I probably should buy JNUG now but would feel more comfortable when its down 6%+…if stocks are starting the long awaited sell-off, gold should have some kind of a rally like they did last Fall…I do not see a 2008 scenario ever again wherein PMs crash…the world perception of gold has changed too much…

Thanks Sean for reminding me to check bonds-Jeesh! They are up a bug 47/64ths on the 10 yr.

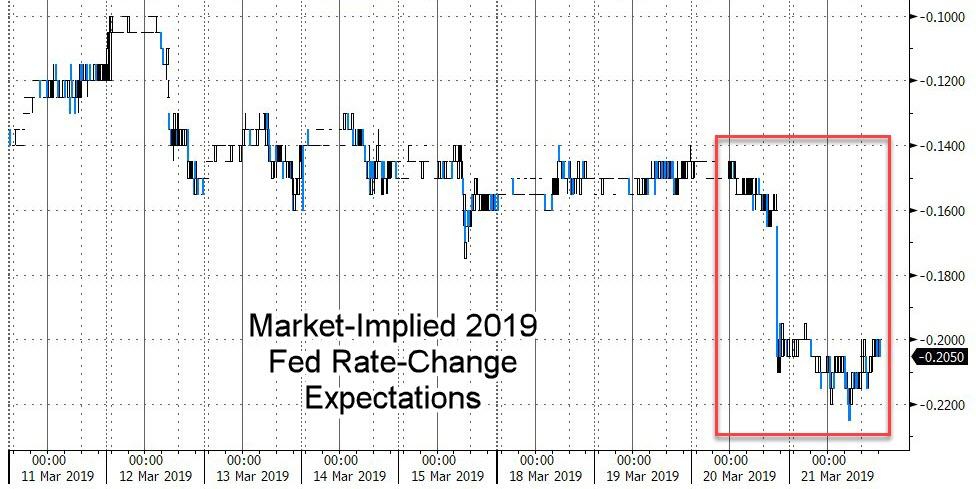

So rates are droppinf fast–this could get serious…what is ominous is how yesterday investors were non-plussed by the FEDs action and today they are soooooooooos surprised at the y.c. inversion…I’m looking hard at. JNUG

Paulson opposes Newmont-Goldcorp merger

Paulson & Co., which holds 14.2 million shares of Newmont Mining (NYSE: NEM), said on Thursday that it does not support Newmont’s proposed acquisition of Goldcorp (NYSE: GG, TSX: G) as it is structured.

Paulson sent a letter to Gary Goldberg, president and CEO of Newmont, that outlines how the deal, under the current terms, creates negative value for Newmont shareholders.

“The $1.5 billion premium to Goldcorp shareholders is unjustified given Goldcorp’s poor performance,” Paulson wrote. “As currently structured, the synergies from the transaction would only accrue to Goldcorp shareholders, the transaction would transfer a significant percentage of the value created by Newmont’s recently announced Nevada joint venture with Barrick to Goldcorp shareholders instead of preserving this value for Newmont shareholders, and following the creation of the Nevada joint venture, Newmont is positioned to create greater value as a stand-alone entity than if the acquisition were completed under current terms.”

cont. http://www.mining.com/paulson-opposes-newmonts-proposed-goldcorp-acquisition/

R640….great call on SM

scum sure sitting on PM’s….Bonds are falling apart.

Yeah…it is the yield curve–a guy on FOX said the FED need to CUT rates now,,,this ZH article explains-[a cut should be gold bullish but we know it will not matter…until it does]

Critically, as Jim Grant noted recently, the spread between the 10-year and three-month yields is an important indicator, James Bianco, president and eponym of Bianco Research LLC notes today. On six occasions over the past 50 years when the three-month yield exceeded that of the 10-year, economic recession invariably followed, commencing an average of 311 days after the initial signal.

Bianco concludes that the market, like Trump, believes that the current Funds rate isn’t low enough:

While Powell stressed over and over that the Fed is at “neutral,” . . . the market is saying the rate hike cycle ended last December and the economy will weaken enough for the Fed to see a reason to cut in less than a year.

Equity markets remain ignorant of this risk, seemingly banking it all on The Powell Put. We give the last word to DoubleLine’s Jeff Gundlach as a word of caution on the massive decoupling between bonds and stocks…

“Just because things seem invincible doesn’t mean they are invincible. There is kryptonite everywhere. Yesterday’s move created more uncertainty.”

Yesterdays rally looked like a zillion dollars-EVERYTHING was in. gear…the Trannies, the Russell–

Today, with 5 minutes until the. open EVERYTHING is red. I. checked all the news sites–even ZH and can’t find. any “alibi”. for the. down stock futures–I did note that Europe–all of the exchanges are. in the. red…what makes this ominous is that the S&P blew out the 2858 line…and is now 2841….as they say Mr Market fools the majority…btw–the feed. on Fox. news is wrong=it’s been. showing gold up. 10 to 11 bucks. since I first looked. at 6am…p.s. just heard on FOX that we are moving towards an inverted yield curve as a reason for. stocks being down…but market pundits pooh-poohed that when. stocks were going up…[trannies down 88 and the. DOW world index down a big 21 pts.]

R640

My 24 hr spot feed has gold up barely $ 2.30.

R640

Yeah I got gold up a measly 3 bucks and silver flat with most of the miners down

So yesterday the shares didn’t get spanked with the metals down because the stock market was up I guess

Today the stock market is down so doesn’t look like the shares will escape the down market.

Plus the dollar is a bit stronger again which is odd with the ten yr. treasury now below 2.5 @ 2.47%

Regardless, pm’s must never be a viable alternative.

@goldilocks

I think the media controls how people think. And what they do. So the press needs to be the primary target to change, to fix everything else. The media never runs for office. Like a dictatorship.

Obviously the global left controls the media and tells people how and what to think. Then those people get older and think and vote the wrong way. The only people that have freedom of the press, are the people that own the press.

Trump just says “fake news”. He can only bash their news, and not allowed to bash the owners, or the “employees” that decide and dictate what is said to the public. Is he not smart? Or just behaving?

I still think he was recruited and unleashed to say different things, his rhretoric to the public. Note their media gave him tons of prime time tv. They (the owners) gave Hillary bad media.

Lets ask ourselves, why did the global owned media want a Trump and republicans to win. It’s always an 8 year run for each party. Not a coincidence. That’s why I knew Trump would win.

the only time it was different was when papa Bush got 12 years. Reagon had to take Bush as a running mate. Reason was not REALLY the president. IMO.

They didn’t want Bush to get a 4th term so they jacked up rates abruptly before the election, and called it the Bush recession. After he lost, the election they abruptly dropped the rates back down.

Globalization accelerated during Reagan. ‘81 to ‘89. Even the 1987 crash. The manufacturer sector collapsed imploded during Reagan. I know, I was there, in it watched it. We all loved Reagan but he was not in charge.

The media was. And taught everyone that we don’t want those dirty polluting menial jobs. We don’t want the rust belt they called us. Said we were going to get higher quality cheaper products.

The scumbag Media directors never mentioned the sacrificed Americans that made the products. They all took 40% pay cuts after that.

Doesn’t anybody remember any of this crap? More to say but I’m done.

Fox Biz news shows gold up $11–must be an error–cause on Bloomberg +my commodity quote site it shows a $5 gain

Also, pre-mkt quotes shows JNUG down 19 cents

So it begins another attack on America where illegals vote.

Delaware House passes bill to give state’s Electoral College votes to popular vote winner

This says it all.

https://thehill-com.cdn.ampproject.org/v/s/thehill.com/homenews/state-watch/434545-delaware-house-passes-bill-to-give-states-electoral-college-votes-to?amp=&usqp=mq331AQCCAE%3D&fbclid=IwAR03lP8mP7bVuuPm9j8CBzgh4RLCDDqNGKfFZYmf4pXuR_yNEG3_xWYtvpY&_js_v=0.1#referrer=https%3A%2F%2Fwww.google.com&_tf=From%20%251%24s&share=https%3A%2F%2Fthehill.com%2Fhomenews%2Fstate-watch%2F434545-delaware-house-passes-bill-to-give-states-electoral-college-votes-to

Gold Train

The Southern Pacific ‘Daylight’…

the spirit that won the West.

http://www.railpictures.net/photo/690396/

http://www.railpictures.net/photo/690583/

Moveon

Bragging they were behind the Iran deal.

One of their latest. Trump just won’t give them what he wants no matter how much bullying they give him then call him a bully.

They look like a certified enabler of trouble.

Trump’s campaign is attacking us for calling on the Democratic presidential candidates to skip this year’s AIPAC (American Israel Public Affairs Committee) conference—an event that will feature Benjamin Netanyahu, the corrupt, right-wing prime minister of Israel; a right-wing lobbying organization that champions him; and Mike Pence.

In 2015, while Barack Obama and MoveOn members joined forces to pass the historic Iran nuclear deal, Netanyahu gave a speech in front of Congress trying to get them to reject the deal. AIPAC also played a hand in spending tens of millions of dollars to block the Iran deal. Netanyahu and AIPAC tried to exploit partisan politics in America to undermine Obama’s historic Iran deal, but together, with President Obama, we successfully defended a diplomatic agreement that helped keep the U.S. off a path to war with Iran. (Trump has since eviscerated the agreement.)

Now, over 74% of MoveOn members who took our recent poll agreed that any progressive candidate vying to be the Democratic nominee for president should skip the AIPAC conference. The conference, you guessed it, seeks to shred the historic Iran nuclear diplomatic deal we fought so hard for—and to deny the basic human rights of Palestinians.

And Democratic candidates are listening. Just today, Bernie Sanders, Kamala Harris, Elizabeth Warren, Beto O’Rourke, Julián Castro, and Pete Buttigieg, as of this writing, have all said they won’t attend the AIPAC conference—which may be in part why Trump’s attack dogs and other right-wing groups are going on the offense against MoveOn.

Got gold?

From ZH readers;

QQQQQQQQQQQQQQQQQ-EEEEEEEEEEEEEEEEEEEEEEEEEEE forevah

Why talk fundamentals when it’s only the rate of money / credit creation that counts in a debt based currency system?

The Western Private Central Banking Cartel takes down the economy when they want. 2008 was more about electing the Kenyan Kommunist than it was anything real. Of course knowing it would happen means our banking lourds and masters knew exactly when to buy into the stock market so they’ve cleaned up there.

Buygold

Gold sneaking up and a nice looking candle on the HUI. Things could be worse!

ZINC???

lme warehouse stocks of zinc have been dropping for a while.

http://www.kitcometals.com/charts/zinc_historical_large.html

the last 60 days has seen a 50% drop in warehouse levels. if this rate of drop continues another 60 days, the shelves will be bare!

zinc isn’t something the global economy can run without. it’s in lots of products. brass, galvanized anti corrosion coatings, latex paint, tires, medicines, fertilizers….

many precious metal miners have a significant zinc byproduct in their ore.

IF kitco’s figures on warehouse levels are an accurate indicator of the global supply level, we’re about to see some turbulence in the zinc market.

Ten Year Bond, Falling Interest Rates 3.2% in Nov, 2.5% Now, A 22% Drop

Gold started up as the rates dropped from Nov.

Well Ipso

for some odd reason the shares are doing ok today for the most part – not sure why given the action in the metals

I guess even the metals aren’t doing that bad considering how strong the USD is.

Then again, there’s always the last hour of the day to contend with.

Here I am waiting patiently ……………………….. well I guess not so patiently anymore

77-year chart shows upswing in gold mining stocks have hardly begun

77-year chart shows upswing in gold mining stocks have hardly begun