hasn’t thrown out anyone, the puppets are still here and the bankers (Rothschild, Hanover etc) are still running the show.

Don’t take my word for it. dyodd. I gave you some good pointers, but FGS do not use Wikipedia.

🙂

R

hasn’t thrown out anyone, the puppets are still here and the bankers (Rothschild, Hanover etc) are still running the show.

Don’t take my word for it. dyodd. I gave you some good pointers, but FGS do not use Wikipedia.

🙂

R

I think your onto something for sure. I’m not trying to poke you. I have reservations about the system and I love cold hard metal. But bitcoin seems like a damn fine idea too and I appreciate your insight and the knowledge you bring to the table. I’m trying to make sense out of what I read in the main stream media about it, and that’s a screwed up approach as usual b/c we know sometimes the truth is the polar opposite of what the MSM chooses to report

What about Cuba? Threw out the puppet. Iran threw out their puppet. The global economy is like a sinking ship, and one by one, or small groups of countries will have to extricate themselves from foreign entanglements. Foreign influence etc etc.

Lest anyone else be labouring under such a delusion, the UK is not leaving the EU any time soon and the UK PM Teresa May (unelected) has pretty well said as much. In any case, under article 50 it would take about 3 years, but since article 50 is treason and should never have been signed in the first place, then there is another quagmire to negotiate. It is the 1972 Agreement that is of significance here wrt a UK withdrawal from the EU and afaiaa that has never even been mentioned in the UK MSM- I doubt it ever will be.

If the UK status within the EU, or anywhere else, could be influenced by a vote then rest assured voting would be abolished.

The EU has its roots in the Pan European Movement going back to the 1920s: Coudenhove Kalergi, Warburg money, the Hapsburgs … check out the Charlemagne Prize. The European project is right on track, make no mistake.

Sovereignty??? pah!

JUNG 10 for 1

NUGT 5 for 1

BRZU 4 for 1

DRN 4 for 1

TMF 4 for 1

After Trump gets in? And the USA re-declares its sovereignty? Lets put our heads together.

#1 What will they CALL it??

#2 What will happen to the alleged U.S. (UN) Dollar??

“Ipso, 3 authentications required to post this short missive!!”

I don’t know how to fix your problem. I’m pretty sure it has something to do with your satellite internet connection. Perhaps you could contact them to see if they have any advice.

Otherwise maybe ask Wanka. That guy is a technological genius!

Artificially CHEAP prices for Airline tickets. Gov’ts support aircraft in various ways. People willy nilly traveling all over the globe for the price of a bus ticket is ENDING. For various reasons.

All the things that don’t make any sense (from the past) are in trouble. All the things that MAKE sense will grow. Common sense will prevail, because it HASED to. NO common sense has prevailed for decades, and we are looking at the results.

“Its not going to be that way anymore.” Me & Trump. 🙂 Cheap Gold and silver? High Taxes? Moon landings? Global Warming? Make no sense.

I’ve talked to folks who’ll quite blithely tack on a zero and plan accordingly. Which I think is missing the point. Be it $3k or $8k or $800k oz it prob won’t matter as the dollar as we discuss it here may not exist when the yellow heavy hits its historic, natural value.

This is prob a subject that’s been kicked around here once or twice.

TAWTHDIK

R

It’s another small sign of a reversal of globalization. It shows growing obstacles for businesses operating unfettered across international borders. This is good for LOWER oil prices too.

Globalization caused an artificial excess demand and price for Oil. Too much oil was wasted on LONG DISTANCE, trans ocean and trans continental delivery of cheap consumer products from various countries exporting to the USA.

“That’s not going to happen anymore” As per Trump, but the trend already started after 2009.

re your “1980 – $800, not unlike … ?”

I figure a factor of 4 or 5 from that era, $3200 to $4000. Houses here were about $40,000. New cars about $7,000.

I thought that article was a goody as well. Ole Andy was right on the mark. Things are getting shaky and when does the collapse come? Not far down the road.

Collecting foodstuffs is a great idea as well. Starving is no fun, watching people you care about starve, is no fun. So be prepared!

Cheers

KM Khan Law Office, actually derives profit directly from Muslim immigration to the United States making him more than just an innocent conscientiousness objector to Trump’s policy?

Brieybart suggests that Khan did, in fact, stand to profit from his viewpoints shared at the DNC and point to his website bio which lists “EB-5 Investments & Related Immigration Services” as a specific area of practice. Oddly enough, since these reports have surfaced the website of Mr. Khan’s law office has been taken down. Luckily, prior versions of the website are available on the wayback machine which can be seen here:

http://www.zerohedge.com/news/2016-08-02/khan

That rant I wanted to post on a well-used, technical BTC forum I found was tightly moderated. As a ‘newbie’ first-time poster, I was isolated until moderators approved the post. When the experienced old BTC developers read it, it was publicly posted immediately and I was made a full member with full access… based solely on the thoughtful content, I was told. (I never used that forum again… can’t even remember the name now.)

But that phrase “…up against all the money in the world” is something we learned as goldbugs, but the BTC community was quite ignorant of what they were up against. That phrase resonated with MANY BTC users who replied to it. It was a revelation for many. I even received ‘feelers’ from developers who wanted me to design secure systems for their BTC exchanges in developement. I had to tell them I did not have the technical expertise for that.

The MT Gox fiasco was about $10 million when done, but it was a huge market hit as that exchange was the only real market-maker of global exchange at that time. While this recent hack of Bitfinex is much larger at $60 million, it is not as devastating to the marketplace as there are now a good handful of other viable bitcoin exchanges to absorb trading action. Percentage wise, BTC did not fall as far this time as the MT Gox crash did. There are no regulatory safeguards on BTC exchanges as with stocks or other bank-sponsored exchanges. It really is about the trust and competence of the exchange. Who do you trust? This really is the lawless ‘wild west’, and you have to safeguard yourself.

And the Chinese are still looking for ways to export their wealth in clandestine fashion, so I expect the BTC market price to recover from this with not too much trouble.

Here’s something you will never see…. a physical bitcoin!

This was a promotional token from a place I did business with.

A homosexual islamist shoots up a gay bar and the eggheads determine the cause:

Your post was most apposite, uplifting and true. many thanks for taking the time to tell that story and share those thoughts. As for giving me the floor and your soap crate, well, if I get on one, y’all will probably run me outta here and change the locks (might be feathers and some tar involved too) 🙂

But I do anticipate good banter … 🙂

MAYA!! Ipso, and others … Hello, Wanka let me in, but he made me promise I wouldn’t tell anyone… So keep it under your hat.

R

on the subject of daydreaming, here’s a little thought you’ve probably come across before. If you add a zero to gold’s highs and lows of the 1970s, then allowing for printing, you get a rhyme for the present price behaviour:

1971 -$34 close enough to rhyme with $220 in 2000

1975 – $195 roughly equates to the high of $1030 in 2008

1977 – down to $137 similarly proportional to the low of $700 in 2008

1980 – $800, not unlike … ?

Welcome back, old friend! Thanks for the coffee…. been some slackers around here lately that never brew a pot.

i just got denied access. did i pi$$ somebody off?

I think you need to add another zero to your numbers. 🙂

Not that I am greedy, but let just one country announce they are backing all or just a part of their currency with gold or silver, and watch what happens. On that day, I think you can fold up your favorite gold chart into an airplane, and send it skyward to get an idea of how high gold and silver are going. That will be the price for an actual ounce, held in your hand.

I think the old Chinese curse is upon us, “May you live in interesting times.”

And I think the old phrase, “Good as gold.” will take on a new meaning most can hardly imagine.

Oops, there I go day dreaming again. Its that dang slow cooker’s fault. You throw in a pot roast, some vegetables, onions & chicken broth, and I got nothing to do for the next 8 hours. I think I’m turning into that Buygold. Aint good for nothing, aint worth the whiskey. 🙂

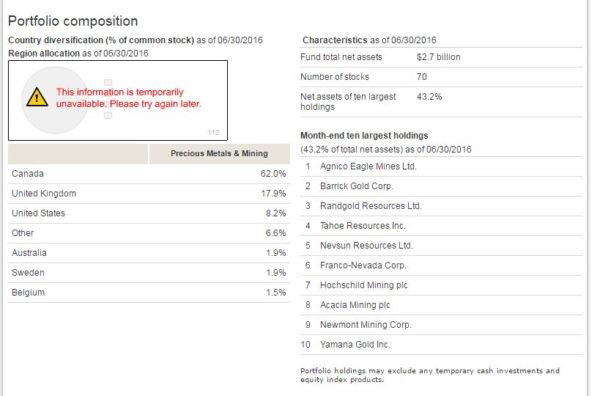

to capture IRA money? Forbes has recommended them in the past too.

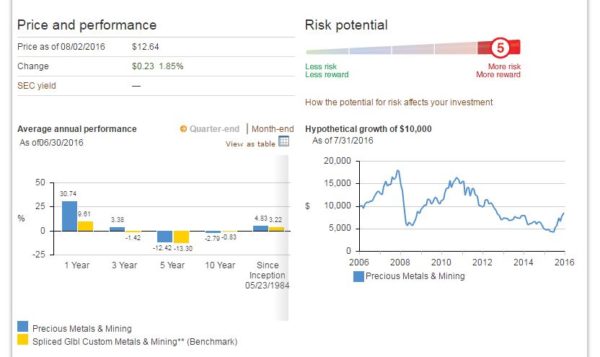

Look how pathetic a $10,000 “investment” does in their fund since 2006. Good job wall st prankers

that my TWO GOLD FUNDS TGLDX & GOLDX are climbing just as FAST as many Exploration stocks .Their charts have a sharp angle up ! with diversification risk minimized ! Many of the Funds are holding the same stocks (Royalties)cash,Bullion ..I figured that out years ago !

The only Fund I wouldent touch is VANGUARD Precious metals ..The reason is some years ago when the move started I was in VGPMX and as soon a Gold took off ,they closed their Fund to NEW investors and would only take SELL ! orders ! WHAT ? That was absurd and against MY INTERESTS .. I suspect they were getting redemptions in the S&P stocks with orders to buy GOLD instead ..The S&P was a Giant business for them so they looked out for themselves first .I quickly sold all I had in their GOLD ? FUND and switched to TOUCQUEVILLE FUND I made 300 % on the switch while their FUND went nowhere for months .I would have lost several hundred thousand. I never forgot that treachery and will never go back to Vanguard.