days for the burden to climb to $35 trillion from $34 trillion, compared to the 92 days it took to grow to $33 trillion from $32 trillion.”

Torsten Slok and Michael Hartnett’s notes were delivered to clients on the first day of March, a session that suggested a month potentially crazier even than February. The Semiconductors surged 4.3% Friday to another all-time high, boosting four-month returns to 50.3%. Nvidia’s 4% advance increased its four-month return to 94.4%. This stock closed the week for the first time with a $2 TN market capitalization, joining only Apple and Microsoft in the $2 TN club. Bitcoin rose another $1,160, or 1.9%, Friday, boosting the week’s gain to a blistering 22.6% – and the four-month melt-up to 76.5%.

Along with the usual crazies, even commodities markets mustered gains. The Bloomberg Commodities Index rallied 1.9% this week. Crude futures jumped 4.5%, with gasoline futures rising 4.2%. And an interesting thing happened on the day Slok and Hartnett were Speaking Truth: the precious metals came to life. Gold surged $38.61, or 1.9%, to a record closing price of $2,082.92. Silver jumped 2.0% in Friday trading, with Platinum up almost 1.0%. Crude rose 2.2% to trade to a four-month high.

While holding out in the bunker would you care for any heart healthy snacks, sushi with salmon, fresh vegetables and fruits, organic breads with Flax and chia seeds naturally sweetened, assortment of drinks like pomegranate juice, and so forth. Just my altered sense of humor but have done things like that for people before including one undercover on a steak out I ran into in my unusual ways that was rather comical.

This topic is Vita D where a heart healthy conscious friend of mine got quite a shock. She is a cancer survivor and while attending meetings took advice from the facilitator that has now caused another problem.

So just how much Vita D is safe? What counter measures can you take to prevent this?

I have sent her information on this and a few other things as counter measures but point here is those taking vita D daily should really get there levels checked. Her GP I remember over a year back she said refused to check her vita D levels which is covered in a regular check up or any check on it. What a jerk.

Part of what she said.

I have been taking 4000IU Vit D daily as the doctor who is a facilitator of the cancer support group recommends. Now I have aortic calcification! I am seeing my cardiologist next month regarding this problem!

I’m sending her info amongst other things that might be if some interest to pass on although mentioned it before. FWIW

This small study shows that drinking pomegranate juice may improve symptoms associated with narrowing of the arteries. Pomegranates are rich in various bioactive polyphenols, including tannins, ellagic acid, and anthocyanins, that exert potent antioxidant, anti-inflammatory, or cardioprotective effects in humans.

They found that several parameters of cardiovascular health improved after one year of pomegranate juice consumption. For example, the participants’ carotid artery thickness decreased by up to 30 percent and their blood pressure decreased by 21 percent.Dec 14, 2022

https://www.foundmyfitness.com › …

Pomegranate juice improves blood pressure and reduces arterial plaques in people with atherosclerosis. – FoundMyFitness

In addition, their total antioxidant status increased by 130 percent. Participants who didn’t drink pomegranate juice did not experience these improvements, and in some cases, their cardiovascular measures worsened.

This small study shows that drinking pomegranate juice may improve symptoms associated with narrowing of the arteries. Pomegranates are rich in various bioactive polyphenols, including tannins, ellagic acid, and anthocyanins, that exert potent antioxidant, anti-inflammatory, or cardioprotective effects in humans.

Pomegranate juice reduces symptoms associated with the narrowing of arteries that supply the brain, a small study has found. Patients who drank pomegranate juice for one year experienced improvements in blood pressure, antioxidant status, and carotid artery thickness (an indicator of the extent of plaque buildup in the arteries).

The study involved 19 people who had atherosclerosis with carotid artery stenosis, a condition in which the arteries that supply the brain thicken and narrow due to the accumulation of plaque. Ten of the participants drank 50 milliliters (about 1.7 ounces) of pomegranate juice daily for one year, while the remaining nine participants did not consume any pomegranate juice. The researchers assessed various aspects of the participants’ cardiovascular health before, during, and after the intervention.

They found that several parameters of cardiovascular health improved after one year of pomegranate juice consumption. For example, the participants’ carotid artery thickness decreased by up to 30 percent and their blood pressure decreased by 21 percent. In addition, their total antioxidant status increased by 130 percent. Participants who didn’t drink pomegranate juice did not experience these improvements, and in some cases, their cardiovascular measures worsened.

Might be over copied, haven’t got the hang of this new phone yet

Along with the previous article I posted that mentions gold from the VonGreyerz Institute. We get one decent day and here come the bullish prognosticators

Hope this link works. This is the performance chart of silver and the HUI. Where the rubber meets the road – uncanny.

Kind of the way I see things, and have for 20 years, but the real question is when will the rig be overcome?

https://www.zerohedge.com/geopolitical/whats-next-when-policy-makers-can-no-longer-hide-their-sins

Thank you for that.

I just get the sense that there’s not much time before things really start to unravel for a whole host of reasons. I’m not sure I just mean that just in financial terms either.

We’re told to look toward the heavens for signs. There will be an eclipse in April that will be seen across the US. The second such eclipse since April 2017, 7 years ago. The second eclipse forms the “Tav” across the US.

There are a lot of implications for that if one wants to search. The number 7 is very prevalent.

I found your ramble interesting and I think that mulling these issues over can focus our attention.

aurum

In the old days I charted the COT values for both pm’s and also for grains. While I still have the spreadsheets for the charts I have not updated in years because I don’t trade in volume anymore, because I have become lazy, or because I did not find them predictive.